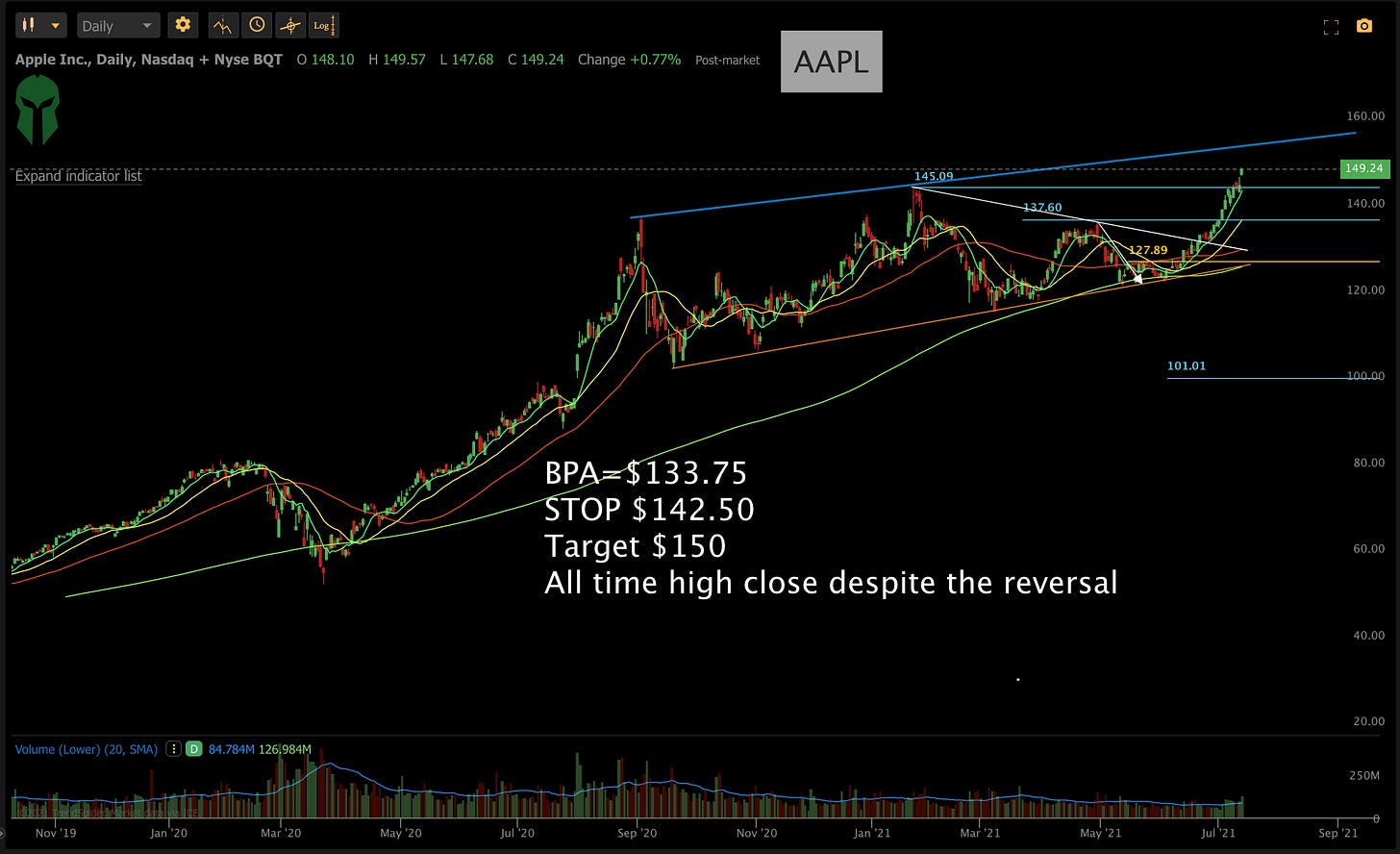

What a difference a week makes ! Since last Wednesday’s newsletter we have seen AAPL AMZN MSFT make record all time highs while the smaller cap names continue to get pummeled . The majority of our names have been very large cap tech. This has kept us out of the brunt of the sell off. Even solid secondary names with multi billion dollar market caps are getting hit. This is an extremely shallow rally with only a handful of names participating. If you do not have a plan, In a market such as this you will experience significant draw downs. It can always get worse than you think. Right now the Indexes are not even dropping 1% a day. What will happen to portfolios without stop losses and processes if there is a real correction? The $IWM is clearly below the 50 day moving average. We closed at the low of the day today. Usually there is follow through. I would continue to avoid any small cap names until this settles down. The SPY and the QQQ both are above the 8 day moving average. Both are susceptible to a small correction. I would think of this as a buying opportunity. Tomorrow at 8:30 am Jobless Claims will be released. This will be an important data point considering the CPI came out earlier this week. The CPI was substantially higher at 5.4% than the 5%. What is interesting is 1/3 of that number is used car increases. So the Jobless claims data is more significant than usual. The Forecast is 360,000 for Initial Claims. Let’s get to it!

Lets Look at the Indexes!

Lets look at Stocks!

Subscribe to YouTube! 👈Subscribe and turn on notifications. There are actionable ideas in the video tonight. Every weekday I do a premarket live show at 8:45 am and a post-market taped recap and plan for the next day

As always all investment decisions need to be made by the individual. We all have different risk profiles.No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions message me. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely in regard to the Newsletter.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

I can be emailed at: Arete@AreteTrading.net

Wishing everyone Massive Success

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇