The green tsunami continues with renewed enthusiasm today on some key announcements. $TLRY one of the stocks on our buy list is in an agreement that allows it access into the U.K. We saw states rolling out more charging stations which has added to EV capital investment increasing. $BLNK $FCEL $PLUG all our setting up for higher prices. We expected this rally after the new administration took office. We talked about it in January and so far we have benefited greatly. What is next? How do we continue to Surf the wave instead of trying to swim against it? Very simply we stick to our process. We set our entry and exit strategies, We plan and we execute. Simple but not easy.

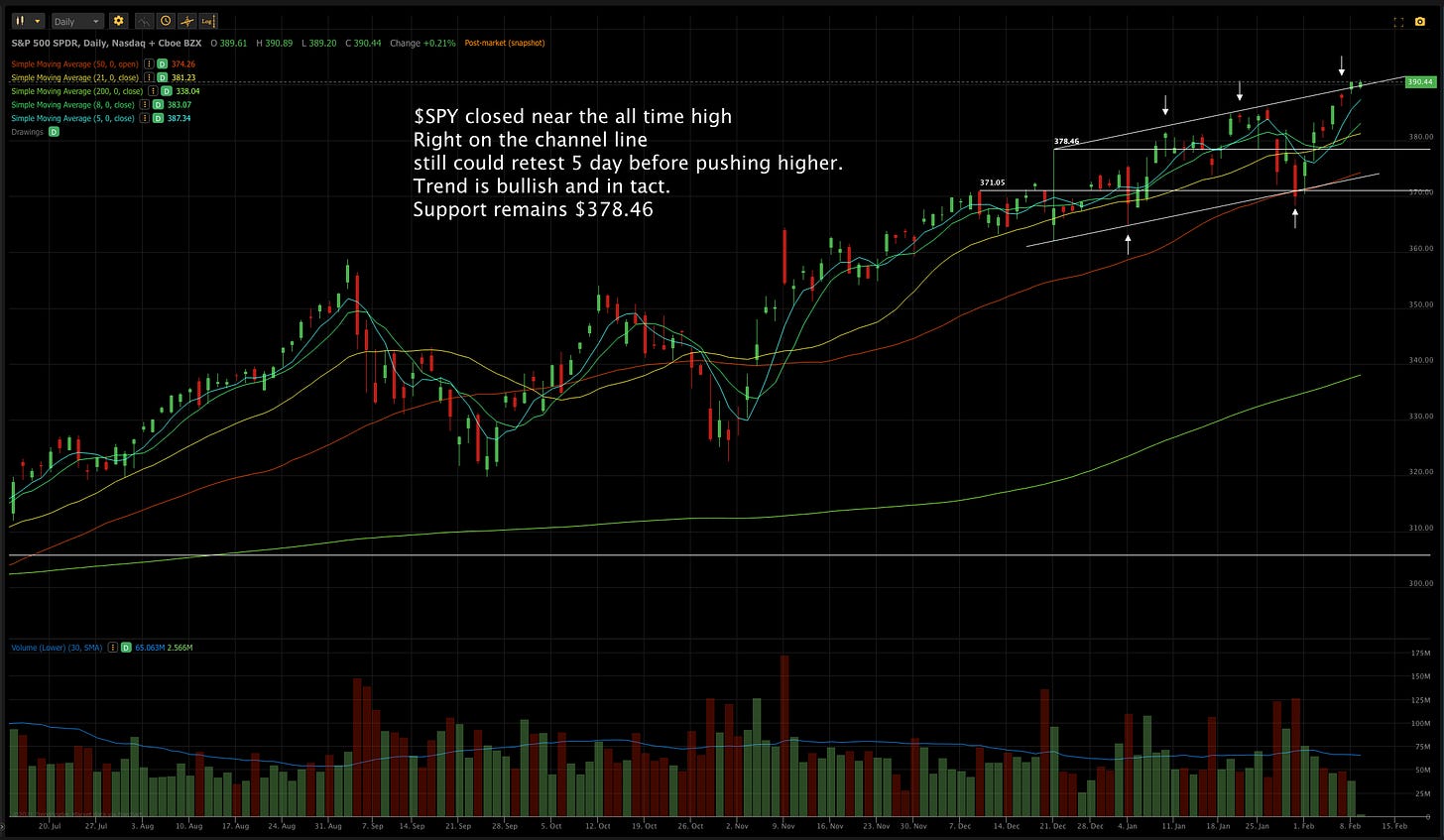

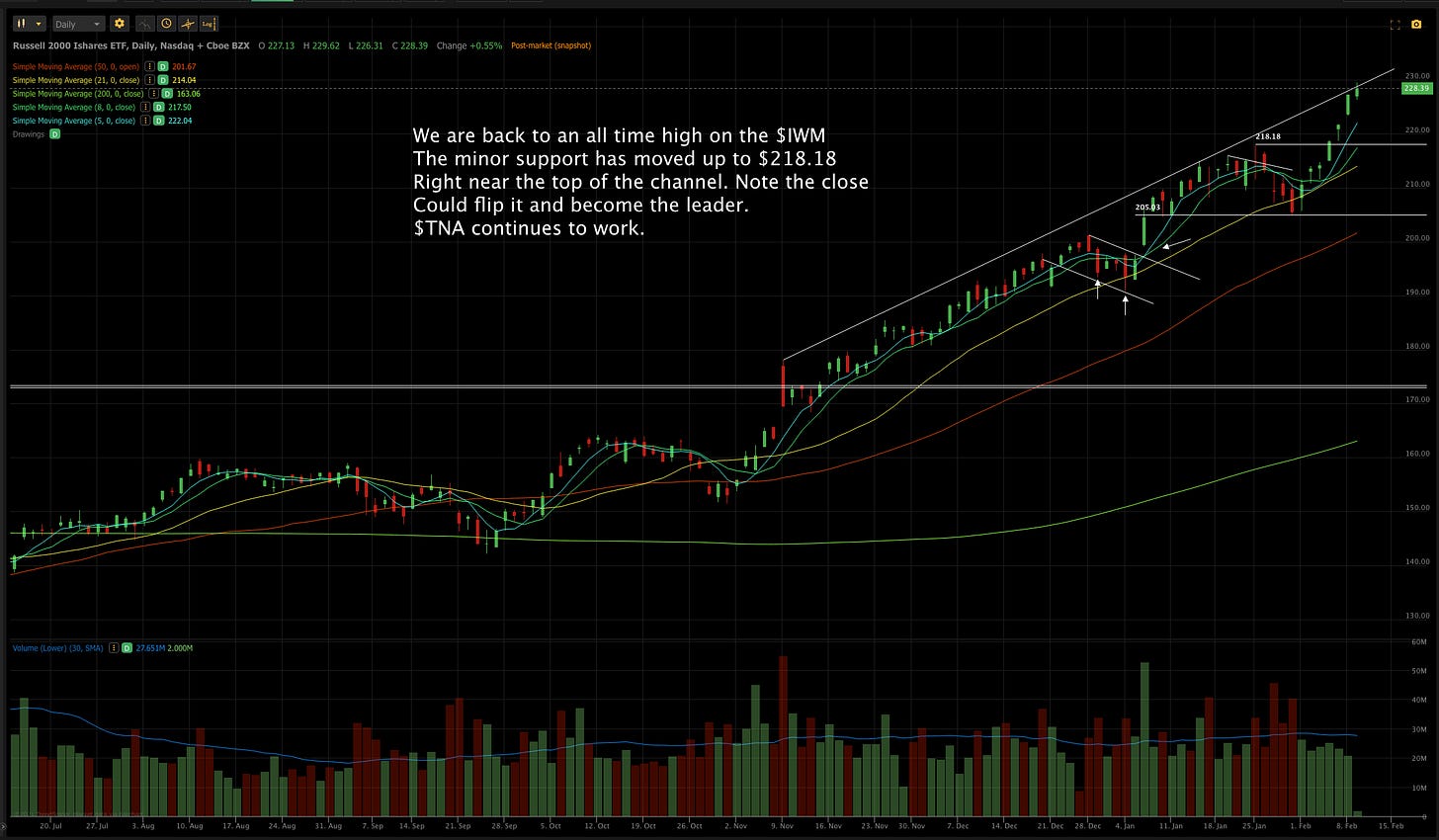

This is what we know. We are near the higher end and pushing through the top channels on ALL the indexes. This means one of two things will happen. We will push through and “flip the channels”This would lead to a parabolic move up. On the other hand we could roll back down and continue the grind. At this point in the indexes you will start to notice wilder swings in your stock portfolio as well as less accuracy in stock buying. Honor your process For those who did not trade in 1998-2000 and think this market is frothy have not seen anything. As I have stated this can go on for years. There are pockets of froth but that is normal bull market behavior where portfolio managers are chasing alpha.

Finally, we must respect price action. Nothing else matters.Trade what is in front of you. Not what you think is going to happen.

Let’s Look at our indexes!

Lets Look at our stocks!

Subscribe to You Tube! 👈Subscribe and turn on notifications.There are actionable ideas in the videos. The Top ideas for the next week video played out very well for those that watched it. I also did one on three stocks today that I thought would move.

As always all investment decisions need to be made by the individual.We all have different risk profiles.No two people trade the same.Understand the buy points,stop losses,trims are suggestions.You need to develop your own process. I am willing to help. If you have questions message me. For example for stop losses I like to see the close.That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications.There are times my updates are timely in regard to the Newsletter.

*For example: From the entry to the exit,I called $SAVA on Monday. Today $NIO volume surge and breakout.You can see the time stamps.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Massive Success Train continues

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Good stuff Arete! Appreciate your looking under the hood of various equities & simple language in which you explain strategies/thoughts. Its important since you'll have complete newbies reading your print & watching your videos, to the multi-year experienced trader. Nice that you keep the ideas flowing and yes, I am a fan! Cheers from Manhattan NYC... Marty Morua

I second Marty's comment. Arete have been pushing excellent stuff, with amazing value especially for investors like me who are less familiar with the intricacies of TA. Keep up up the great work!