Well we expected volatility but that usually implies not straight down. As we look at the reversals of the past two days we see massive tax selling on small and mid cap stocks. We also see a massive rotation into big cap names I personally thought $FB and $GOOG were rolling.This is good for $FNGU. The island reversal is in effect until a higher high $282.50. Most likely that break would lead to putting the $320 target back. Expect lighter volume until the end of year and more exaggerated moves. We saw a litany of failed break out attempts. Honor your stops. They are there for the most important reason of all: To protect capital. When markets get like this and the probability of success is diminished , consider doing nothing in the way of new positions. Better to be out then in sometimes. There is a reason its called risk.

In regard to the indexes , We have a clear new leader. $QQQ currently is above the 5 and 8 day moving average. I would expect this to continue. I thought the tech heavy index would become our leader as it does in almost very bull market. However I did not anticipate the sell off in $IWM. Please note our $TNA trade and the position it is in on the chart. We knew this was a tough level and its why we monitor those levels closely. $SPY is muted and continues to be boring. Right now boring is not that bad.

Lets look at our indexes!

Lets look at $TNA Note the levels !

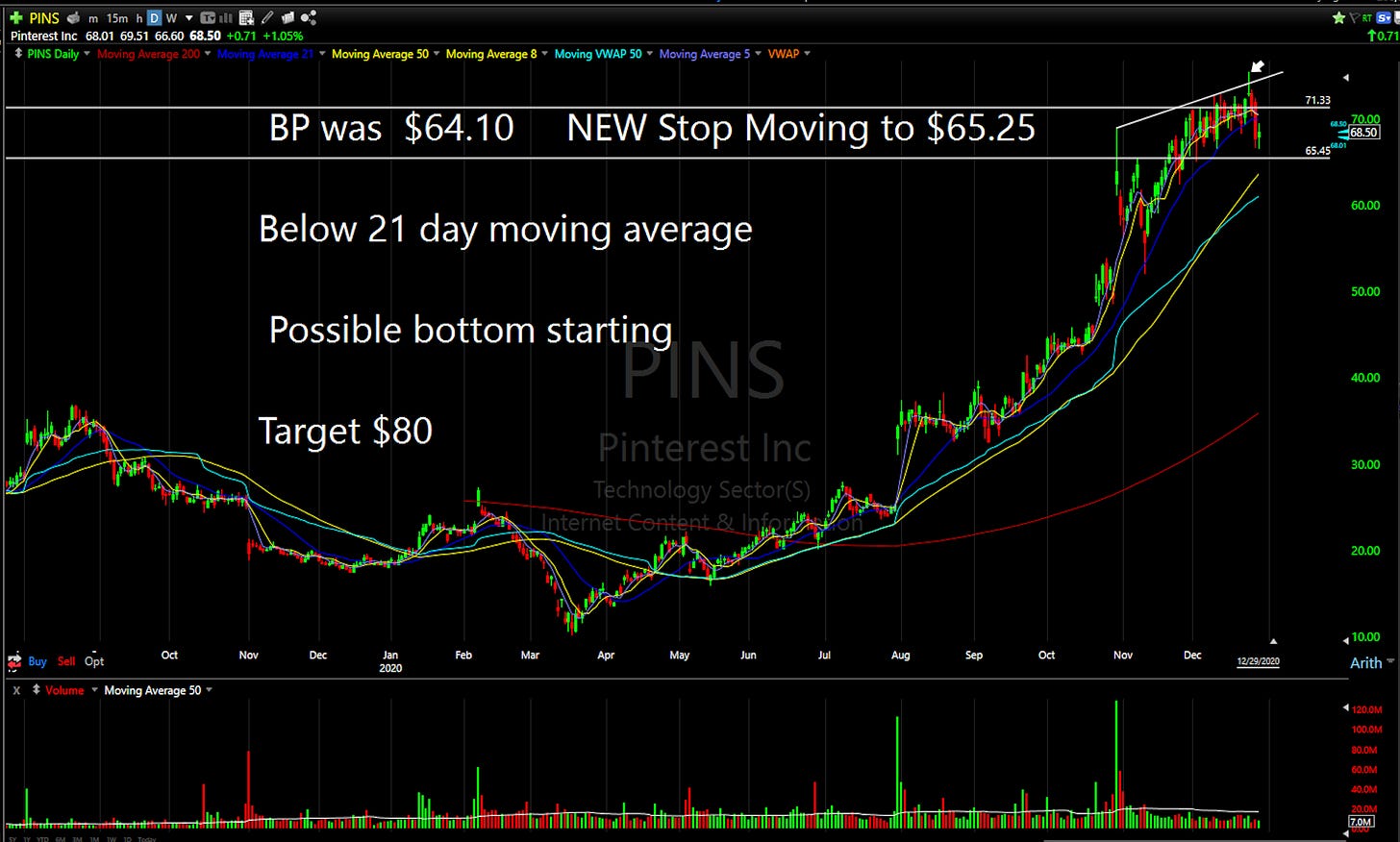

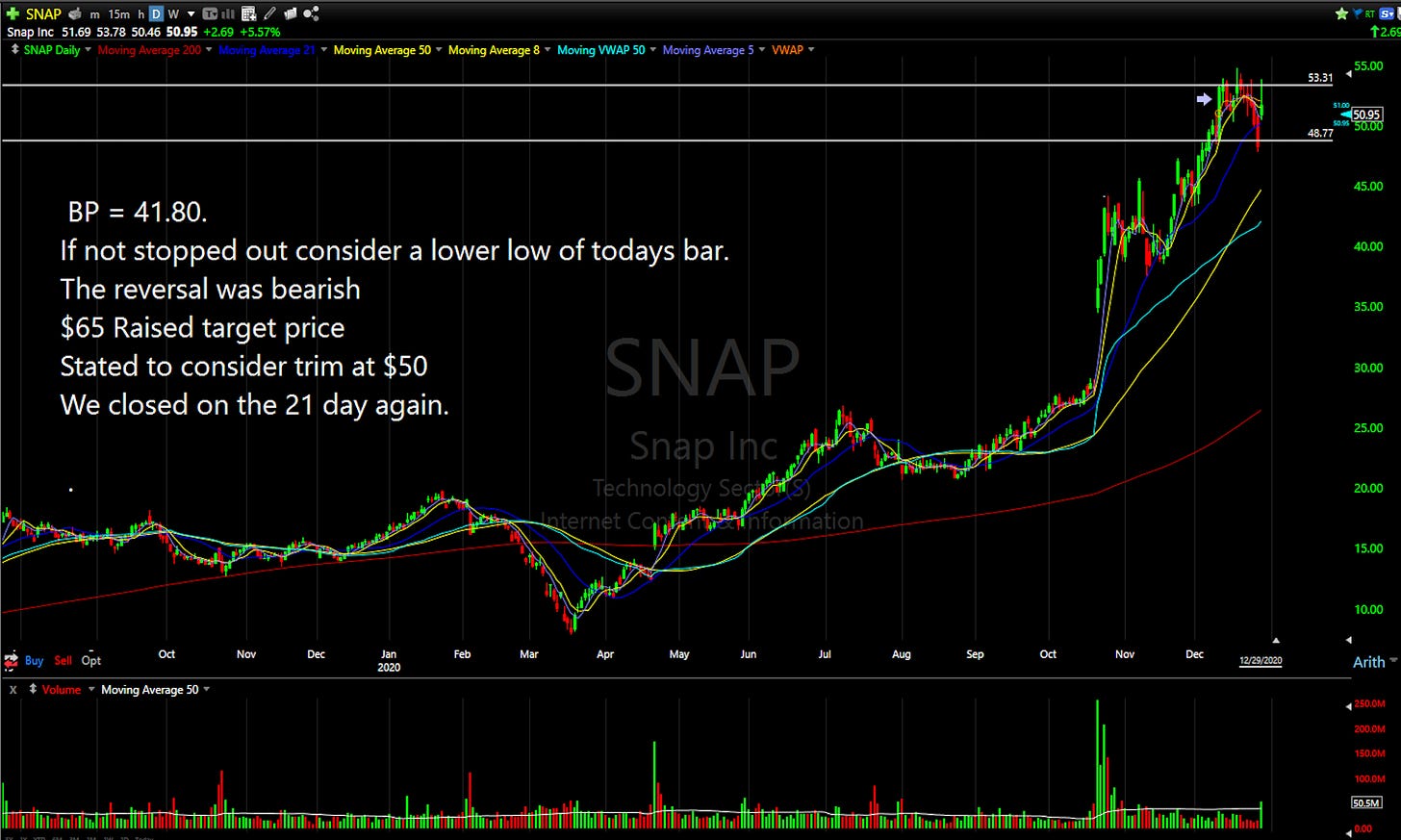

Lets look at our stock positions !

It is important to note stops mentioned are parameters. I can not stress enough to consider developing a process that allows you to stay in a portion of a trade to see the closing price. Especially in environments like the past two weeks.

As always all investment decisions need to be made by the individual.We all have different risk profiles and no two people trade the same. Please make sure if you follow the Newsletter, you follow @aretetrading on Twitter. I also started doing videos on You Tube. They have been met with positive reviews so be on the look out for more. If you already follow me on Twitter consider turning on notifications. There are times my updates are timely in regard to the Newsletter. If you do not see a position and have questions please ask me.Thank you again for all the messages telling me how this Newsletter helped your performance or made you better. I remain humbled.

Two days left!

Lets finish strong!