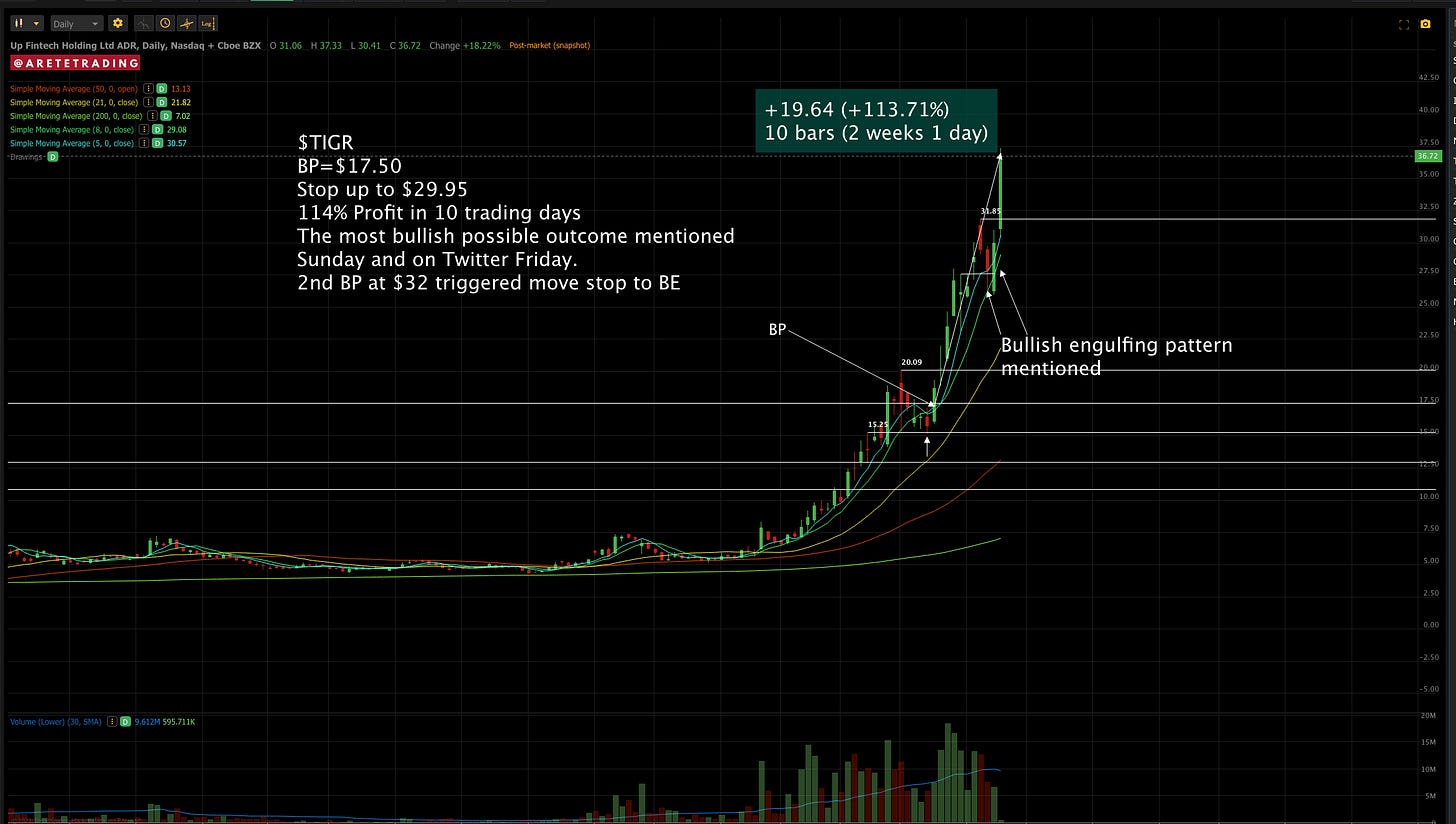

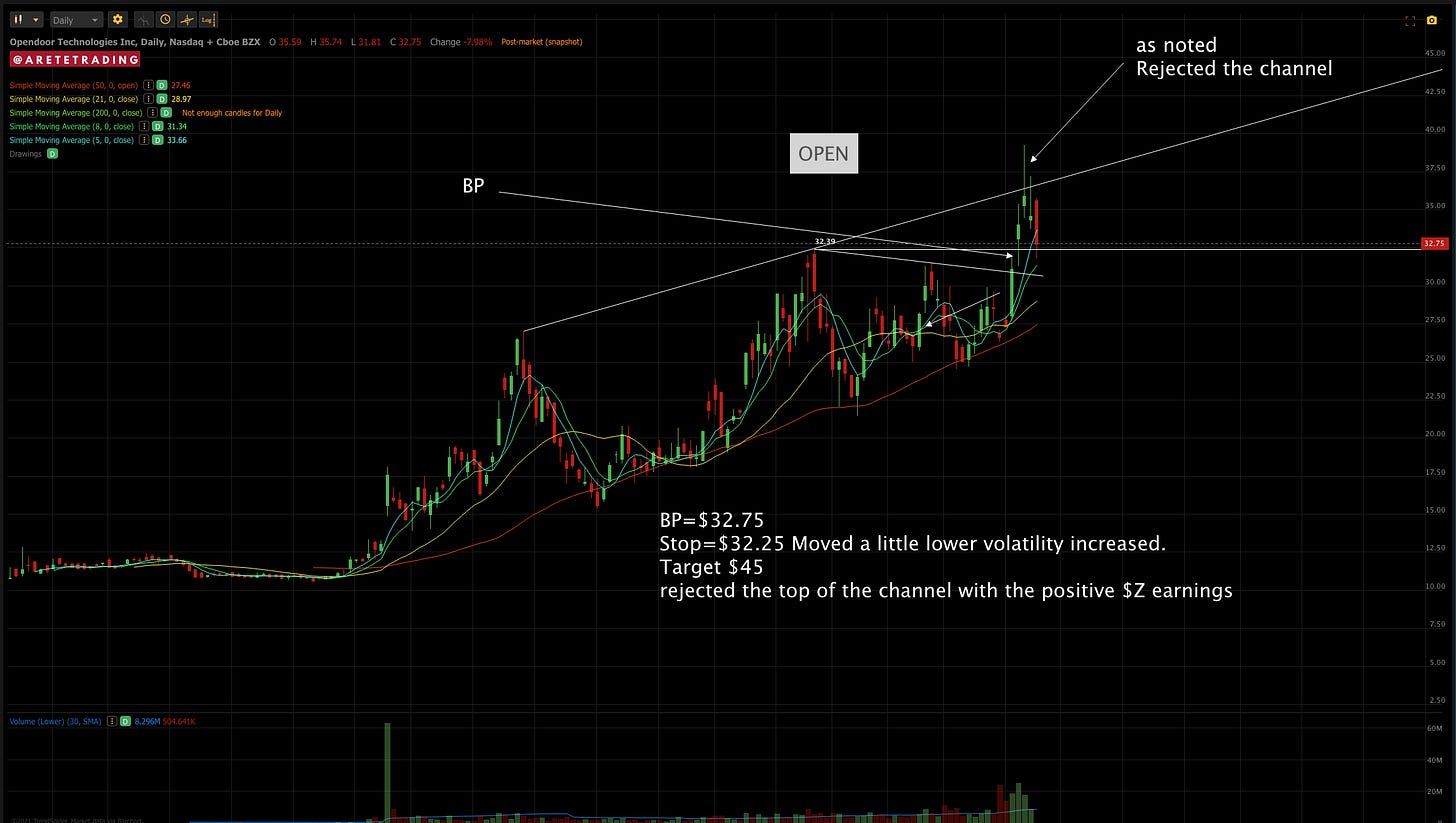

Well, that was odd. We started off the trading day as if we were going to explode higher and then drabs of news started coming out and hitting various market sectors. To start with the snow apocalypse that wreaked havoc on Texas has spread to 12 other states and possibly Cuba. We had a massive power spike in pricing that put one power trading firm out of business in a day. On top of this, the rumor mills on trading desks are buzzing with another Luckin coffee type blow-up as well as circulating information about a SPAC that already released the statement a week ago. Needless to say, EV stocks and EV suppliers got hit on the news that it was costing $900 to charge your $TSLA in Texas. Also, the rumor of another foreign blow-up added pressure to anything Chinese-related. This double whammy put pressure across the board. There were pockets where some of the momentum names on our newsletter acted well. $TIGR followed through on the bullish engulfing mentioned earlier in the week giving us a 114% return in 10 trading days. Also triggering our 2nd buy point today. $BNGO continued to see upside pressure which was unexpected considering that the sector was weak today.

In regard to the indexes, we saw a solid gap above the top of the channels on the $SPY. We did not go back under the channel but simply bounced around with all the uncertainty today. The $QQQ plummeted 27 basis points to levels not seen since Friday. <-sarcasm. The $QQQ opened at an all-time high only to settle down in the middle of Friday’s range. If you look closely the previous open was the low of the day which is bullish. The $IWM continues to act the weakest. We have closed below the 5-day moving average for the second day in a row. Note the stop level on our $TNA trade.

Let’s review the indexes!

Let’s review some momentum stocks!

Subscribe to You Tube! 👈Subscribe and turn on notifications. There are actionable top stock ideas daily posted and reviewed.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions message me. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

*For example I called $CPSH today which rallied $3 points in an hour. I also reiterated the second Buy Point on $TIGR when it triggered.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive Success

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇