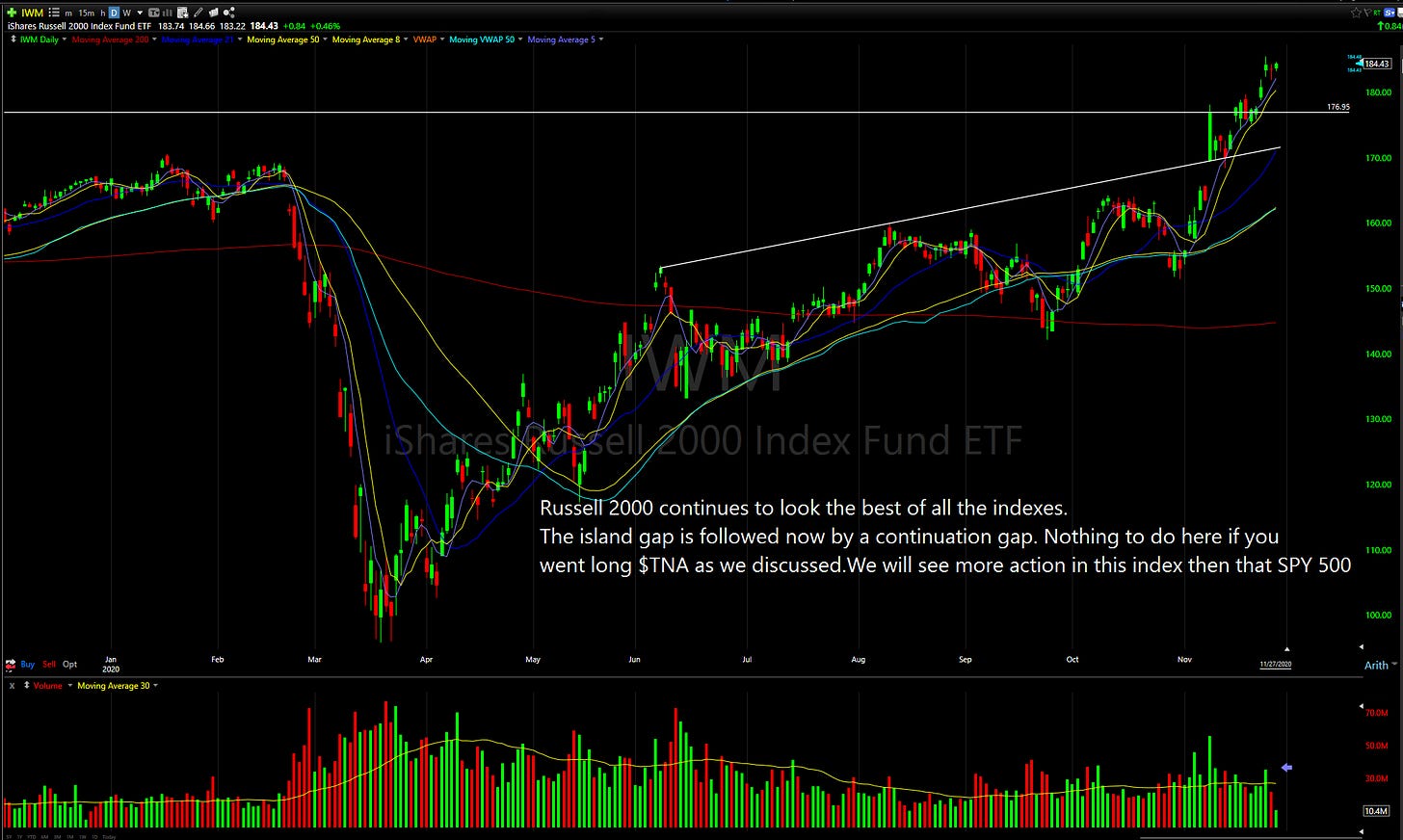

We had a very light volume week but as usual Thanksgiving week did not disappoint. There were a lot of small cap stocks that swung wildly throughout the short week. These kind of weeks make it harder to chart because less players which means less volume. Hence the volatility. I bring this up in case this week you notice your entries are not working as well as previous weeks. In regard to the indexes, Russell 2000 broke out of the island gap we talked about a week ago. It followed with a continuation gap. SPY500 will move but it will be muted. Technically it looks great but there is some overhead resistance . The Nasdaq looks poised to run.

Lets look at the indexes.

Lets follow up on recent added positions.

BP= Buy Point Stop = Stop Loss BE= Breakeven

Some possible new adds

As always each investment decision is based upon each individual. Every one trades different and has different risk parameters. This is simply my approach. Use it and make it yours. If something has been removed from previous newsletters , please feel free to message me. Finally, target prices are simply guides. See you all on Twitter!

Happy Trading!