For over a month now. I have been talking about the great tech resurgence. It’s here and people are not benefiting as they think they should. Very simply you get what you put in. If you do the same thing you previously did, you are going to get the same result. The same goes for investing. Last year and early this year smaller tech companies and start-ups were the rage. Companies with pre-revenue plans and coming to market as SPACs. Regardless, these were the big winners. That’s what we want. What people fail to understand is we bought them because they were making us money. We did not buy them because of any other reason. We buy a stock because we think we can make money by allocating capital to it. It’s that simple. The game has not changed. For weeks we have been talking about how large-cap technology ALWAYS rallies first after a correction. The reasons are based upon liquidity and stability. Yet, day in and day out we are looking at smaller-cap names and waiting for them to participate. I went through this in 1999-2000 and it was significantly worse than this. Some stocks will not come back. Some will be delisted. Some will merge. Some will go bankrupt. We all need to focus on what is working not what we want to work. So stop looking back. You are not going that way. Focus on what is working. It’s exactly what you did in the first place.

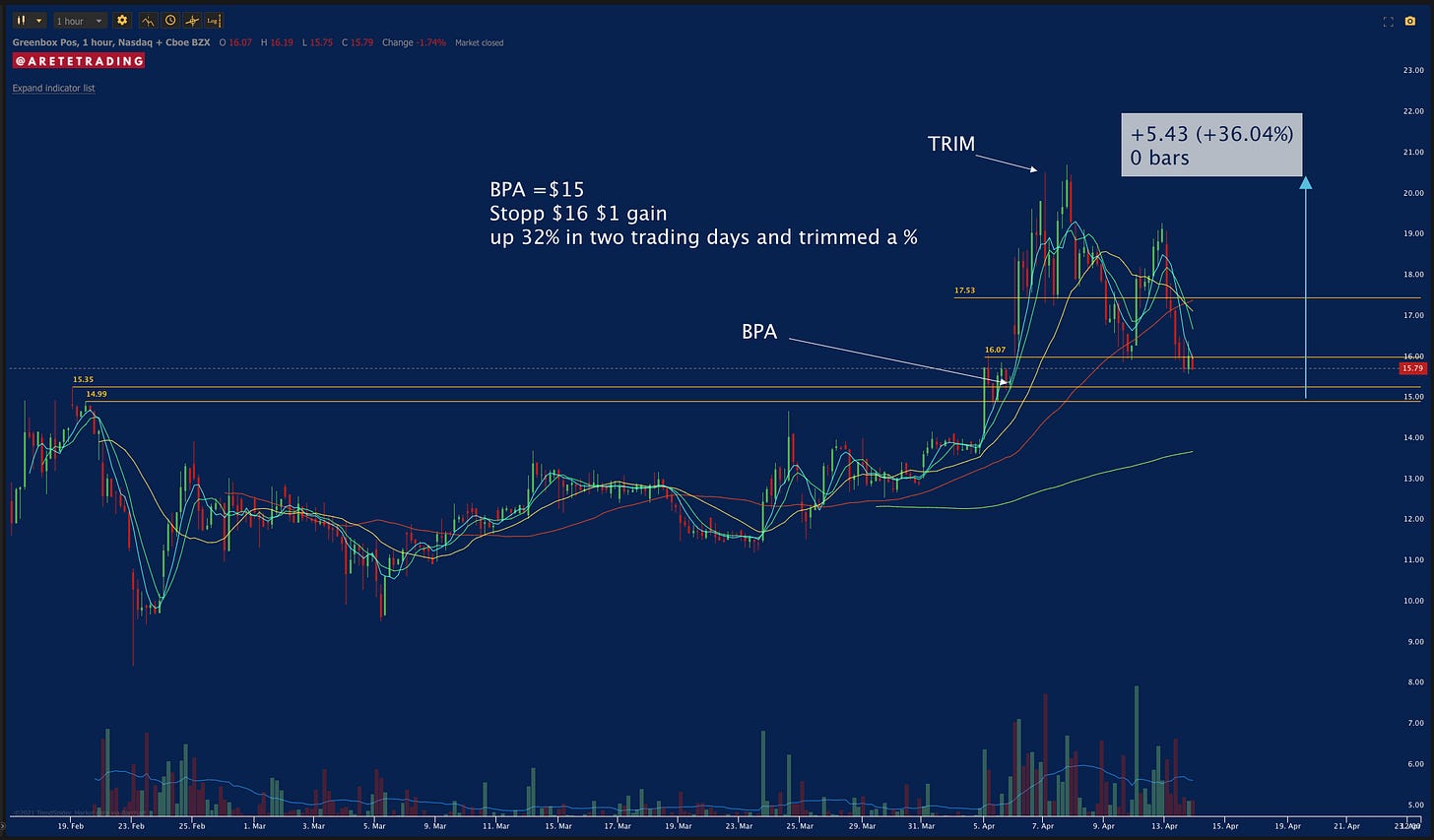

Very simply the $QQQ is making new highs. We closed above the $338.75 level today. This level has become minor support. Note the gaps up in the index. This is not normal. There is a massive inflow of capital trying to get in growth. I still feel comfortable that there is a 10-12% move left. The $TQQQ trade is looking exceptional. We are up over 10% in the $FNGU in two days and over 90 points of profit in $NVDA. The $SPY looks great making another new high today closing at $412.65. Minor support is $398.75. Note the slight uptick in volume. As we have stated the $IWM has broken the lower trend line and can not rally over it. We might have put in a short-term top. This could lead to an acceleration in the Nasdaq. The $SOX looks toppy and $MU and $INTC both rejected new highs. Bull markets rotate. Look at the $IBB and trading the $LABU 3x ETF if it starts to move. Also $CLOU ,cloud software names, look ready $CRWD $NET $DDOG. The larger the capitalization the better!

Let's get to the Indexes!

Let’s get to the Stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. Below is a link to the game plan for tomorrow. What is moving on the “stocks to buy video” as well as some of the names on the newsletter. Actionable points etc.

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. For example on stops. I want to see it close there at the end of the day.

You need to develop your own process. I am willing to help and offer feedback.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter. I called key levels on $TSLA and $UPST buys today.

Any questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive success!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇