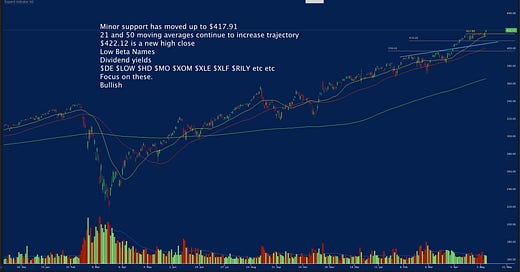

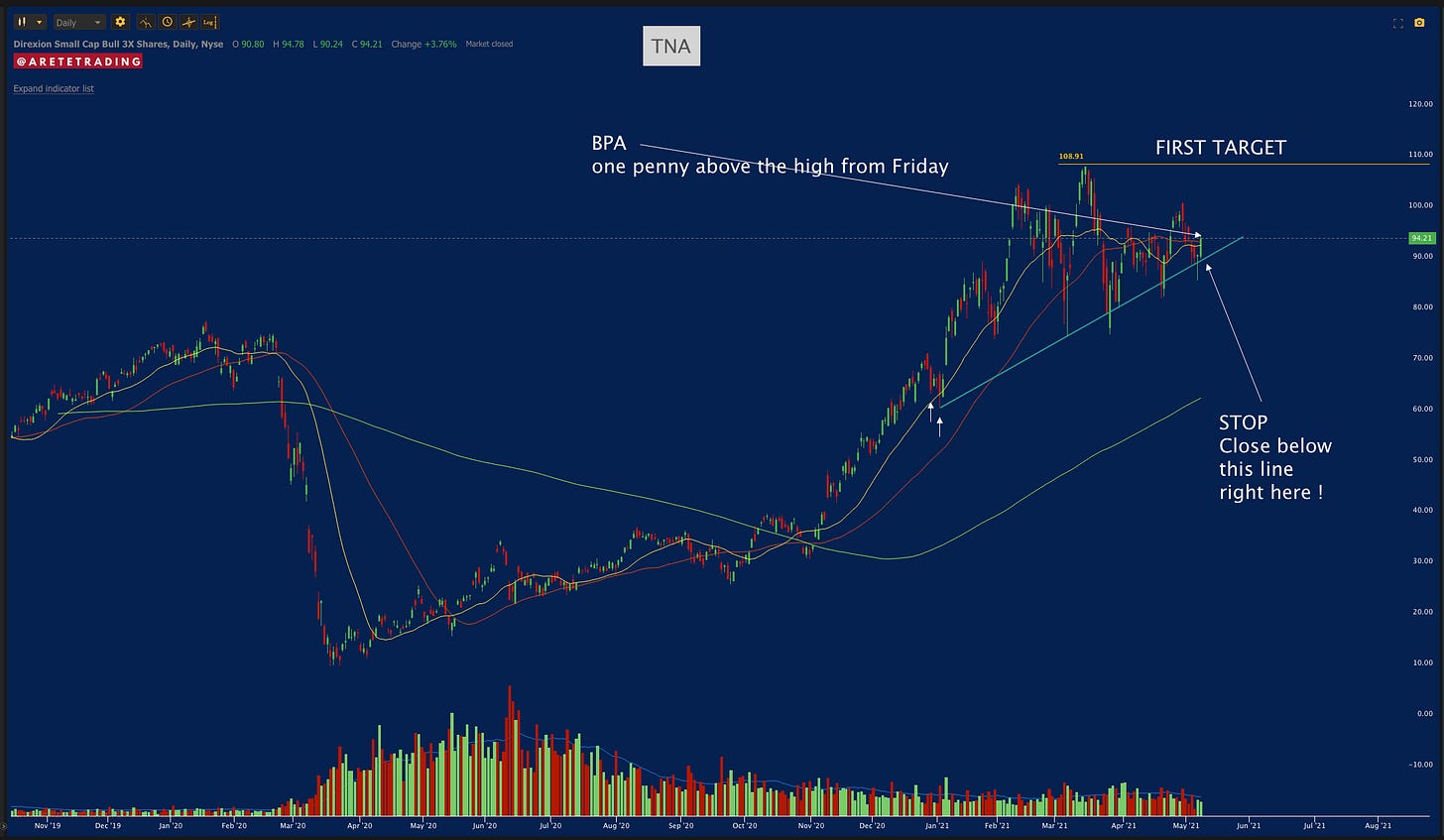

The Hwang over continues. Bill Hwang has done a number on the prime brokerage units of the world and the banks are still feeling it months later. As I mentioned Thursday, High beta names are under attack. This will lead to the continued selling of tech names on rallies. We did see some action come into the semiconductor and larger tech such as $AAPL. This is a good sign. However the lower end of the spectrum tech. The SPACs and companies that are not producing solid revenue and earnings will bear the brunt of this. Nothing was clearer than $PTON and $ROKU who both had solid quarters. $PTON obviously has some issues but overall that was a great quarter. It was penalized by constant selling all day long. $ROKU rallied to $334 only to fall back $20 points. The Nasdaq opened up higher only to fill the gap to the $336 level (see the blown-up chart below) and reverse. Until this deleveraging is over we will see the $SPY and $IWM lead. Key Levels are marked on the charts.

I mentioned previously that we will not see a bottom in tech until we see $ARKK has massive redemptions. The key reason for this is not her holdings but her LACK of leverage. Most levered funds we need to sell sooner. Due exactly to the leverage. $ARKK will not have this issue. As the stocks in the portfolio drop, she will get redemptions or outflows as they are called. Once this is over and she starts seeing inflows it would be a sign that tech is turning.

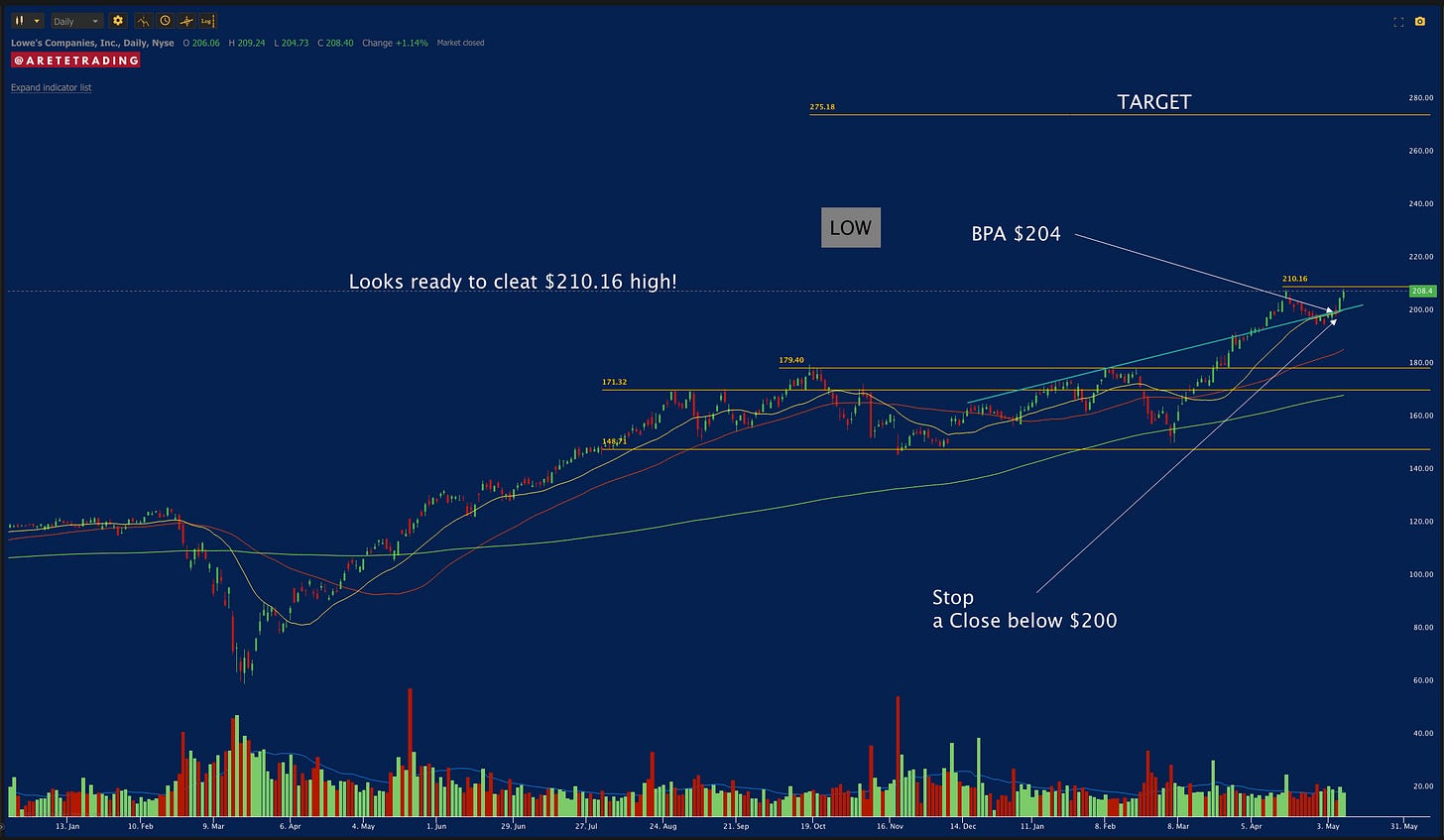

There are a couple of additions to the buy list. Note the new support on the $SPY Also, Saturday’s replay of the live stream top ten is below. It’s worth watching. Let’s get to it!

Let’s look at our indexes!

Let’s look at our stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of Saturday’s live stream event! It was a lot of fun! There are my top ten ideas and timestamps of ALL the stocks covered so you can bounce around. Tons of actionable ideas. Also, I walk through the importance of entering a stock correctly. Consider making these videos a daily part of your routine. If I go over the lessons from the trading of the pro series during them and point them out in real-time situations.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter as well as other ideas. I called levels on $PTON $ROKU and $NVAX today.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇