Fairly productive trading week The markets continue to new highs. We are seeing some rotation in the Nasdaq. This is healthy and broadens the move. We are seeing a lot more money come into the markets as a whole. $ARKG doubled its AUM and is one of the five largest inflows last week. The market continued broadening can make a long lasting bull. The SPY500 continues to be slow. The Russell continues to act better. It outperformed on the week. Cruises, airlines, casinos were mentioned in the last newsletter as having continuation gaps . That is broadening out. We are seeing lots of Right shoulder failures in the consumer discretionary sector and energy.

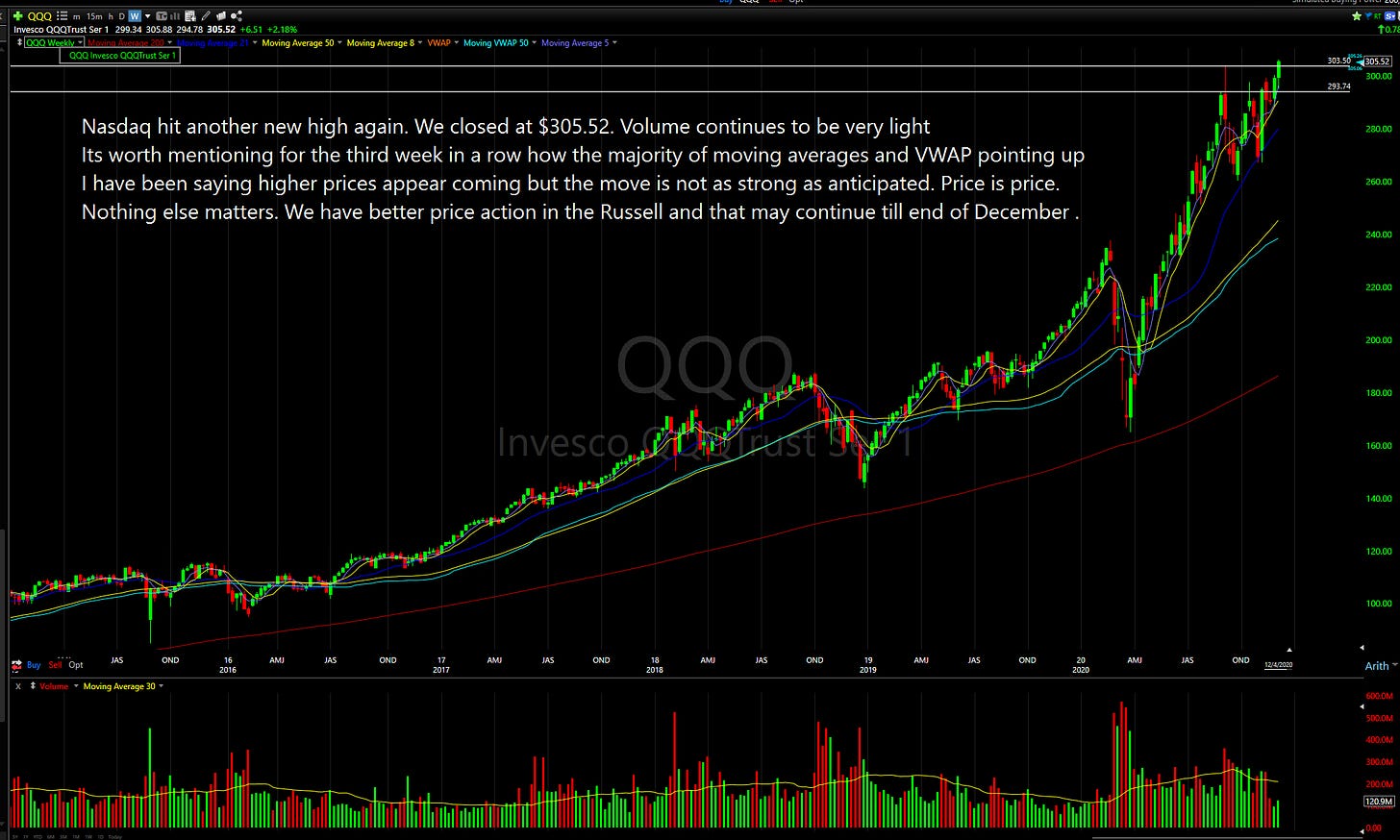

Lets look at the Indexes.

Lets look at two of the best performing major sectors on the week.

Lets follow up on our trading ideas

As always ,each person makes there own investment decisions. We all have different risk profiles. No two traders are alike. So far doing the Buy Alerts real time has made them more beneficial. $YALA actually started moving fast. If I waited until a regularly scheduled Newsletter, it would not have has the same risk profile. If you do not see something that was previously listed and you have questions. Message me on twitter.

Happy Trading !