Buyback Blackout Window

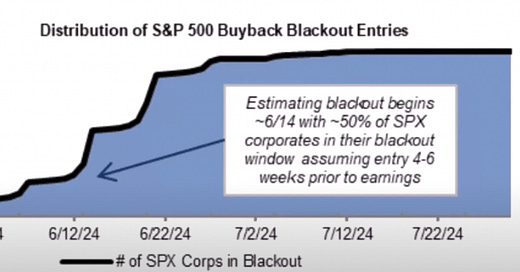

I’ve been talking about it for a few weeks now, but it is very important to know that we are in the middle of a corporate stock buyback blackout window.

This means that roughly 50% of SPX companies right now are unable to execute stock buybacks.

We’ve known this for some time. Now let’s layer in some new information.

Buyback Volume

The graph below is from Yardeni research and it shows us volume of buyback activity over time.

Notice that right now we are at our third highest level ever of corporate buybacks.

So now we know that we are in a buyback blackout. We also know that we are seeing massive buyback volume.

Putting that together, what that’s telling us is that once the blackout is over, we have a lot of buybacks that are going to be occurring, which is a huge catalyst for the market.

This is a very bullish sign and something to keep an eye on once the blackout window ends.

Watch this video where I dive into further details on how to take advantage of this knowledge: