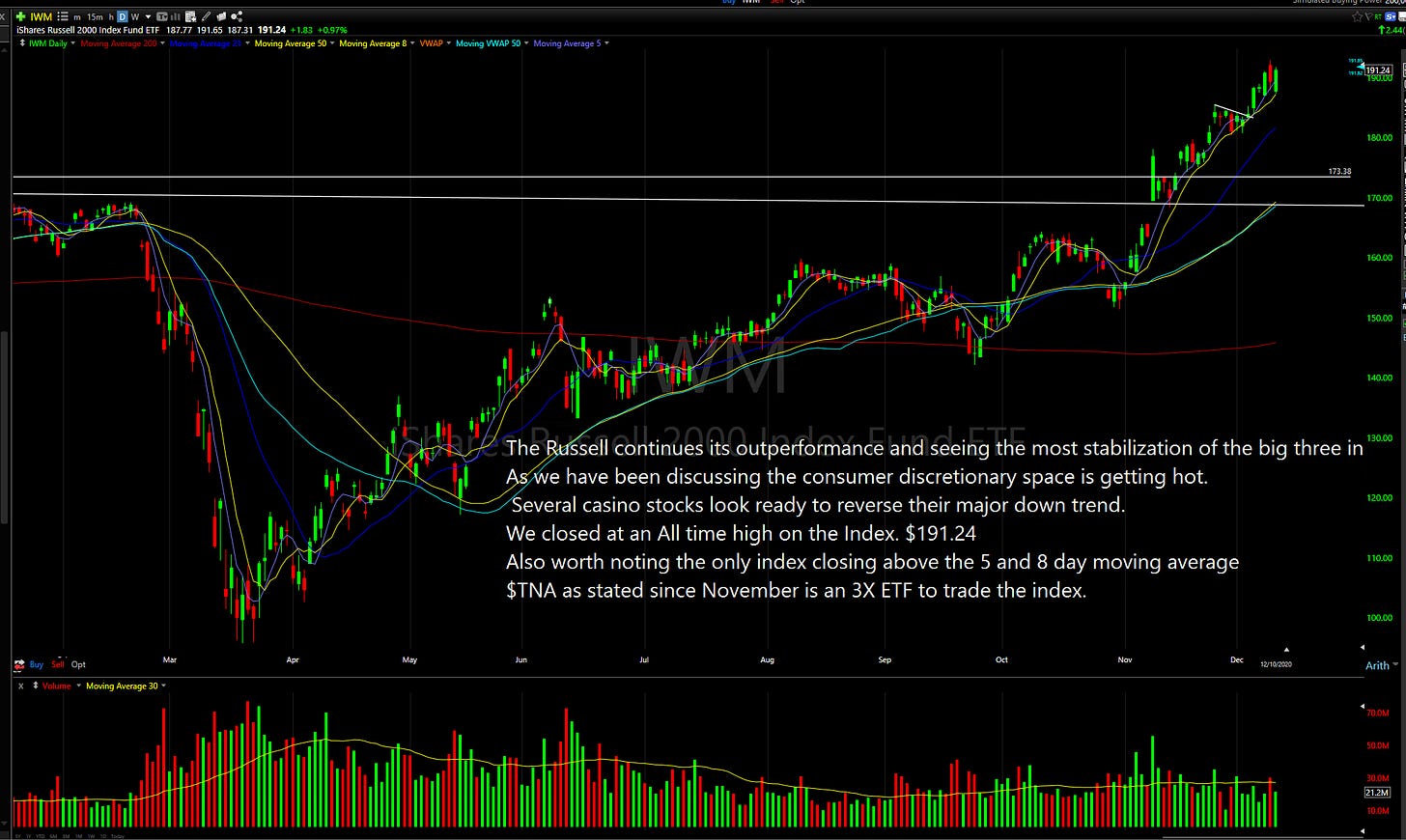

So stocks can go down as we learned this week. The Nasdaq was the index that took the biggest hit which makes sense based upon its trajectory this year. The Spy sell off was fairly quiet. The Russell made an all time high today. Tonight’s Vaccine news of the FDA granting emergency use of $PFE/$BNTX could lead to more buying in the Russell. Casino stocks in particular are reversing their downward trends. I will have some new ideas shortly in that sector. Also continue to look at consumer discretionary names $EXPE $BKNG $TRIP. The majority of people are ready to be mobile once again. Consider looking for stocks that meet that premise and avoid the ones that have benefited from the lockdowns. Some at home trends will stay others will fall by the wayside. Lots of stocks are setting up for higher moves. Its worth noting the $CLOU ETF rocketing today and some components hitting all time highs. $CRWD for example. Lets see if we can continue tomorrow.

Let’s look at the Indexes

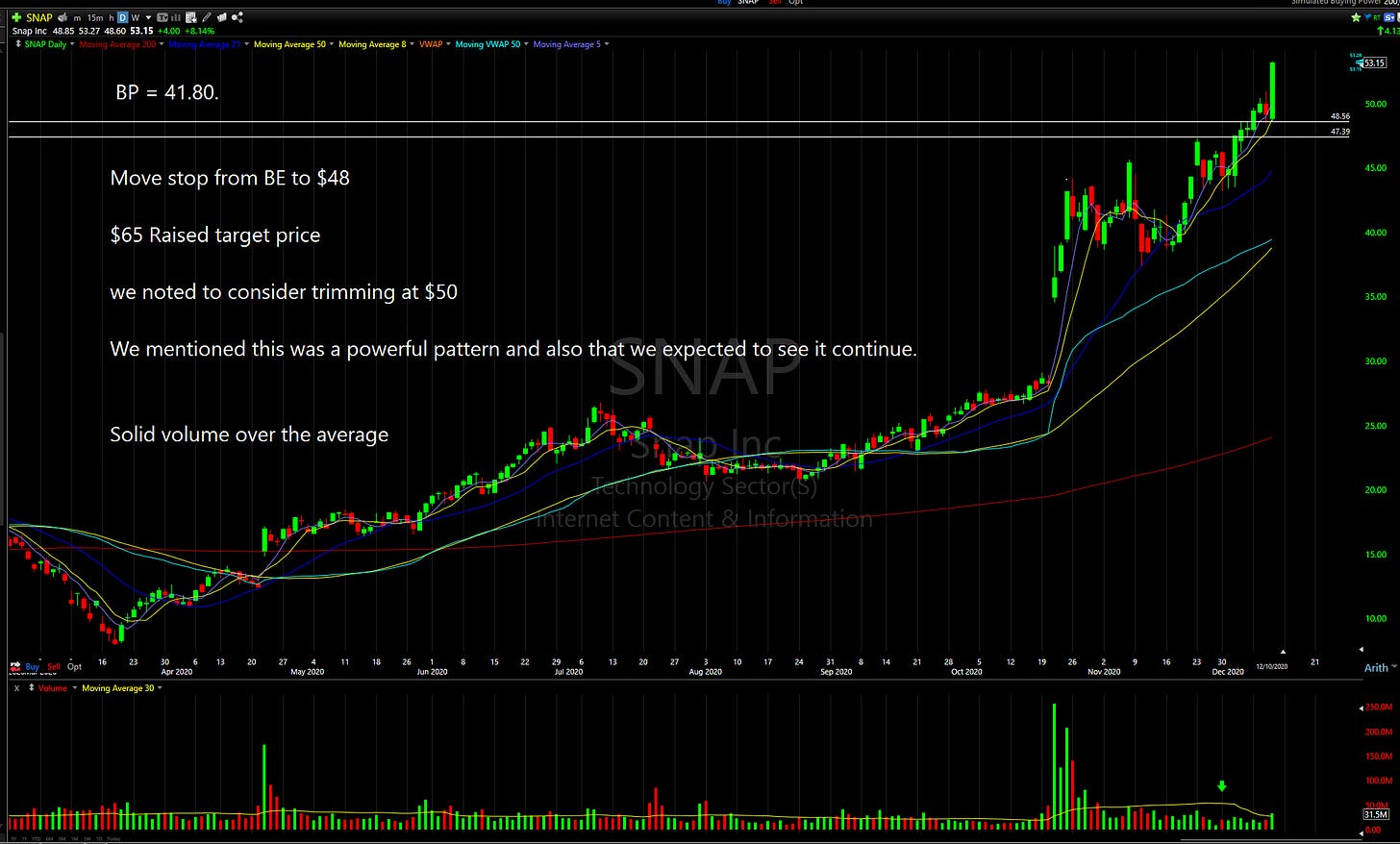

Lets look at our stock ideas.

As always all investment decisions are made by each person. We all have our own process and risk tolerance. One point I am attempting to hammer home. There is nothing wrong with taking a profit on a position that is up 20%. How much you take is based upon your risk tolerance. That process will allow you to weather the storms of swings like $YALA $NET and not care as much. Statistically speaking its prudent. If you do not see a stock on the list that was previously on here and you have questions, please message me on Twitter. Thank you for your messages on twitter about how this Newsletter has helped you. I am truly humbled . Lets finish Strong.

Happy Trading !