Equity Risk Premium

Simply, equity risk premium tells us the risk/reward ratio of investing in the stock market.

When it is low, investors will purchase bonds and other guaranteed return vehicles because statistically that is the better option vs. purchasing equities that runs a higher risk.

Conversely, when equity risk premium is high, this means that we are in a risk-on market and investors are better off purchasing equities because the risk/reward is in their favor.

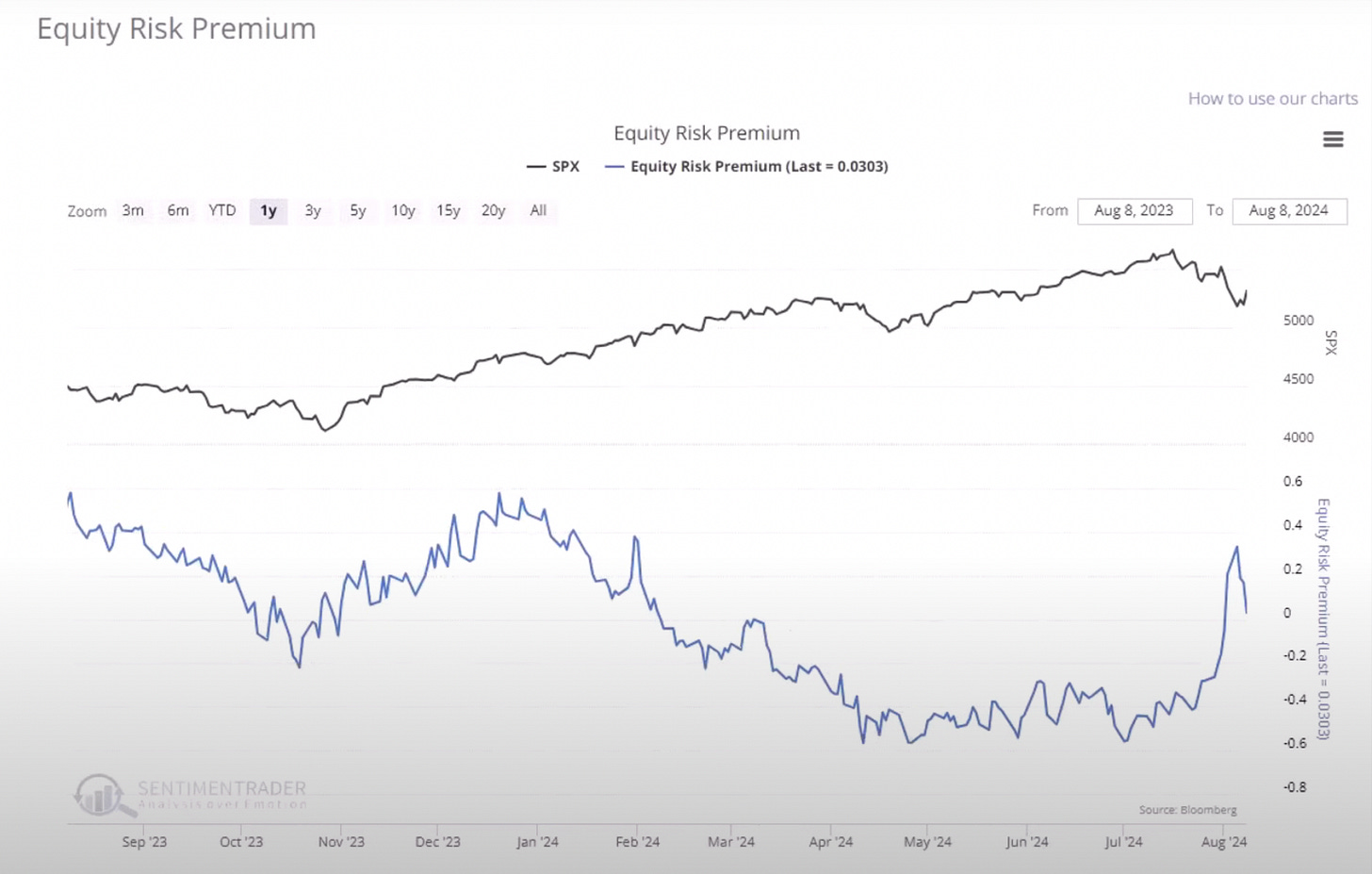

We are seeing an interesting development right now in equity risk premium.

You can see that by and large, the market moves in correlation with equity risk premium. However with the recent dump that we had last week, we are seeing a divergence Equity risk premium shot up while the market came down.

Divergences like these typically do not last very long.

This is a bullish sign for the market that equity risk premium is rallying and I expect the divergence to sort itself out. You just want to make sure that it stays over the zero line.

More on equity risk premium and how I am using it to give me an edge in trading here: