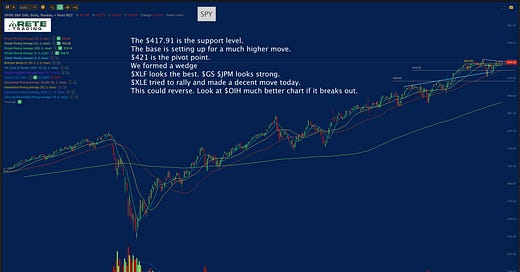

We had mixed results on Tuesday. Primarily lots of second-tier names rallying while the leaders rested. The rotation is good and healthy but very fast and has people second-guessing positions. A great example of this was $NVDA today. It opened right on our key resistance line to reject and head down below $640. By midday, we reversed and made a new all-time high of $655. Yet it closed under resistance. We are seeing certain beaten-down names starting to shape up. $JMIA $FUBO are two that are starting to turn and set up for much higher prices. Also, we are starting to see action in the second tier EV names such as $NIO and $CCIV. One sector that is primed to continue its run is $KRE. Regional banks continue to look to outperform and the majority have not had a large comeback as a whole from pre-pandemic levels. One way to play this index is the 3x ETF $DPST. Overall the strongest group for the $QQQ WAS the $SOXX. Today the semiconductor index ran right into resistance and closed negative rejecting two key levels. We may backfill and rest. As far as the major indexes. $IWM is ready to make new highs. $TNA the 3x ETF is in play again and you can consider using it to trade the Index. the $SPY continues to try and make a new high close. It might take a couple more days but we are there and the index looks ready. The $QQQ looks ready to test the 50 day moving average today’s bar was a bearish engulfing. Tread light with tech until this works itself out. Key levels are marked on the charts. Let’s get to it!

Let’s look at our Indexes!

Let’s look at our stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a video of Tuesday’s stock market action and a game plan for tomorrow. It’s packed with actionable ideas. I walk through several trades. Consider making these videos a daily part of your routine. I go over the lessons from the trading of the pro series during them and point them out in real-time situations.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter as well as other ideas. I called levels on $AMC $UPST $NVDA today.

You can see the timestamps.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success! 🍀

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇