Two days into into the trading week and so far there has been a lot of rotation inside sectors of the Nasdaq. We are seeing average volume go up in large cap tech names. Most notably FANG stocks. Large cap Semiconductors and Biotech are outperforming. In regard to the SPY500 we continue to be muted. The Russell is acting well off our breakout but the 5 day and 8 day seem to be waning and should be watched. The small cap stocks of cruise lines, airlines , casinos have not swung down as usually has happened in 2020. This could be position buying by larger firms. I mentioned Sunday “that these kind of weeks make it harder to chart because less players which means less volume. Hence the volatility. I bring this up in case this week you notice your entries are not working as well as previous weeks.” You’ll notice the volatility off the opening Monday as a prime example.

Lets look at the indexes.

Lets look at two sectors where money is moving into on the Nasdaq

Consider drilling down into these sectors and looking at the holdings.

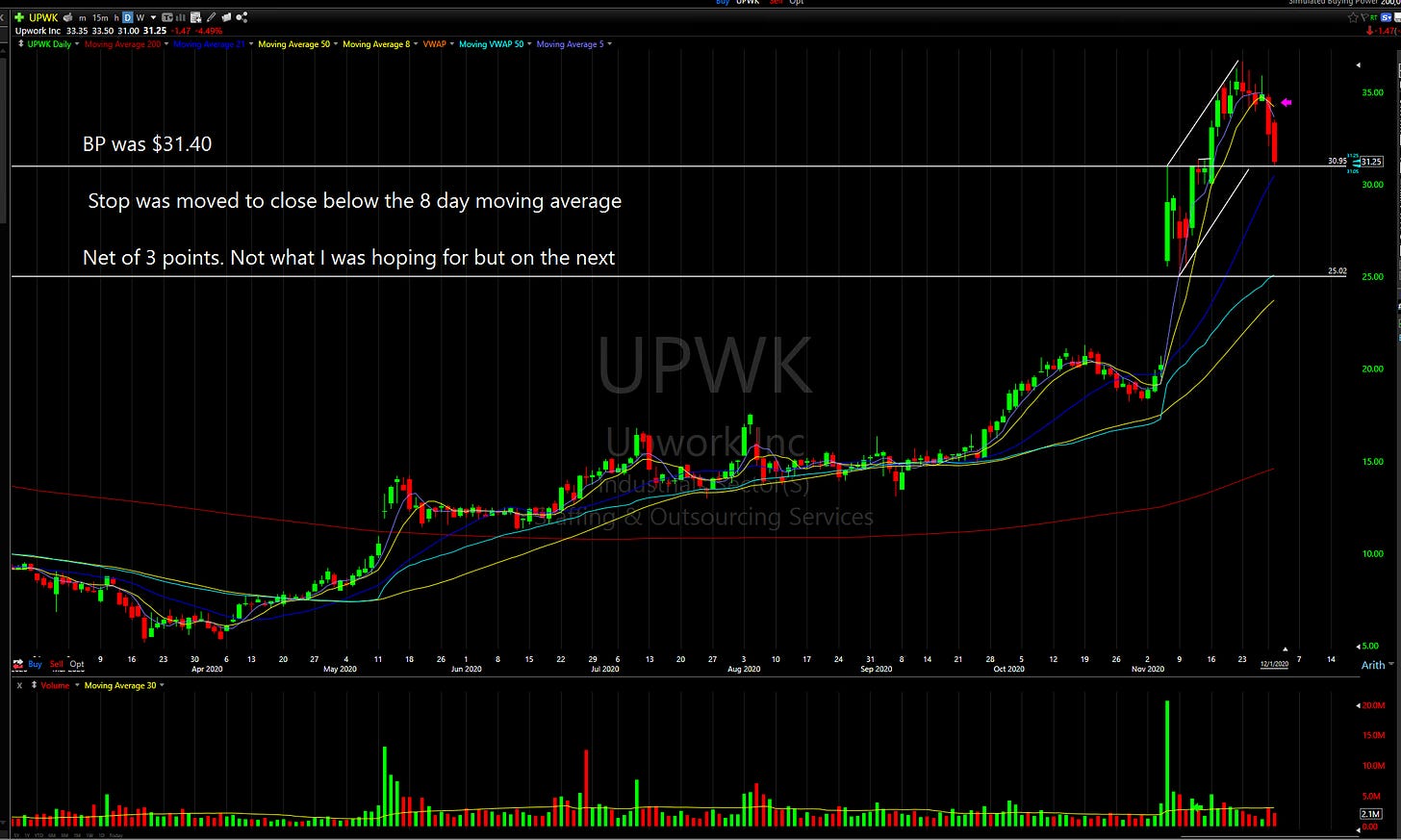

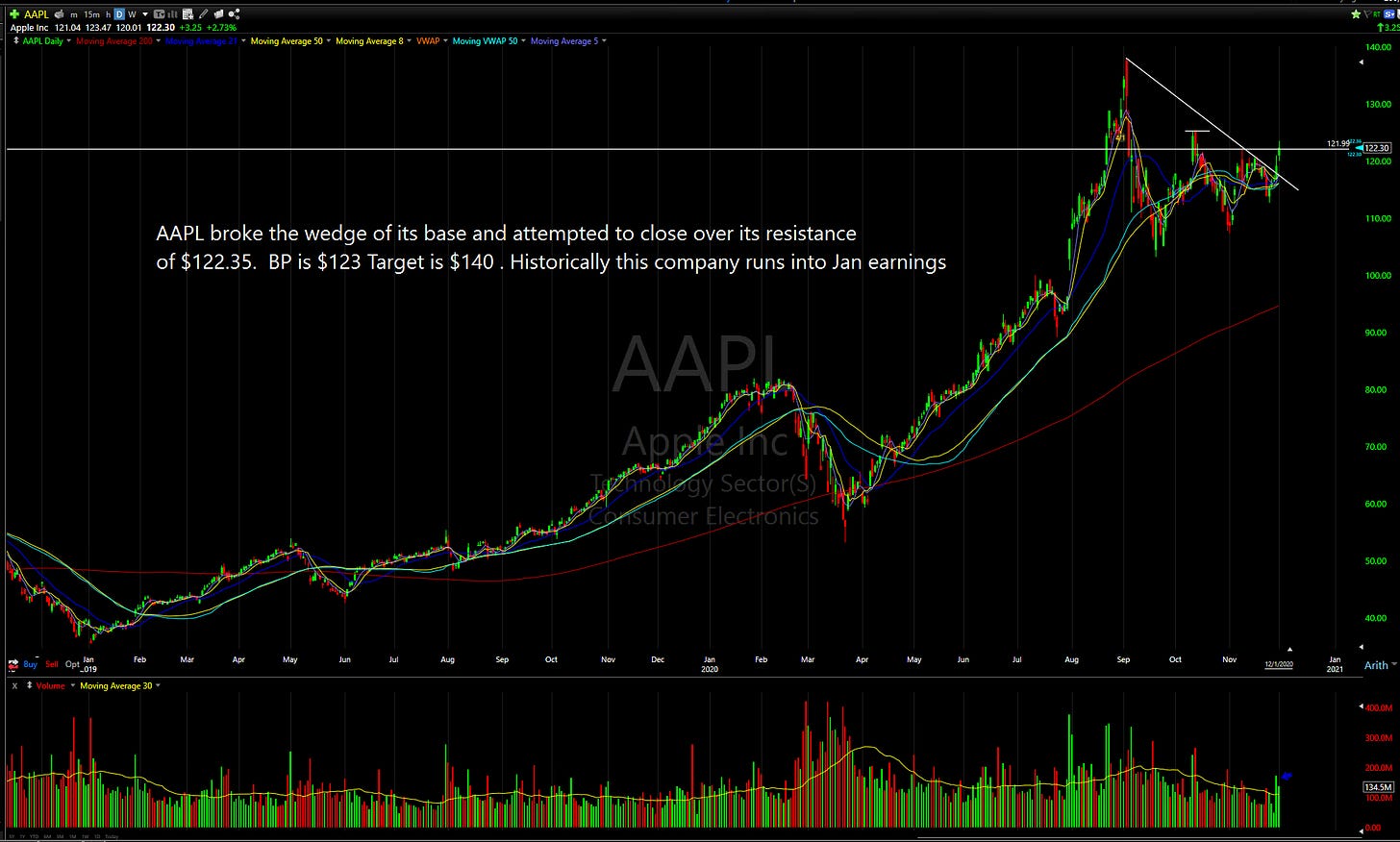

Lets follow up on some of the stock ideas

If you do not see something that was in a previous Newsletter and you have questions please message me on Twitter

Lets look at one particular sector of the market and some possible ideas in it

As always. these are ideas and everyone needs to make their own investment decisions. We all trade differently. We all have different risk parameters. If you have any questions at all or anything is unclear, please reach out via twitter.

Finally , to be of better service. I have decided it is best to publish buy alert ideas as they form. I will alert via twitter of an Newsletter update This is will be more timely. I have been waiting till Sunday,Tuesday and Thursday but certain ideas are left out as they move before the Newsletter. Lets finish 2020 Strong !

Happy Trading!