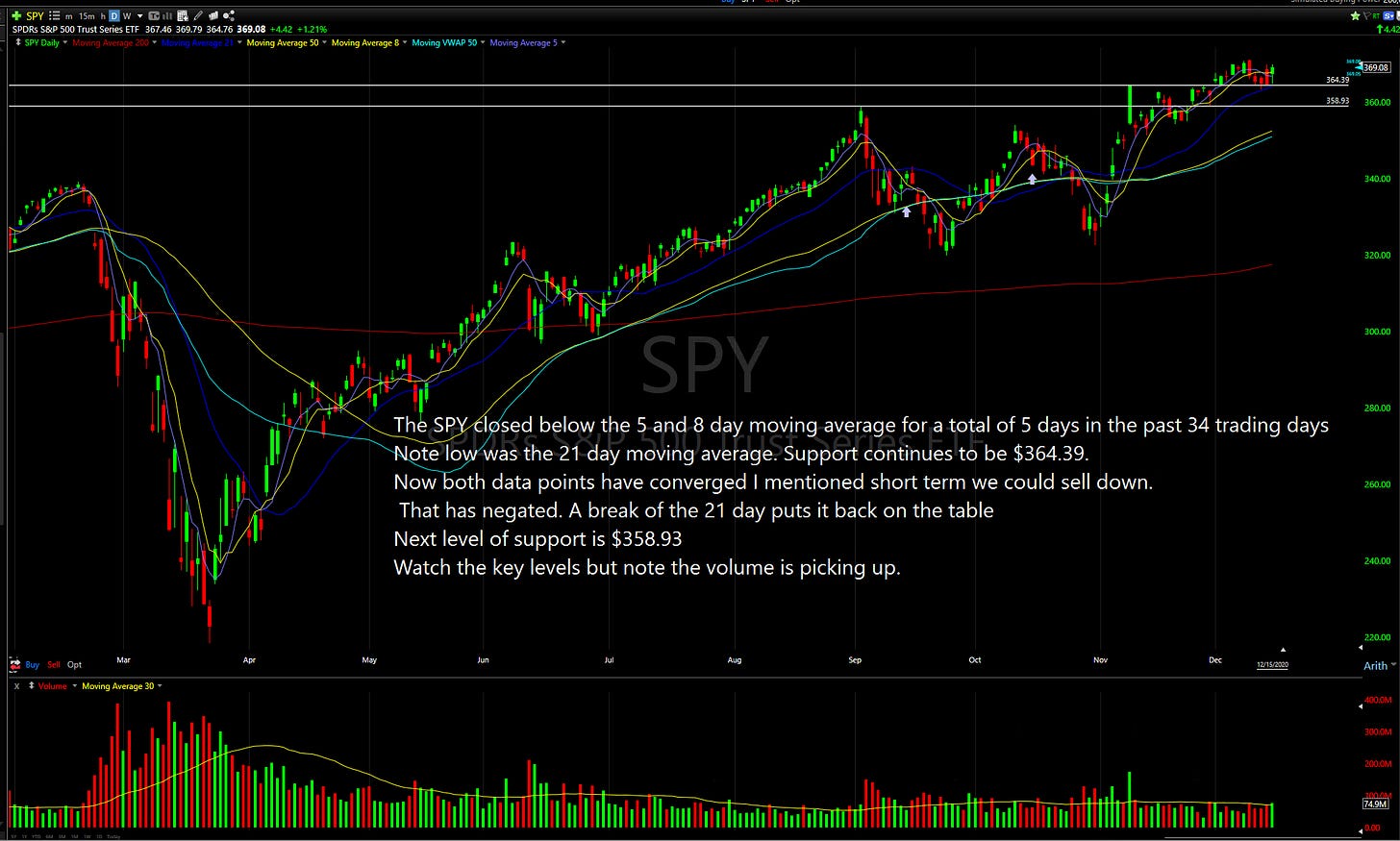

What a difference two days makes. The Russell continues to be the best index out of the major three. Making new highs on solid volume today. This move looks like it will continue and outperform into the end of the year. One sub sector to drill down into is the cruise lines. Awful fundamentals and dilution but holding key supports and bouncing solidly on them. SPY and Nasdaq look solid holding key levels. Positive $PFE/$BNTX news over the weekend became negative by Monday with a release of adverse side effects. $ARKK is putting its $15 Billion war chest to work. I am surprised to see how well $CRSP and $EDIT are holding up. Note she has been adding $DOCU $PTON $TAK. We talked about the need to put that money to work. It becomes a self fulfilling prophecy. Goldman Sacs upgrading the semi stocks followed by $AAPL 30% increase in productivity of its phones tells you all you need to know about tech demand.

Lets look at the Indexes!

Lets look at our stock ideas!

Legend of abbreviations as follows :

BP=Buy Point

BE=Breakeven

Stop=Stop loss or Risk

Continue to drill down into the indexes and sub sectors we talk about in the Newsletter. Semis are acting exceptionally strong. $MRVL $AMD $MU $NVDA

As always all investment decisions are made by each person. We all have our own process and risk tolerance.If you do not see a stock on the list that was previously on here and you have questions, please message me on Twitter. Thank you for your messages on twitter about how this Newsletter has helped you.

Three days left!

Happy Trading !