How do we profit on red days? Very simply we profit from being prepared and having a solid process that fits our risk parameters. As I have stated everyone is different. You must develop your own tailored process over time. The questions you need to ask yourself if you are not profitable are the following:

What were my stop levels on my existing positions?

How much would I lose if they all triggered?

Am I willing to take that loss?

If you do not have those answers, you are not prepared to protect your capital let alone be profitable.

Next set of questions:

If we do sell down what are the top ideas I really want to own or sell short?

What are the support and resistance levels on my top ideas?

What needs to happen for me to put that risk on?

What are the levels I would enter and exit?

If you have the answers to all of these questions and you were not profitable. It’s your process of entering and exiting a position and that is easy to fix. If you do not have the answers, you are not prepared and have not nailed down your process. It’s not easy but it’s simple. Consider having answers to the above questions every single day. When we invest even passively , we are playing against the most intelligent and disciplined people in the world. Showing up without a plan or process only makes us chum for the sharks.

The indexes have not resolved themselves over the top of the channel. They came back in and are all testing the 21-day moving average and minor support levels. All our key levels marked on the charts. Nothing is broken. We simply are pulling back and backfilling. This market acts a lot like 1995-1998. There were two years after that was spectacular. I do not see this bull market ending anytime soon but as I have mentioned in previous Newsletters. I do see possible corrections and if this gets worse, so what!? Honor your stops and wait. We will have new setups. As always, there will be an abundance. Look at our new three additions and how they act. Something is always able to be traded.Wash.Rinse.Repeat. Don’t overthink it.

Let’s look at the indexes!

Let’s look at the stocks!

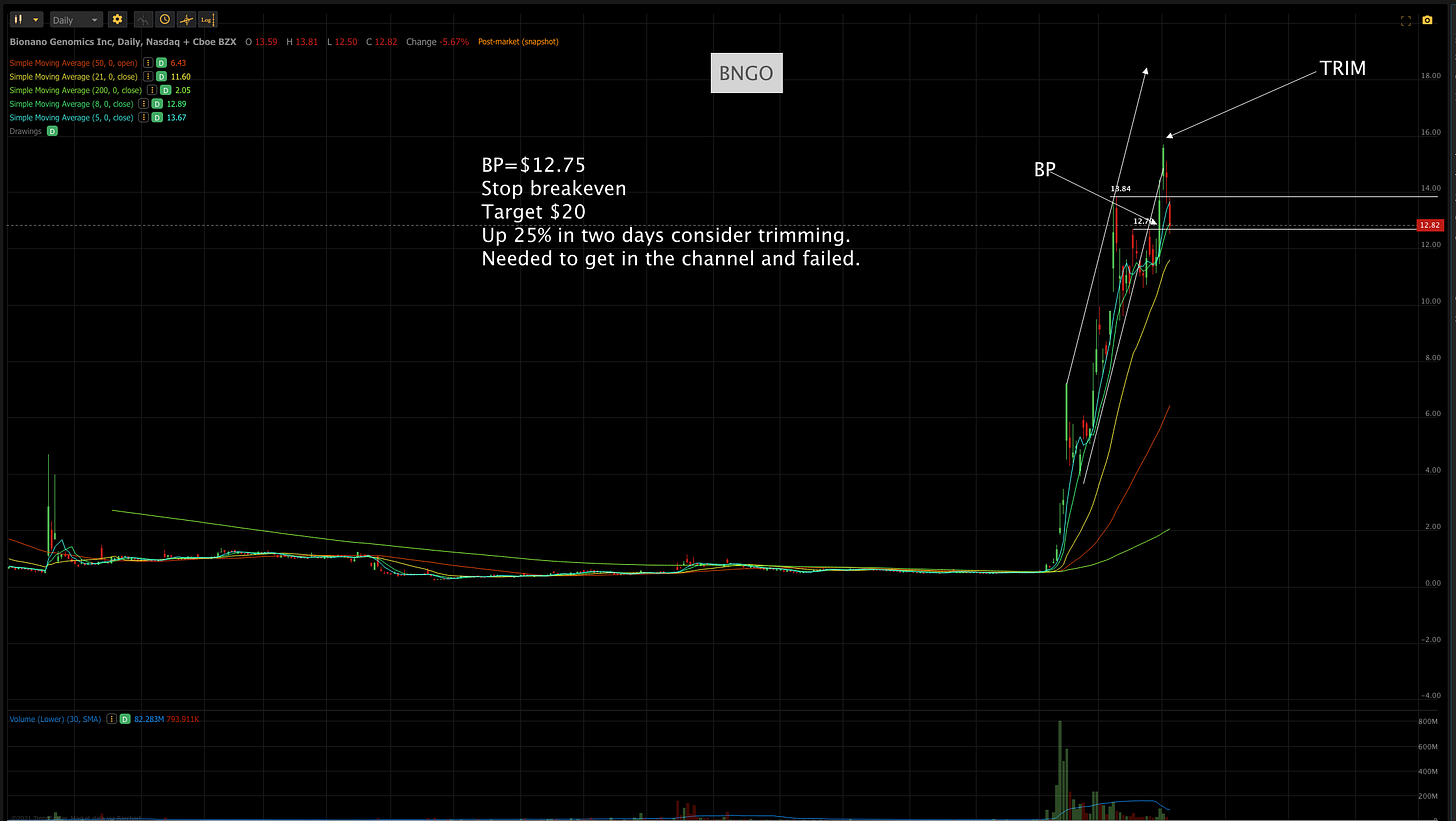

BP= Buy price Stop=Risk Target=Reward

Some people were stopped out of $SEED today. I received a lot of DMs. You must honor your process. When it started making highs I pointed it out and that is when the DMs started to get back in. That is not a process. Over the next couple weeks, I will be working on some kind of system to help people get better at identifying entries and exits. In the meantime feel free to message me.

Subscribe to You Tube! 👈Subscribe and turn on notifications. There are actionable top stock ideas daily posted and reviewed. I reviewed the Indexes in today’s midday video.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions message me. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

*For example I called the $RIOT short yesterday and the cover today which was an $18 gain.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

One day left! Finish Strong.

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇