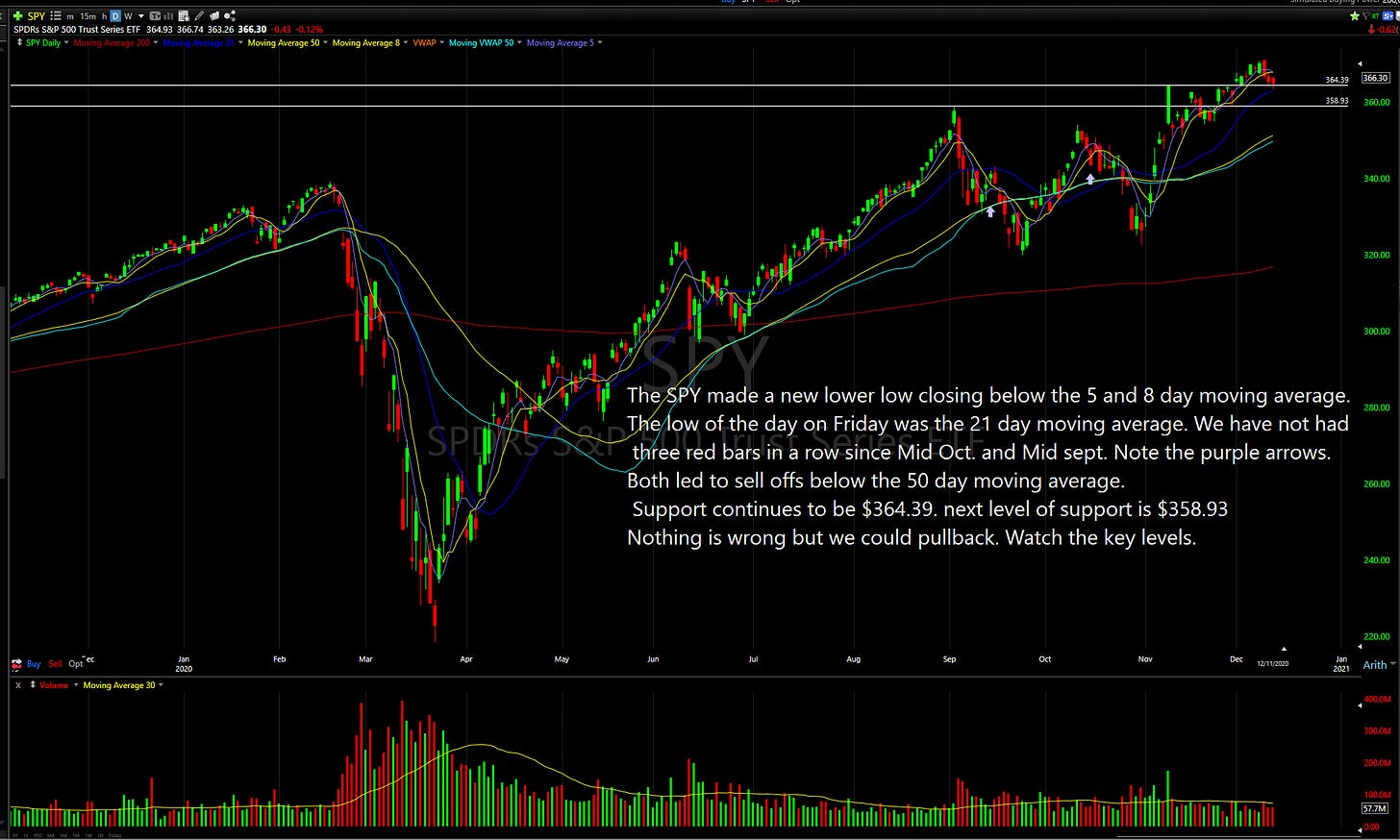

The Nasdaq took the biggest hit this week but held support and the 21 day moving average. The SPY selling down was a little more concerning with the third down day in a row. We have not had this kind of action for about 2 months.The Russell continues to be the strongest. We hardly sold down and continue to see inflows of new capital. Positive $PFE/$BNTX news this weekend could lead to consumer discretionary names continuing . Look at the entertainment sub sector. It outperformed significantly on the week. We also saw massive inflows again in $ARKK up to $15 Billion in assets versus $9 Billion end of Sept 30th. We mentioned to look at their holdings and moves. Note the move in $ROKU and $EDIT. I expect moves in their holdings to move dramatically considering the amount of money they have taken in. They are setting inflow records not seen in years. They need to put it work.

Let’s look at the Indexes

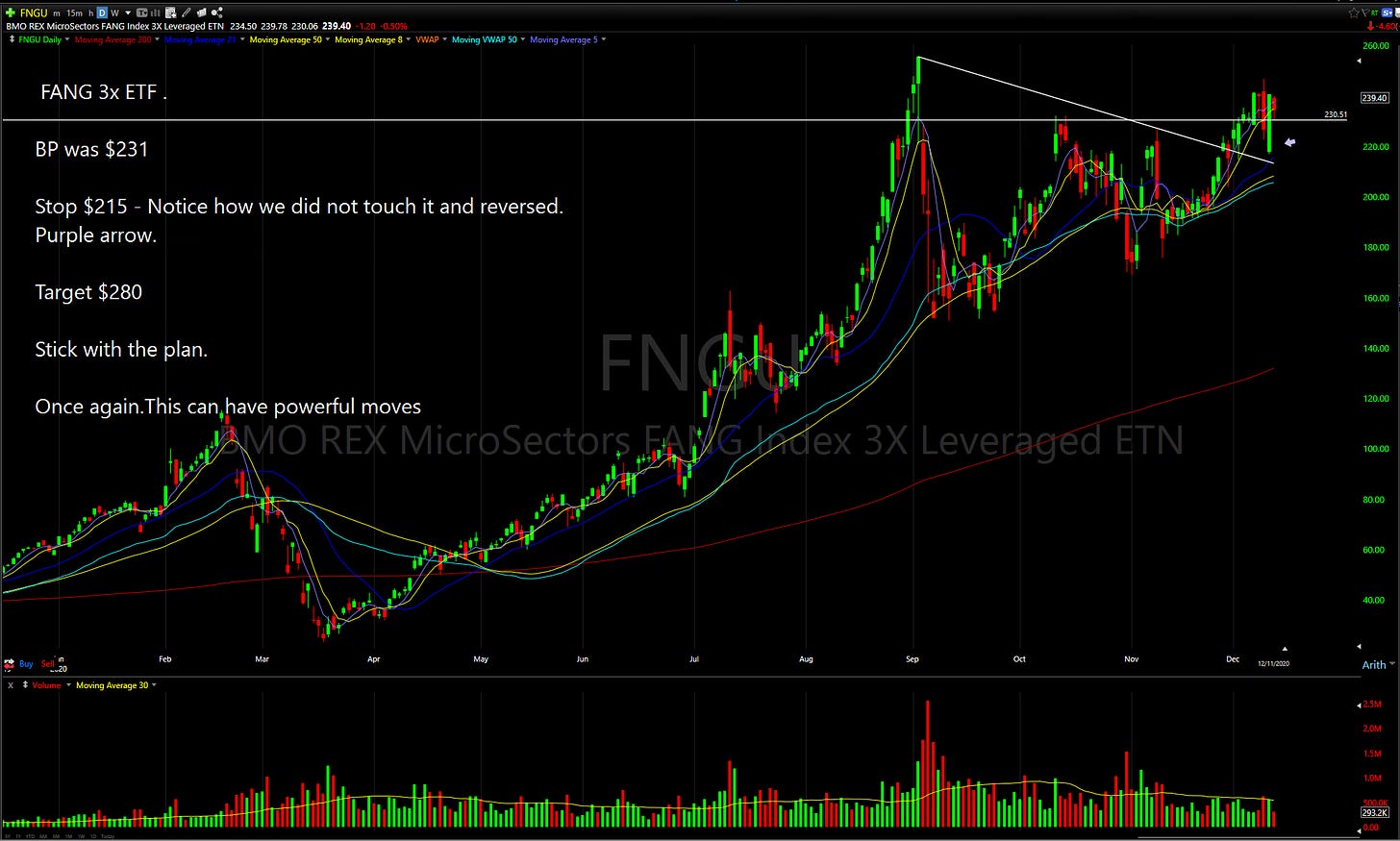

Lets look at our stock ideas.

For those that our new: BP=Buy Point BE=Breakeven Stop=Stop loss or Risk

There are several sectors I mentioned setting up. The markets as a whole are in intact but we can see rotation. We saw massive moves this week in entertainment $ROKU $DIS. Take a look at $GRVY. Its setting up. Drill down into the indexes and sub sectors mentioned in the letter. Message me with what you consider possible ideas. The goal of this letter is too provide ideas but more importantly to educate. I hope I am doing that.

As always all investment decisions are made by each person. We all have our own process and risk tolerance.If you do not see a stock on the list that was previously on here and you have questions, please message me on Twitter. Thank you for your messages on twitter about how this Newsletter has helped you.

A couple trading weeks left. Let’s finish strong.

Happy Trading !