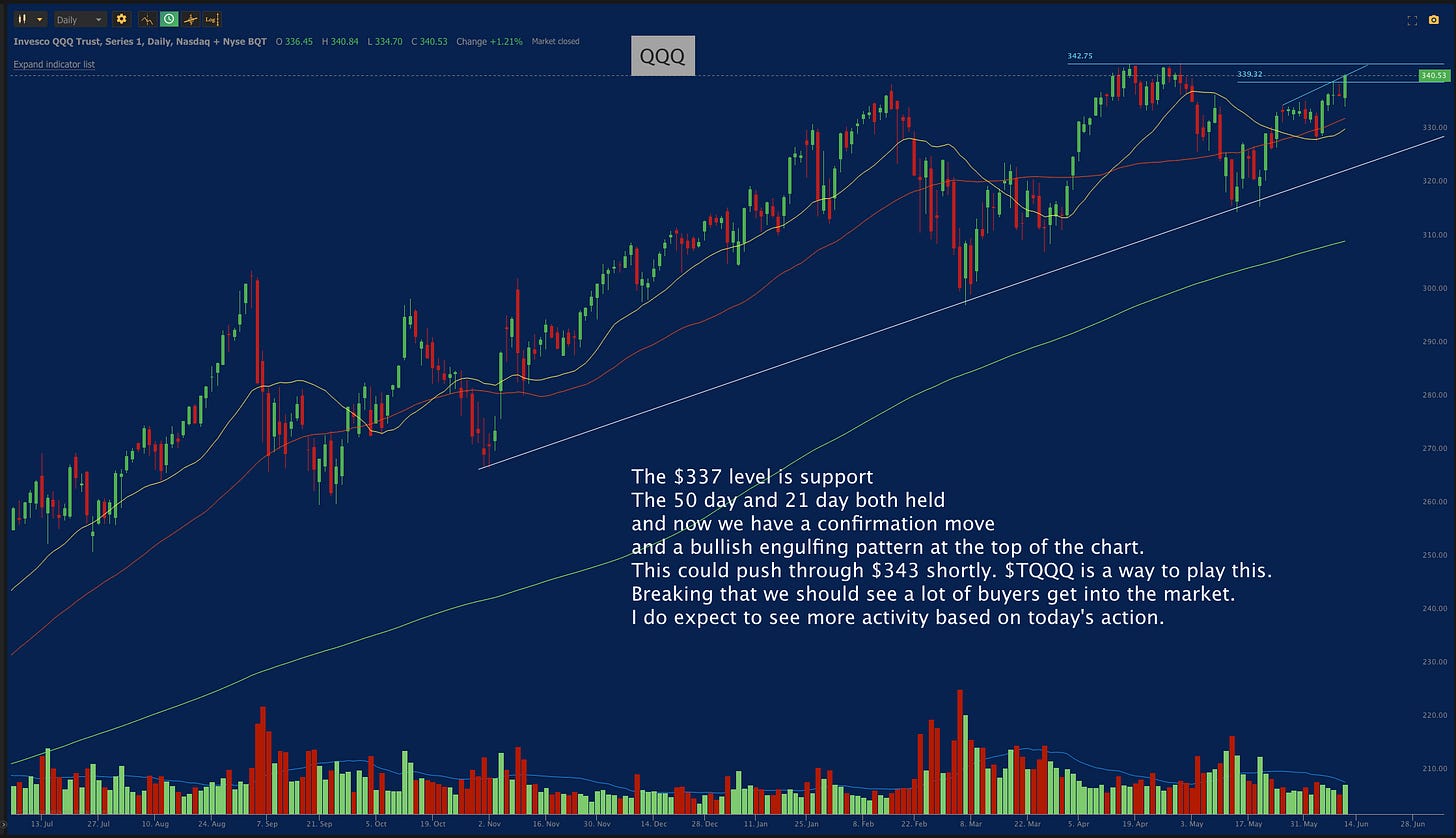

Several sectors of stocks fell hard across the board on the CPI and jobless claims news. Inflation risks have been there for some time and It looks like this was simply a reason to sell the higher beta names. We saw several high fliers come in very hard with no lift. Usually, this means institutional selling. When you see a straight line or perfectly angled line selling it is usually a larger selling group. For example, look at how perfect $GME selling was today. It was orderly. Retail selling is more emotional which leads to more jagged price swings. If you look at the selling and look at the $SOXX and $IBB you will see the indexes lifting as the $GME group of stocks sold off. This is very healthy for the market. If you watched today’s action you actually saw the $QQQ close at the high of the day. Note the move in $CLOU could based software names such as $CRWD up $14 and $NET almost at a new high. We are seeing rotation. But in there lays the issue. To rotate with them or not. I would suggest that we are in a bull market. There will be rotation. There is no faster way to underperform than to keep rotating your investments AFTER the rotation. I would suggest having a list of stocks that you want to buy and when they sell down add to them. Two such names today were $CELH and $ZS which I added today to our buy list.

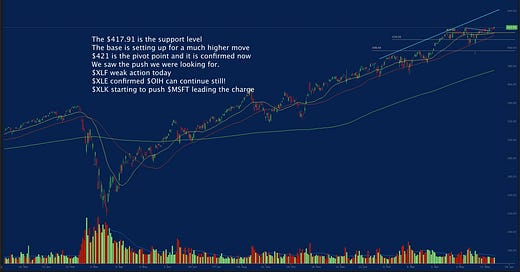

All the indexes continue to set up for higher prices. The $XLK is pulling up the $SPY. The $XLE is helping as well but was weaker today on Oil news. The rotation into $IBB is becoming obvious and we should see that continue. People will be chasing the next $BIIB now. This will add another leg to the $QQQ move higher. The $SOXX continues to sit right below its resistance level. Breaking above $40.75 could lead to a major push. The $IWM looks perfect and I am looking to add to the $TNA trade. Key levels are marked! Let’s do this!

Let’s Look at our Indexes!

Let’s Look at our Stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of today’s market movers! It’s packed with actionable ideas. I walk through several trades. Consider making these videos a daily part of your routine. I go over the lessons from the trading of the pro series during them and point them out in real-time situations. I walked through the $GME trade step by step in this video. ALSO, WE DO A DAILY PREMARKET VIDEO LIVE STARTING AT 8:45 AM EST. To get ready for the day. It’s packed with information.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter as well as other ideas. I called levels on $GME today.

You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success! 🍀

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Hey Arete. Will you be on the two day conference as well? See here: https://www.youtube.com/watch?v=f27OHL9WPdY