It’s going to be an awesome week! I ran through several hundred charts this weekend and I am seeing more and more stock setups across all the indexes. Before we begin simple reminder to plan your investing strategy on the weekends. This gives you a solid advantage over the unprepared. Common themes I heard this past week were “ I did not know what to do when X happened” or another gem “ I missed the move”. If you are prepared properly these two lines are not something you say. You know exactly your buy list, your entries, your stops, and how much you are willing to risk per position size. Whether you are investing with the prospect of holding long term, which to me is years, versus trading which could be a day. Those principles apply. Both those statements are the equivalent of saying “I was not prepared”. When you invest you are playing in an arena with the smartest most disciplined people in the world. Bring your A-game.

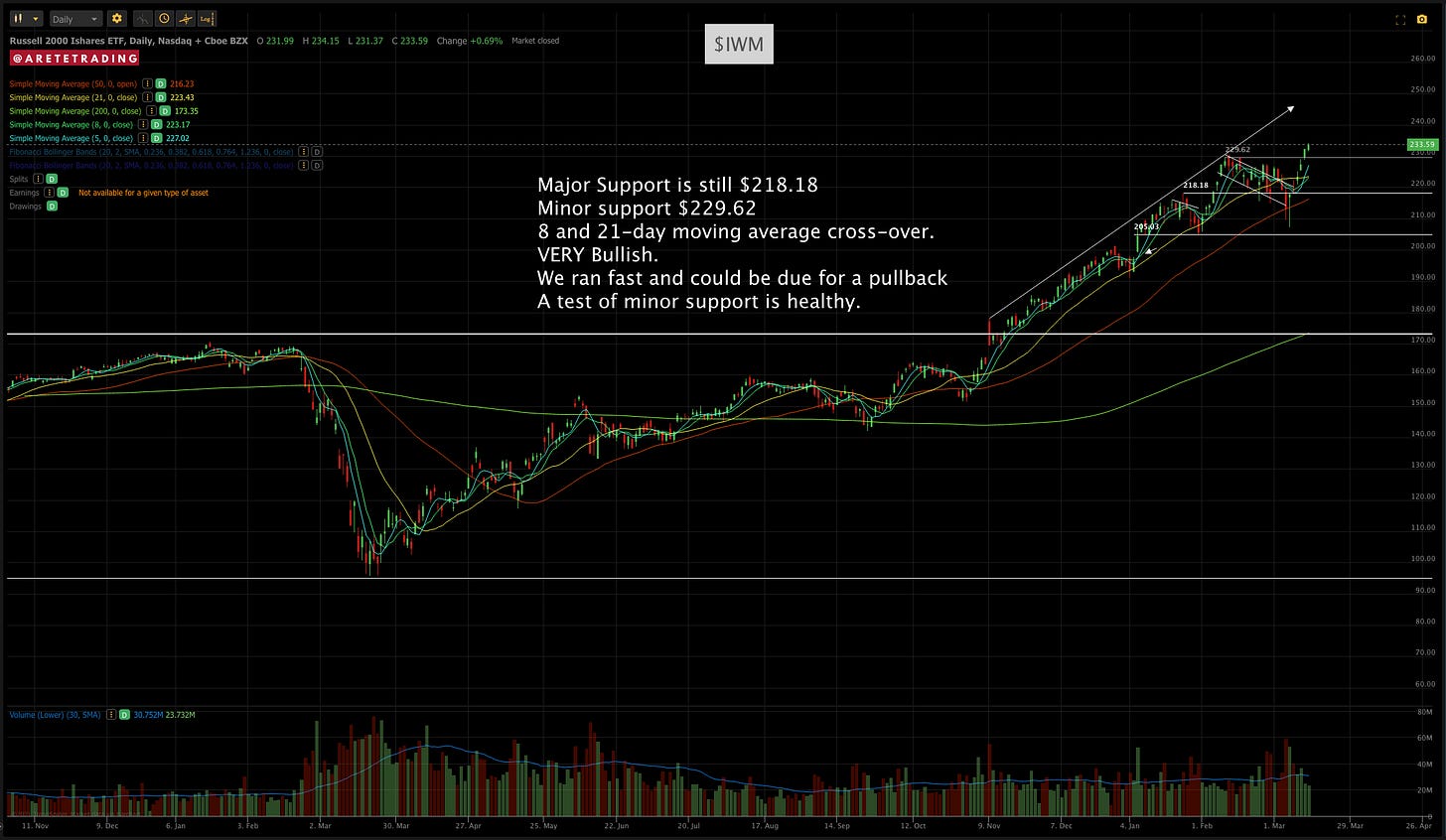

The Nasdaq did exactly what we needed it to do. We held the $304 level and then cleared $312 hitting the top of the Bollinger band on the hourly chart I showed Thursday night. I clearly stated we may need some rest and that’s all Friday was. You must fully expect to backfill after rising so much so off the bounce. This provides an opportunity. We are able to purchase stocks at levels that we may have missed. There is a large rotational trade going on The $XLE and $XLF both have broken out and gone almost parabolic. This is unheard of and most indexes and sectors always revert to a mean. While this can continue for some time, eventually the market will correct. the 10-year has cleared the 1.55% level hitting 1.62% but note our Nasdaq has not dropped as much. This is due to the slow down of the increase. The $IWM is approaching the top of the trend line and could come back in so be careful chasing small caps here. The $SPY is basing and has plenty of room to run. I fully expect money to flow back into certain tech areas. the $SOXX is holding and the $IBB is basing. Another clear sign is our $ARKK trade is acting well. This is the epitome of growth. This theme is not going away.

Finally, I did a video of the top ten stocks to watch for the week. The link is below.

Let’s get to the indexes and sectors!

Let's get to the stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. The TOP 10 stocks of the week have some opportunities that developing. See below

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day. You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

blah blah blah