We are seeing signs of a bottom. Today started off with us being deep in the red with massive selling in the indexes. By the open we started seeing buying in larger names only to roll back down and test the lows of the day. As the day progressed we saw increased buying mid day. This was the first time we had this kind of buying in about two weeks. On top of that we cleared higher highs on the SPY500 and Nasdaq with closes above the 8 day moving averages. The Russell 2000 small cap not to be outdone touched the lower trend line only to bounce and hold forming an imperfect dragon fly pattern. Dragon Fly patterns usually mark bottoms. After the market tonight we saw several stocks release good news and continue to rally. Three names that stood out were. APP,AFRM ,LEVI all of these had good news or earnings and traded up after hours and stayed up. Its crucial for us to stay above the 8 day moving averages. its starting to become time to start looking for longer term positions especially if we close green again tomorrow. Below is a new video series I started call the Top 5 in 5. It lists top 5 ideas for tomorrow in 5 minutes. Its a good place to start. Key levels are on the charts. Let’s do this!

Let’s Look at the Indexes!

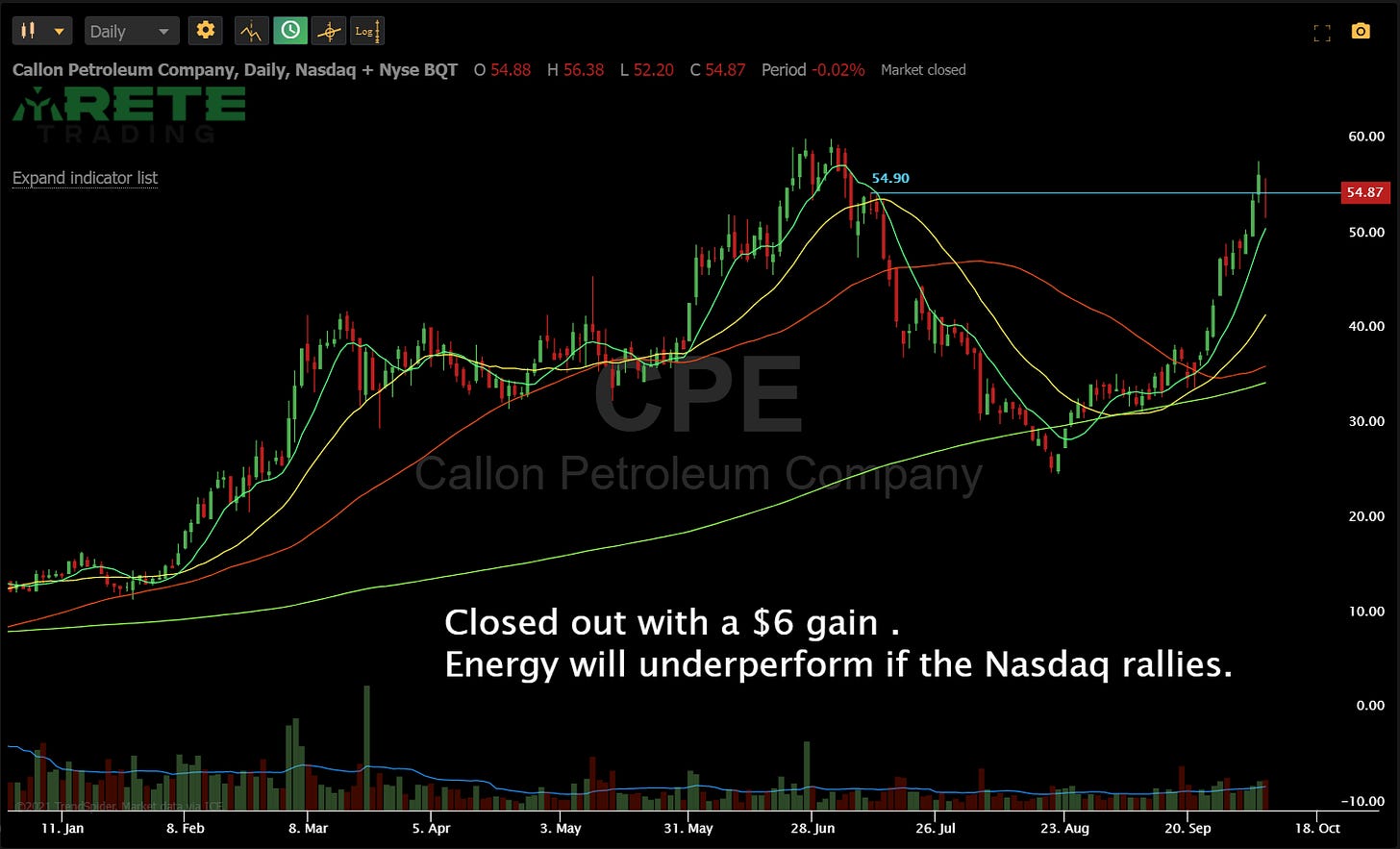

Let’s Look at the Stocks !

Subscribe to You Tube! 👈Subscribe and turn on notifications. There is a new daily video after the market! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. Its loaded with actionable ideas Today’s video has three buy ideas and two shorts. Its worth your time. It is hyper specific and actionable. When you subscribe turn on notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely. If you do not see a position and have questions please email me: ARETE@ARETETRADING.NET Wishing everyone Massive Success

Now you can share the Newsletter!

👇👇👇

Subscribe Now

👇👇👇