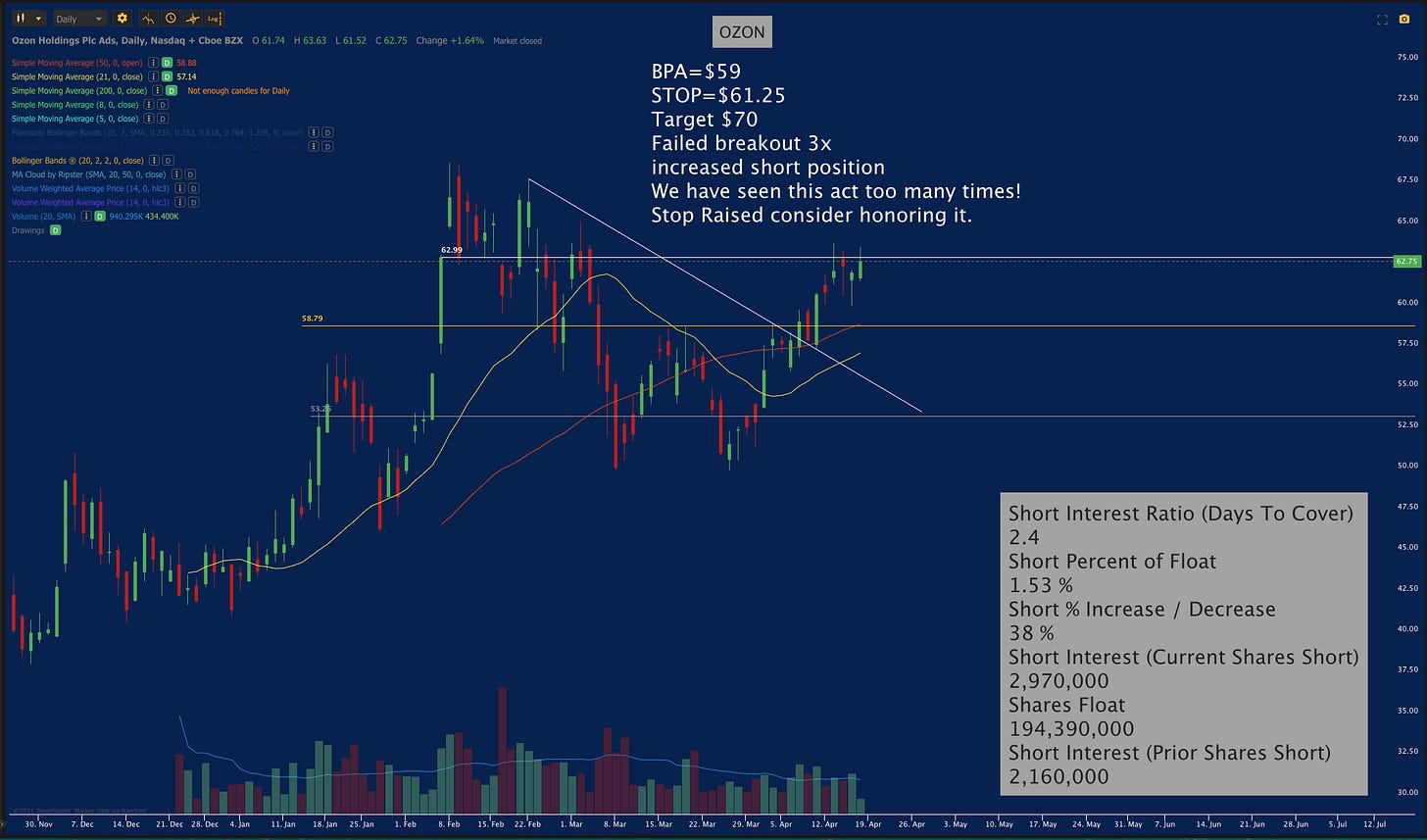

So the Bull market continues to climb yet we keep seeing sectors failing breakouts and retesting supports. This week alone we saw the Biotech index give us signs of life only to roll and retest major support. The $CLOU stocks showed signs of life only to rally and reverse. One of the major issues we are having is volume. As we come out of a correction there is less volume. This is true not only during the correction but also when you come out of correction. So what happens is exactly what is happening now. We have more and more failed breakouts. Is it frustrating? yes. It’s why I have been leaning toward large-cap stocks and ETFs because they essentially are untouchable to what I will kindly call nonsense. If you look at our larger-cap trades as a whole they have done very well. $NVDA is up $100 points since our recommendation. Also, note $TQQQ is setting up for new highs. One area that seems to still have some pain is the $IBB. It looks like it’s not ready to move just yet. Based on the current action look for $IBB to get above the 50 moving average before buying ANY biotech positions. Friday’s reversal was a clear rejection. $CLOU on the other hand is holding in nicely above all its moving averages. This looks like the next sector we may see rotation. While some of these names sold off on Friday. They did not break support lines.

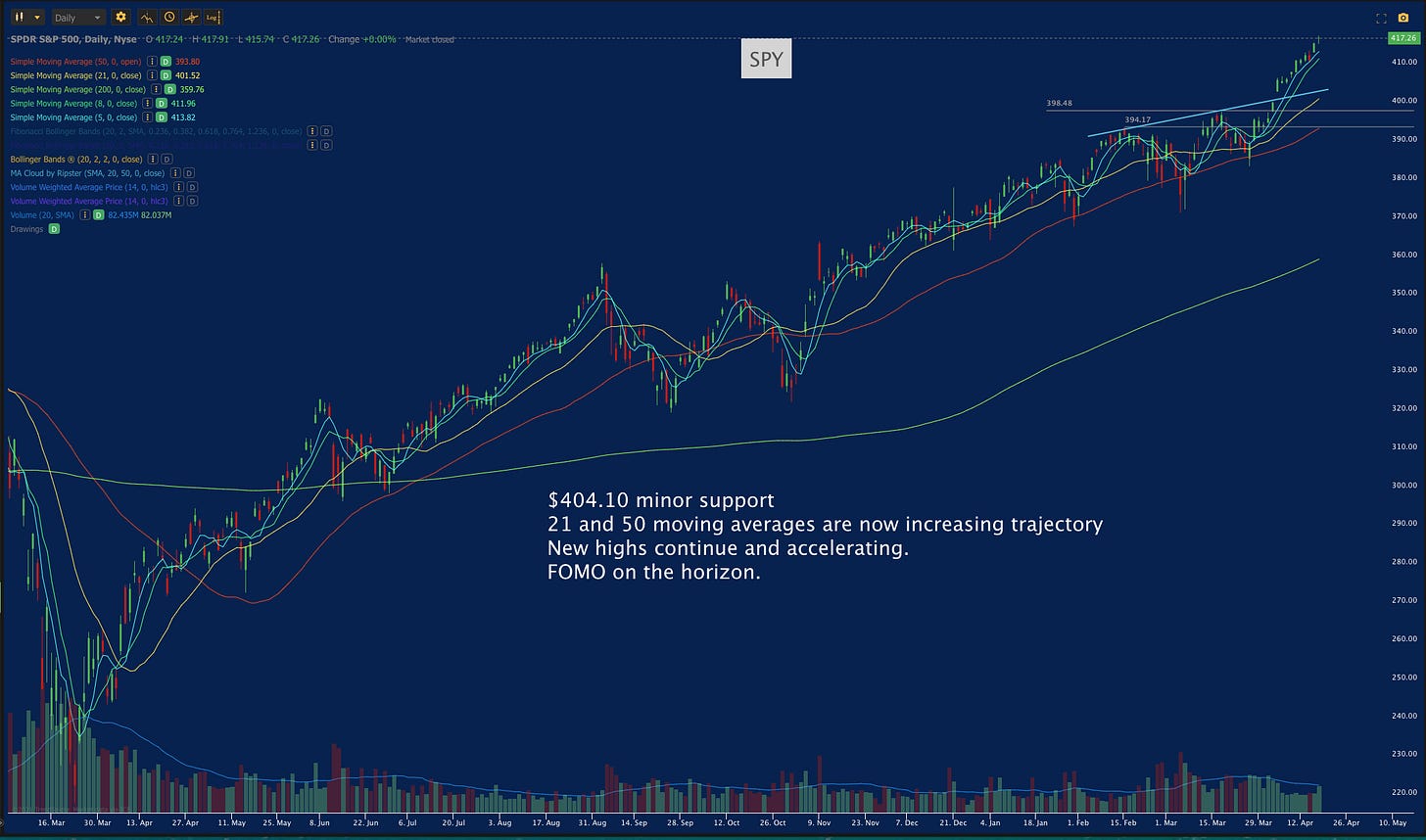

The $QQQ made a new high as well as the $SPY. Key levels are marked on the charts. Not much more to add They look great. We could always come in to support lines and retest moving averages but it will be short-lived. The $IWM continues to ride the lower trend line of the upper channel. We will see this market base for some time. I do not expect much movement either way.

At the bottom of the newsletter, there is a video for 16 stocks that could short squeeze into massive buying. I explain exactly the key entry levels and short interest. At the end of that video is our weekly 10 top stocks to buy. Last week’s big winner was $BNTX up 28.79%. I am really enjoying the YouTube platform. I have received a lot of requests to do a live stream. Our first live stream will be on Saturday, April 24, 2021

at 1 pm EST. Let’s do this!

Let’s look at our Indexes!

Let’s Look at our stocks

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of 16 stocks that are set up for a short squeeze. Consider making these videos part of your routine. I go over the lessons from the trading of the pro series during them and point them out in real-time situations.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter. I called buy levels on $NET and $COIN and $SI today.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

blah blah blah