🔥Bullish Action on the Fed Hike...

The Indexes traded up all day with lots of volatility on several pieces of information. First , China issued a statement that they will bolster up their economy through stimulus. This led to massive short squeeze in names such as BABA , FXI and BIDU. These stocks were heavily shorted and any dip was covered. To put it in perspective BIDU was up over 20% today. Second, talks between Russia and Ukraine are making progress. It looks like one step forward but tow steps back as the day progressed. Hopefully, this ends soon and there were some glimmers of hope. Third, we had the Fed finally hike interest rates 25 basis points which initially sent the market down. This reversed at 2:30 when Powell laid out his plan on making sure we are stable and the economy can handle the hikes. While his words worked, if it is not delivered in the future, it could mean equities selling down again. It’s good to be optimistic but being honest about inflation and how 25 basis points will do literally nothing to curb it would have been refreshing. For now we play the hand we are dealt. A market with money flowing into beaten down names. Specifically tech names with large capitalization. GOOGL, AMZN, NVDA all had massive inflows today. Institutions are putting money to work in equities and they want to make sure they are liquid. They do this in case they are wrong and need to sell right away. The QQQ was most impressive up 3.71% on the day. It closed over the 21 day moving average which we have done only one other time this year on February 9th. While we are not out of the woods this was a great start. It will take weeks to confirm if the bottom is truly in but today’s action was promising. Support and Resistance levels work best in markets such as this. Note them marked off on the charts below. Tonight’s video below gives 5 new Buy ideas for tomorrow and in depth coverage of the indexes and 10 year Treasury. Let’s get to it!

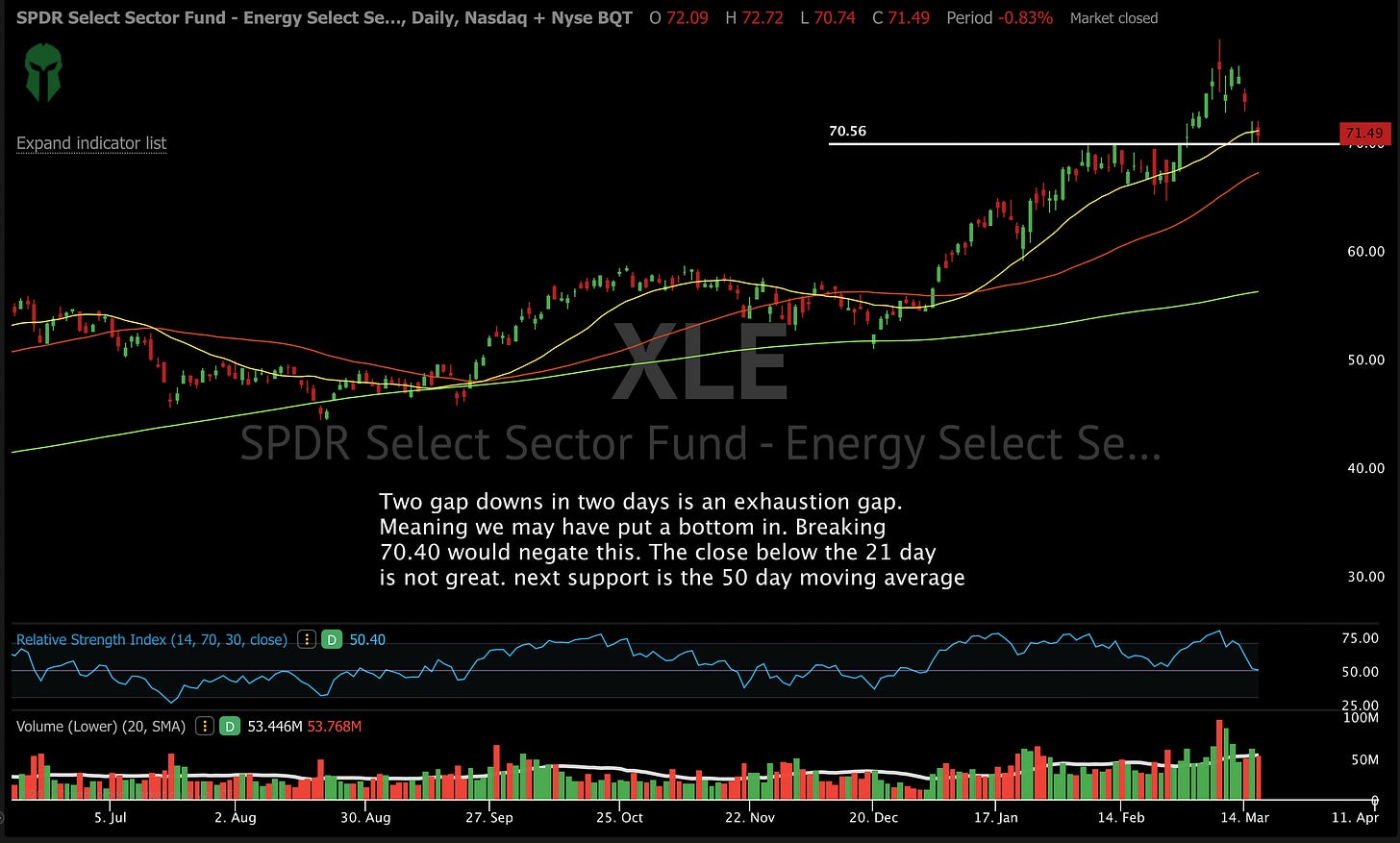

Let’s look at our indexes!

Let’s look at our stocks!

With money flowing back into equities and the recent action I will be leaning more on the buy side. I expect more ideas in the coming weeks to develop as they come out of new bases.

Subscribe to You Tube! 👈Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes 5 Longs with entries and stops marked. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube make sure all notifications are turned on so you receive it. The video below is the Top 5 from tonight and focused on actionable ideas based upon the indexes and earnings tonight. Pay close attention to what is said about NVDA and TSM.

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Wishing everyone Massive Success

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇