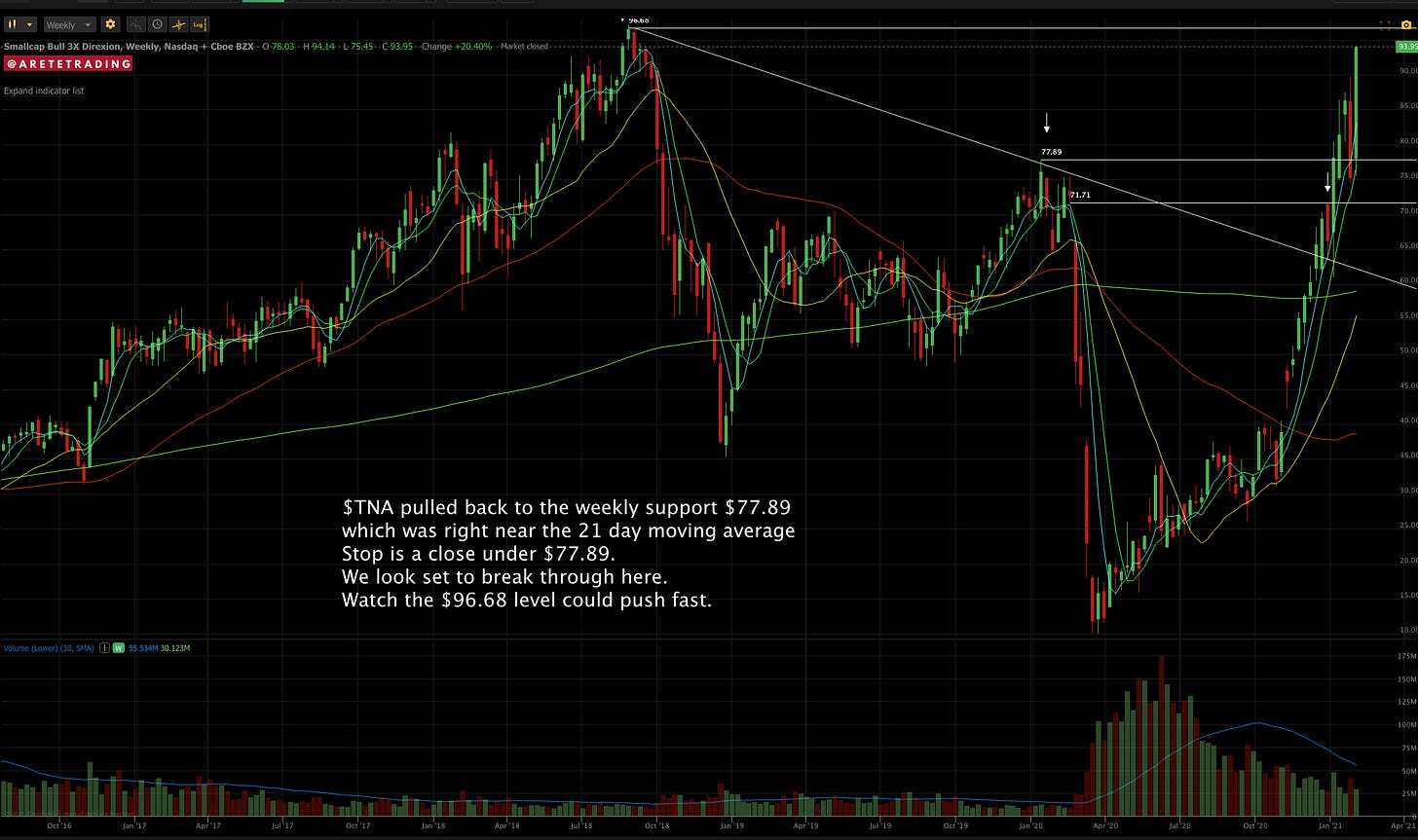

Great week for our newsletter stocks! How do we do better? What a difference a week makes. If you are new to the newsletter I would recommend reading the previous last Thursday so you can see difference in planing for market volatility. We reduced our stocks positions aggressively leaving only the top ideas on that were holding key levels. We also did not initiate any new positions until we saw the indexes act and confirm.By Monday afternoon we had our answer and starting adding buy alerts. During the downturn We were able to re-initiate a position in $TNA with a tight stop. Currently we are setting up for al time highs on the ETF. We had a great week but how do we do better?

I have been doing this for over two and a half decades and I can tell you the one way everyone can do better is to understand the competition and to out work everyone. When we trade or invest we are playing against the smartest and most disciplined people in the world. They have the money. They make the rules. That should be abundantly clear to everyone over the past two weeks.We do better by understanding their motives and being prepared To do that it requires us to out work them. To clearly define why you are trading and get precise as to your expectations and what you are willing to do to achieve them.This will be the difference in your level of success.

It Super bowl Sunday did you do the following:

-Review key earnings dates

-Analyze current stock positions

-Run chart scans for new opportunities

-Create a list of top 5 stock ideas

-Check the Indexes for support/ resistance levels

-Set stock alerts

Or did you watch the Superbowl pregame?

Lets get to it. Check the index charts for key levels All three are solidly in their channel and above their respective moving averages I expect to see follow through on the week. As one advantage we have is that we can be nimble. The larger players that pulled out last week have to invest the capital back into the market. This usually causes and over correction to the upside. The $QQQ is clearly the leader. Look at how the $IBB is setting up to run after a 6 year base. We saw massive action in that sector Thursday and Friday.

Lets look at our indexes!

Lets look at our stocks!

BP= Buy Price Stop= Stop Loss Target=possible reward level.

Subscribe to You Tube! 👈Subscribe and turn on notifications.There are actionable ideas in the videos. Today I posted some Top ideas for the next week or two that might make the newsletter. Also there is a short video on How to be profitable and consistent in trading.

As always all investment decisions need to be made by the individual.We all have different risk profiles.No two people trade the same. Understand the buy points .,stop losses, trims are simply suggestions. You need to develop your own process. I am willing to help. If you have questions message me. For example for stop losses I like to see the close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications.There are times my updates are timely in regard to the Newsletter.

*For example I called the double top in $OSTK and $FUV this week. You can see the time stamps.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader.

Wishing everyone Massive Success this week!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇