What is going to happen tomorrow? The quick answer is no one knows. What we do know is that after two weeks of corrective action the markets found a spot to bounce and move forward with such stocks as SHOP up over $110 from the lows and TSLA up 460 from the lows. The list of major reversals goes on and on and I cover ten top ideas in my youtube video this weekend. Also, there is an extensive but quick, simple, and easy-to-understand video as to why the markets may have bottomed.

The markets have bottomed. No one likes to say it or call it because you really never know. You can look for clues and deduce based upon several factors but in the end, you need to be prepared. In Thursday's newsletter, I walked through key areas to watch not only across the major indexes but also the 10-year treasury and the VIX, which is the volatility index. The VIX saw very little action with such a sell-off showing clearly that institutions were not interested in hedging their stock positions. More importantly the 10-year treasury held at the 1.55% level. The yield is not as important as how fast we moved up. The rise and lack of clarification as to Fiscal policy by Janet Yellen or Jerome Powell spooked the markets. Finally, we look to have exhausted and can now go on the premise the bottom is in and look to start basing, building, and buying new stocks as new leaders always emerge from corrections. Also, understand larger capitalization names will be bought first before the smaller capitalization companies now.

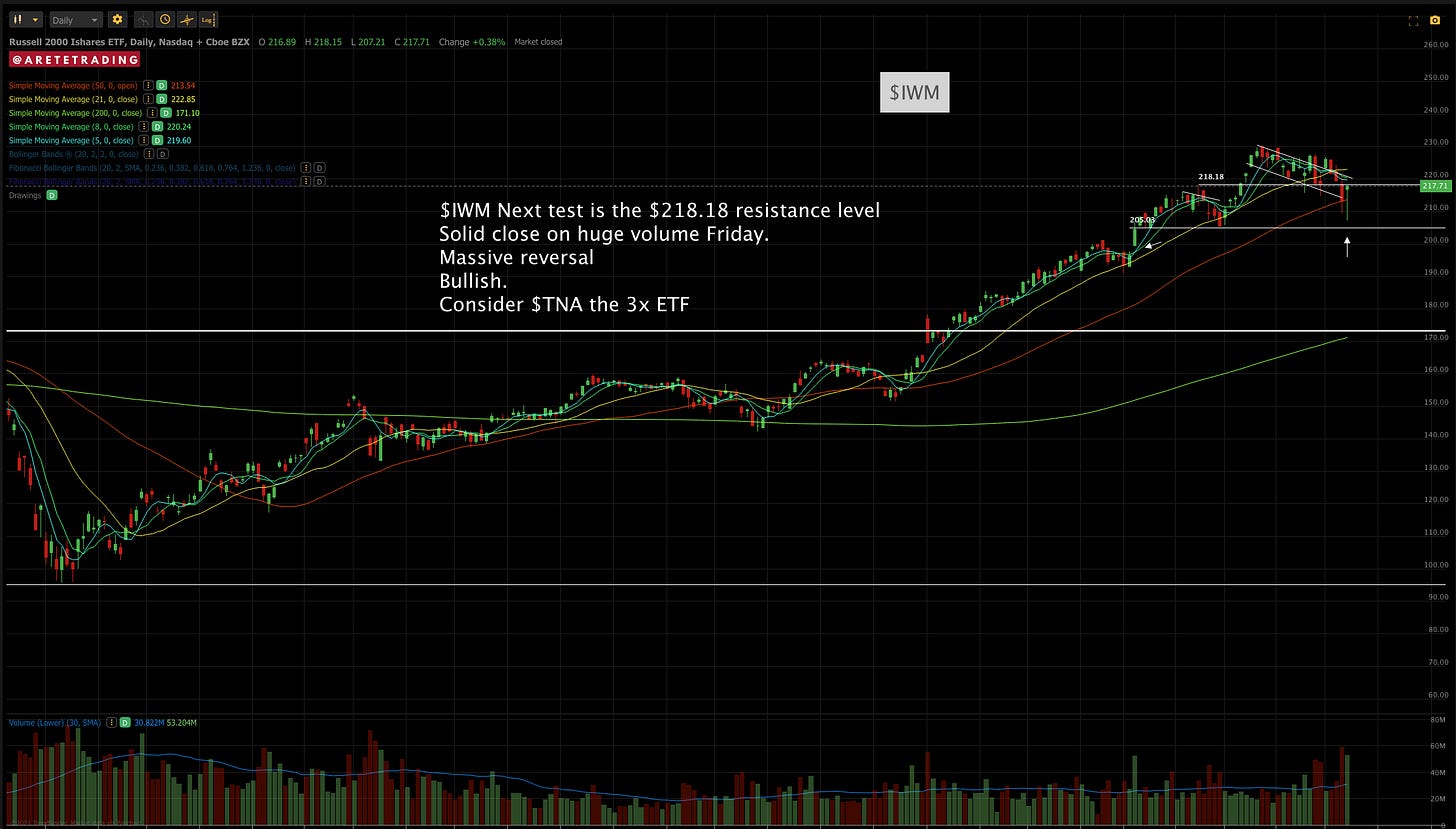

The Nasdaq bounced right off our key level of $298 and reversed over $304. This was the first time in weeks we flipped a resistance level to support. We formed a hammer bar which is a clear sign of the shorter-term trend changing to resume the longer-term trend. Now $312 is the next key level of resistance followed by $316.50 to get us back into the upper channel. The SPY closed right at the top of the wedge and over the 50 day moving average. This was done on the largest volume since April 2020 which is a very bullish sign. Finally, The Russell 2000 closed above the 50 day moving average and right under our $218.18 resistance. When we flip that level we could see a short-term push in the index.

Expect several stocks to be added to our buy list in the next couple of weeks. Our Add on Friday of ARKK is working out well so far. Expect lower accuracy on your position as this sorts itself out. As stated Thursday you can always trade the TQQQ, TNA, SPY, or even the SOXL instead of stocks to reduce volatility as we rebuild.

Let’s get to the Indexes!

Let’s look at our stocks. Well stock 😂

Several more stocks will be added in the coming weeks as the charts develop from the lows.

Subscribe to YouTube! 👈Subscribe and turn on notifications. I covered why I believe the stock market bottomed. There is also a link to 10 stocks that look ready to move.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day. You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

*For example SOXL long call on Friday as well as QQQ reversal were mentioned today. Those that followed along did quite well. You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇