What do we do now? The markets keep dropping. The 10 years Treasury is rising at an enormous rate. Trades are not working. Accounts are having drawdowns. Stocks are at levels not seen in a long time. Some stocks are at levels we did not think they would ever see again. First, take a deep breath and realize this is simply a correction. That is all it is. It is a blip of the trend and we will get to that. We talked over the past few weeks that we were hitting a tough spot and it could correct. We are exactly at the level pointed out in the last Newsletter. So the levels and what is happening is not the issue. What might be the issue is that we were not prepared or did not honor our process. That is an easy fix. Simply prepare better for next time. Refine your process and go forward. The market is giving us an opportunity not only to buy cheaper but for us to use this event to get better. We will be going over a lot of different charts tonight and different time frames. There are a lot of nervous people out there. Consider sharing this Newsletter with anyone that has concerns so that they can understand what is going on and what to do.

As stated on Tuesday: Realize that until this market settles down we will get stopped out of more stocks than usual. If you are not ok with the drawdown. Simply wait for it to settle. If you want to be active but reduce volatility to specific stocks. Consider investing in the indexes right now. It’s much easier to track their movements in this particular environment.

$TQQQ as a long or short vehicle 3x ETF

$TNA 3x ETF on $IWM

$SPY

We are going to jump right into Indexes!

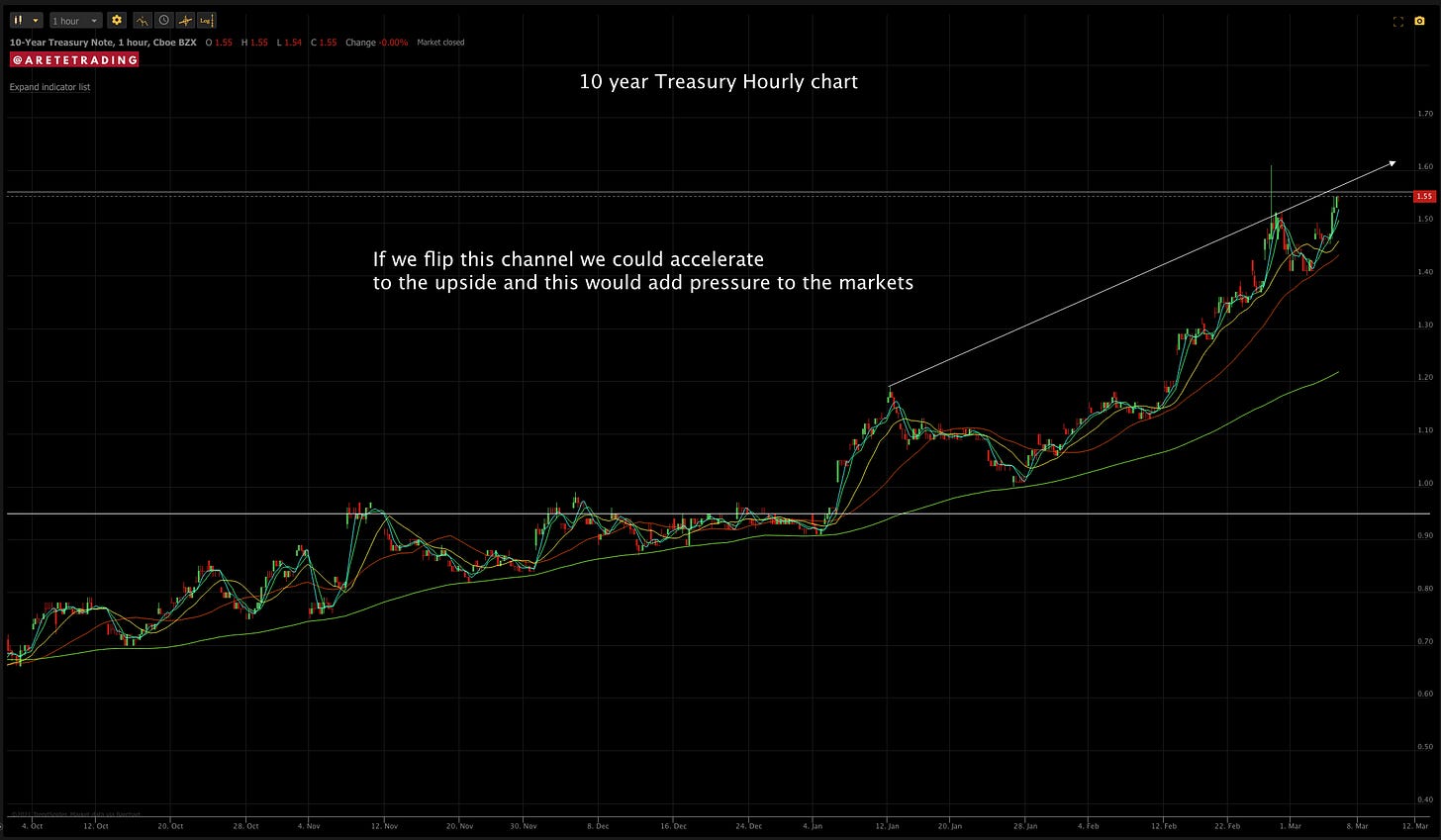

10 year Treasury Yield- This is what is contributing to the market sell-off. It is not that the yield is rising. It is the fast pace it is rising at We have had roughly a 33% rise in the 10-year yield in less than two weeks. This affects mortgage loan rates, borrowing rates which is why tech companies are taking the brunt of the carnage as well as the cost of goods. For example, Lumber prices have risen 18% in two weeks. There are two key levels marked on the charts. The first is $1.55 which is 1.55% the second level is the $2 or 2% yield level. It would be best if we hold here.

10 Year Treasury Weekly

10 Year Treasury Daily

10 Year Treasury Hourly

VXX Short term volatility index

The VXX determines the amount of panic or fear throughout the market in particular the SPY We usually see explosive moves when the SPY declines. The moves typically far exceed the movement seen in the SPY. A 5% drop in the SPY may result in a 15% gain in VXX. VXX usually provides more profit potential than simply shorting the SPY. However, that is not the case right now. Institutions buying the VXX? The answer is no. Certainly not yet. Take a look below it hardly moved.

VXX WEEKLY

VXX DAILY

SPY We touched the $371.70 support line and bounced. Let’s see if we hold. If not $368 is next.

SPY DAILY CHART

SPY DAILY CHART #2

SPY HOURLY CHART

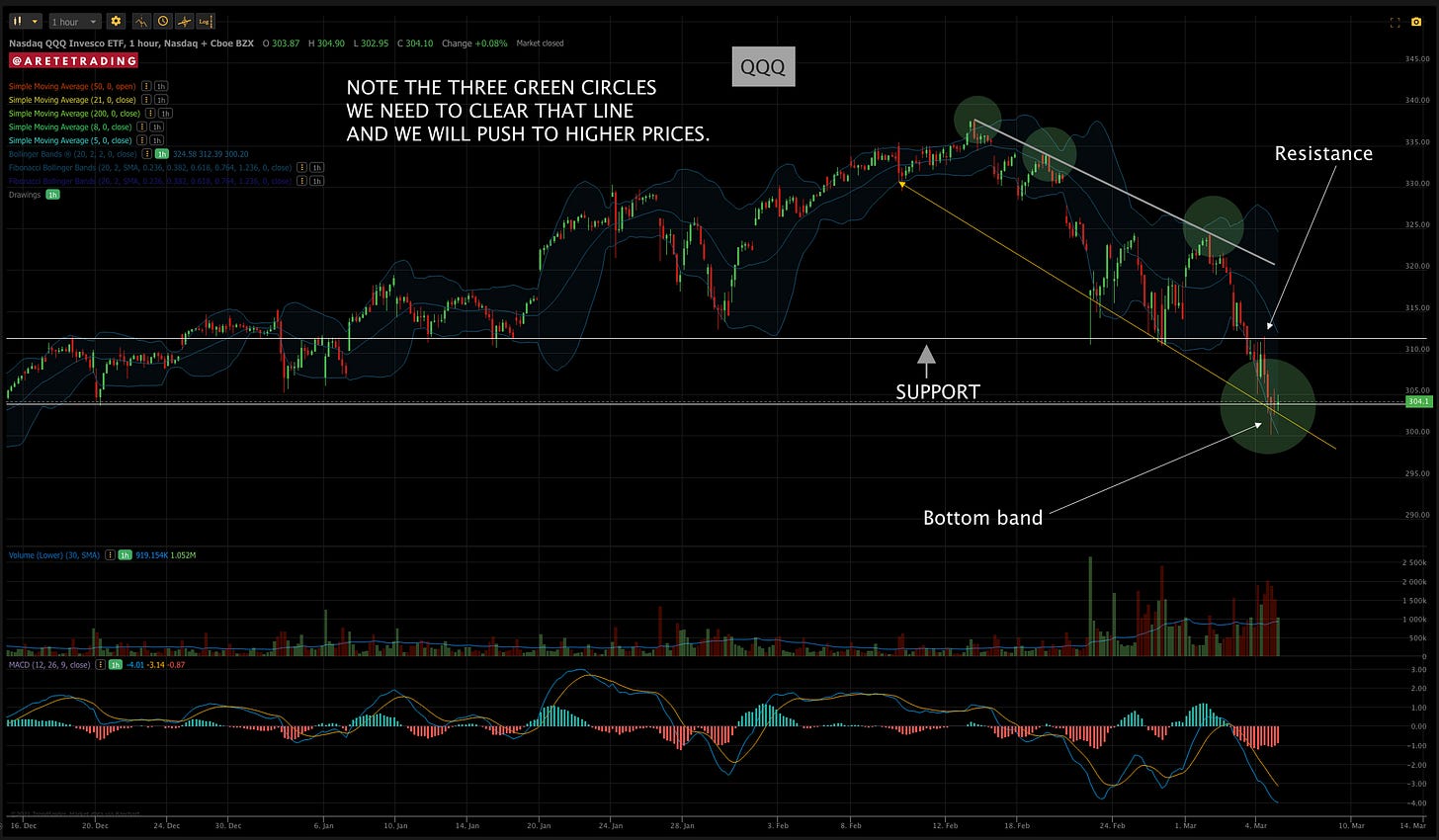

$QQQ Clearly broke out of the bear flag and $311 support became $311 Resistance and we could not rally to it. We did close above the $304 level which was our next level.

$QQQ DAILY CHART

$QQQ HOURLY CHART

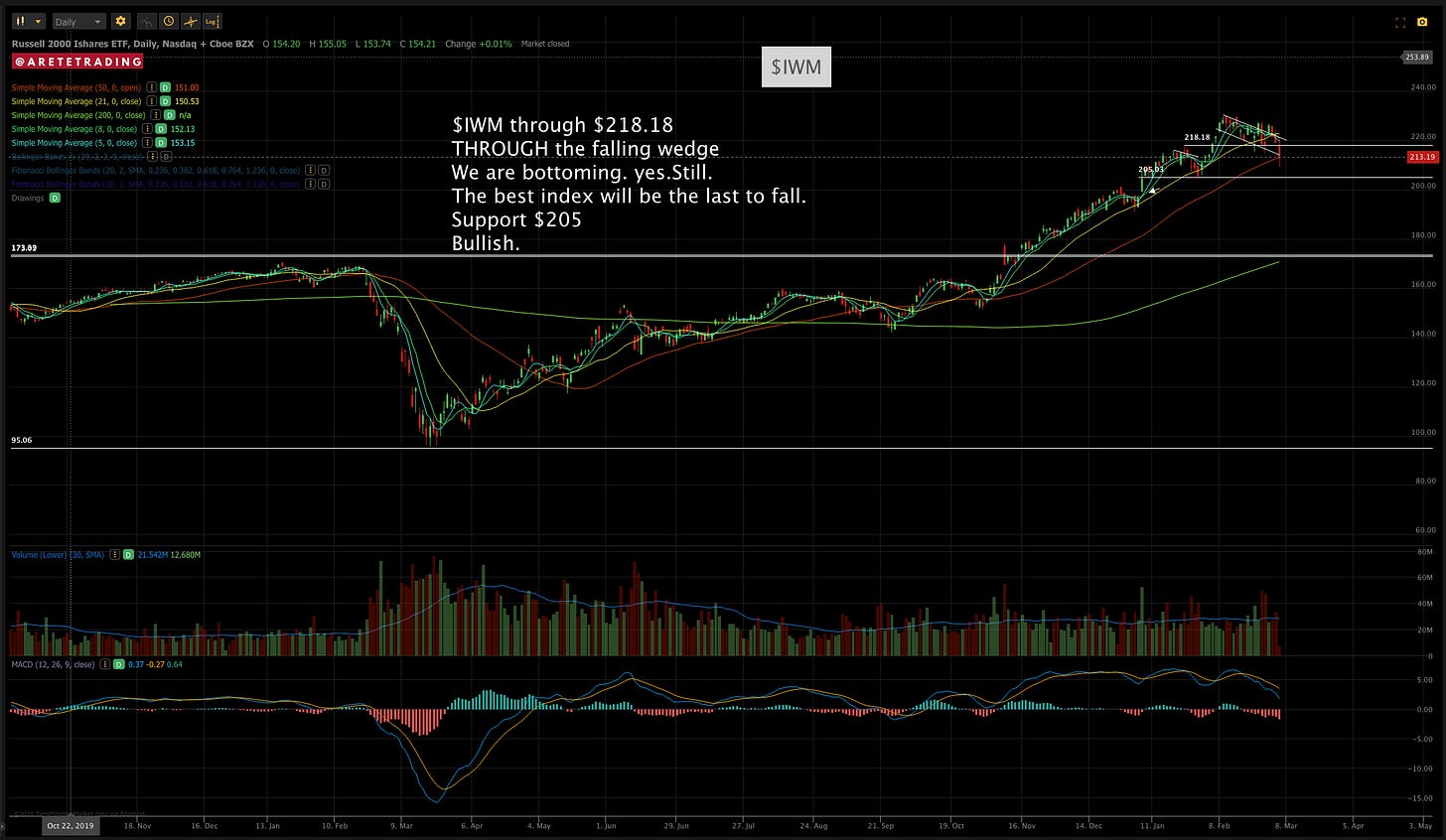

$IWM is the best of the Indexes and that means it will be the last to fall.

ALL Stock positions are stopped out by today. I will be adding more. They will be added quickly based on the volatility Realize the probability of stock ideas working in this environment is diminished.

Subscribe to YouTube! 👈Subscribe and turn on notifications. I covered the Index key levels today and the $GME trade that went quite well.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day. You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

*For example $GME long and $PTON short were mentioned today. Those that followed along did quite well.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇