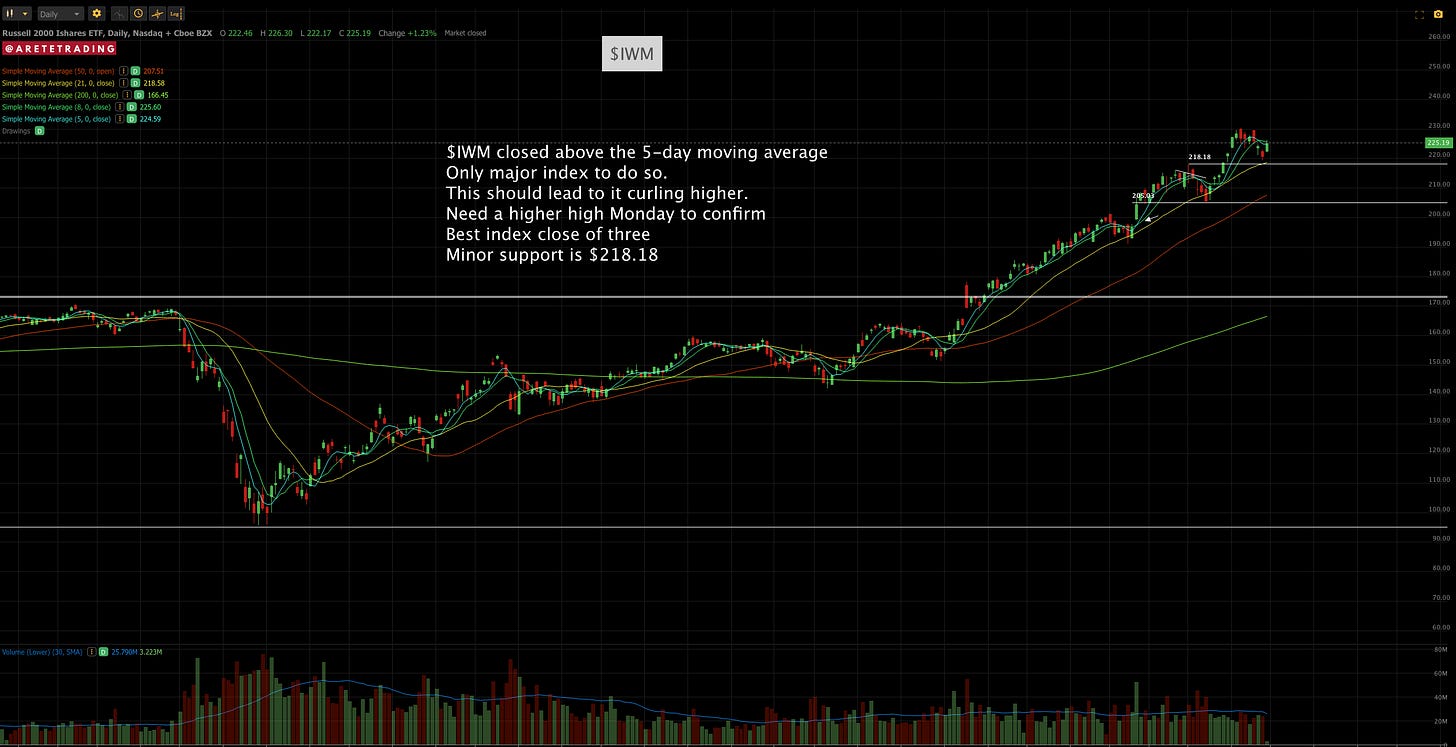

Large Volatility leads to opportunity and that is what we had plenty of this week. By understanding the key levels of our stocks portfolio we were able to add and trim effectively. This led to being stopped out of small losers before they became massive losers. It also allowed us to add to winners and trim into strength. As always be proactive in your approach. Know what you are going to do in any given situation before it happens. This preparedness gives us an edge to act faster than the next investor. Overall the markets acted as expected with the top of the channel being an issue for the $SPY $QQQ and $IWM. It is worth noting again that when we are at the top of the channels our new trades will be less likely to win due to volatility. This can also provide an opportunity as most will undercut a key level and stop people out only to reverse. We have strong market internals right now and need to use that edge to our advantage. We tested the 21-day moving average on both the $QQQ and $SPY. We also tested minor support and bounced. I would have liked to see more follow-through on the wedge breaks today but we rolled back into them. The $IWM on the other hand did not come in as much and is now above the 5-day moving average which could make it curl and retest the recent highs. Monday will be a key day. Higher closes would me confirmation and follow through. Friday action was not overly surprising. When we have several down days and then have a rally most investors sell into the strength to raise capital and reposition. The trend is bullish and until fiscal policy changes, it will stay intact. Let’s get into it!

Let’s look at our Indexes!

Let’s Look at stocks!

I am continuing to work on a system to help people get better at identifying entries and exits. Possibly doing live Youtube videos is one idea.

Subscribe to You Tube! 👈Subscribe and turn on notifications. There are actionable top stock ideas daily posted and reviewed. This weekend’s videos were packed with ideas that might be added to the newsletter soon.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help and offer feedback. If you have questions message me.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

*For example I called the $PLTR long and $RIOT short both live today as well as selling points on $TIGR. You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇