The Stock Market rally continues! The Nasdaq is leading the way and tech is coming with it. Over the past week, we have seen significant strength in the market through various sectors. On the Nasdaq, we see $SOXX(Semiconductors) and $CLOU (cloud software) Leading the way. Even after a large move off the lows, we have not seen a significant pullback. This usually means more strength lies ahead. As stated consider using pullbacks to initiate positions. This is a very different market from two weeks ago. Winners are being rewarded. A perfect example of this is our $RBLX trade. We are up 26% or $20 points in 4 days. I expect pullbacks and choppiness nothing goes straight up. That said I do believe the worst is over for the Nasdaq and I stand by my call on May 12th that we bottomed. Time will tell but the breadth and depth of this move are telling.

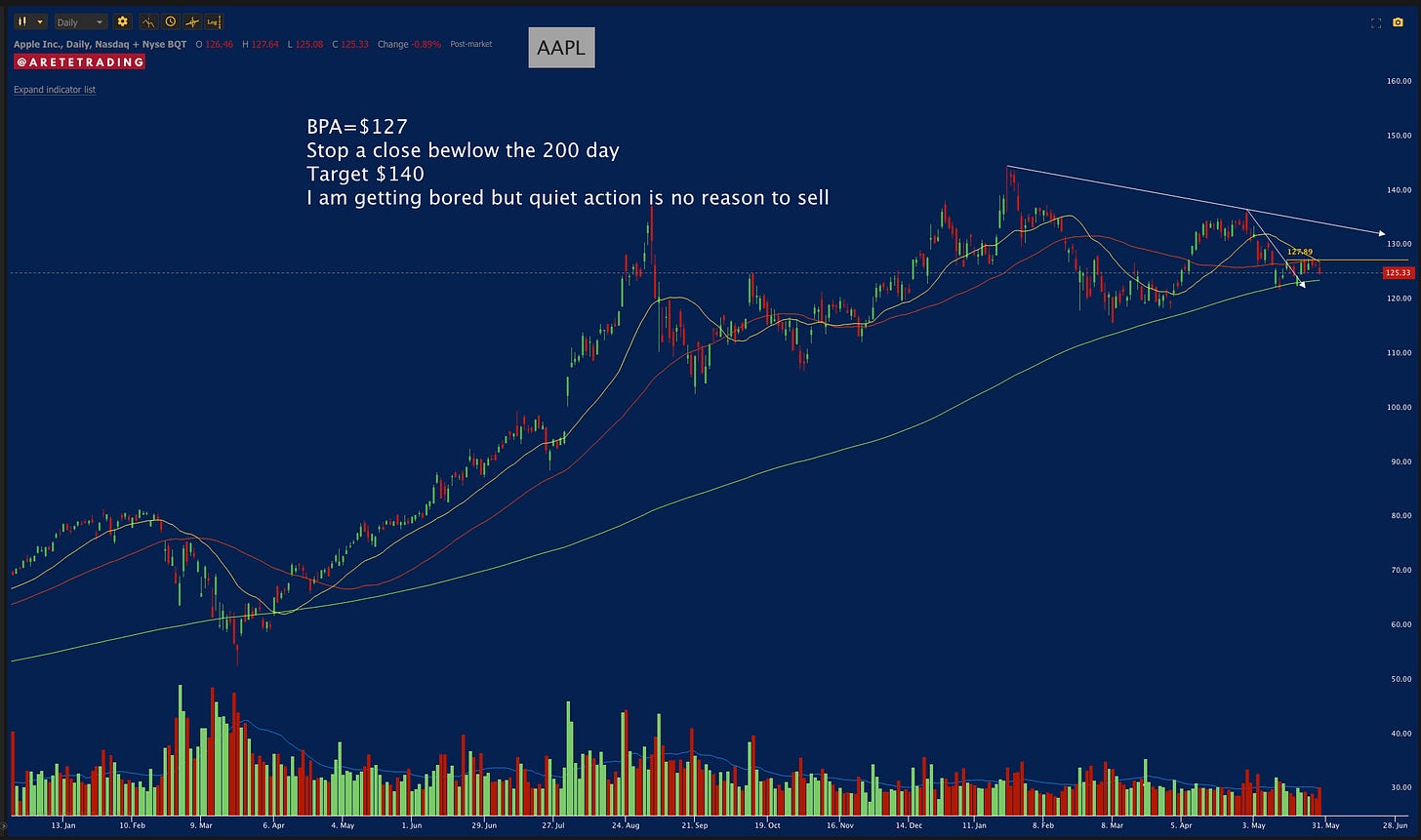

The $SPY continues to trade sideways but the rotation out of tech when tech on the Nasdaq is going higher is a conundrum. Both $MSFT and $AAPL are underperforming. The $XLE tried to make a move today only to come back into its wedge. I would not chase energy here. Let is work its way back up before engaging. The best sector right now is $XLF. The financials clearly bounced off the 21 day and had follow-through today. It was one of the only sectors on the $SPY up today which shows strong relative strength. $GS and $JPM charts both look great and ready for higher prices.

Just when I think I have the $IWM figured out it gaps up. We broke a minor wedge today and now looks like we will test the $231 resistance. This could lead to out performance over the next couple days. Airlines, casinos, restaurants all started moving today. The move just started and I will be watching closely. Let’s get to it!

Let’s Look at our Indexes!

Let’s look at our Stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of Thursday’s game plan for tomorrow. It’s packed with a lot of actionable ideas. I walk through several trades. Consider making these videos a daily part of your routine. I go over the lessons from the trading of the pro series during them and point them out in real-time situations.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter as well as other ideas. I called levels on $AMC and $ABNB today.

You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success! 🍀

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇