Tech stock rally continues and looks ready for higher prices! We saw the $QQQ open right above the falling wedge pattern that has developed over the past three weeks! What is reassuring is that was the low of the day. We had follow through and closed above the 50-day moving average as well. Overall one of the best days for tech in weeks. Our next level is the $331 price point. This gets us over the 21-day moving average. It has been 4 weeks since we have been above both of those averages. Note the Strength in the leaders. $NVDA has rallied off the bottom close to 10%. We have seen a 25 % move in the $SOXL in two days. $TSLA looks ready to get back over the 200 day and possibly move higher. $CLOU stocks are starting to shape up. Take a look at $CRWD. That looks the best out of the software names. I stated around the 15th that it looks like the bottom is in. Today’s move is confirmation. I would be looking to add to longs and be careful with short positions now. We could see some squeezes. Look at the crowded short trades such as $PTON. It broke above the bear flag today. This is usually a sign of higher prices ahead.

The $IWM continues to underperform. Consider avoiding these names until it shapes up. Right now It looks like this might be a victim of rotation back into the $QQQ.

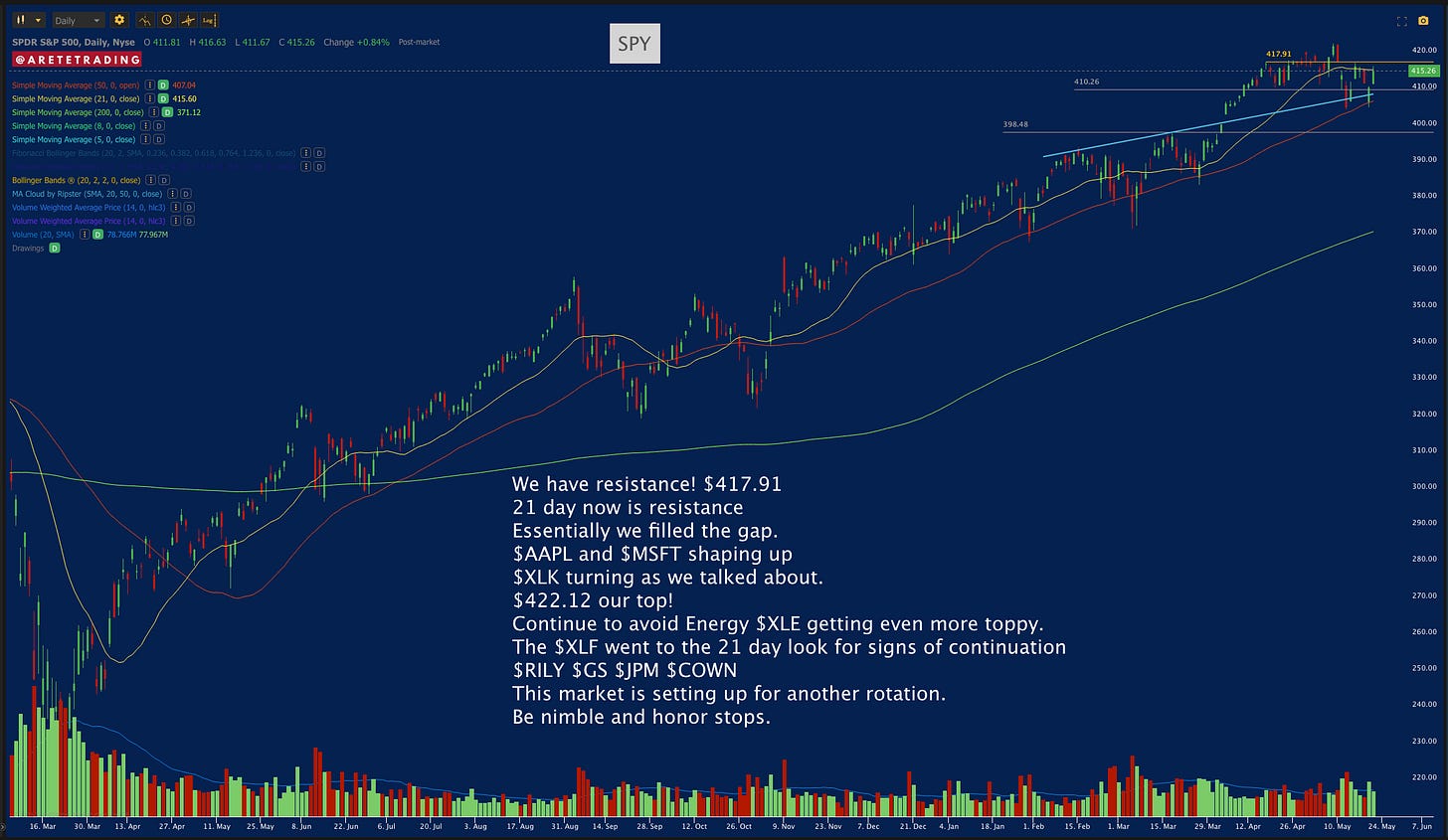

In Regard to the $SPY. The sector rotation we started talking about over a week ago has just begun. $XLE is clearly rejecting the top $54.50 which is a multi-year rejection. We maintain our secular downtrend on the index. The $XLF has hit the top of the channel and reverted to the 21 day mean. This could start working higher. It could also be capital for rotation into $QQQ. Look for setups. Usually during the imminent chance of rate increases financials rally. Key Levels are marked on all the charts. Let’s get to it!

Let’s look at our Indexes!

Let’s look at our Stocks!

You are going to see more stocks added shortly and new leaders emerge. Consider watching the videos and turning on notifications on Twitter. This market is moving very fast.

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of Thursday’s game plan for tomorrow. It’s packed with actionable ideas. I walk through several trades. Consider making these videos a daily part of your routine. I go over the lessons from the trading of the pro series during them and point them out in real-time situations.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter as well as other ideas. I called levels on $NVDA $TSLA $UPST today

. You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success! 🍀

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇