Friday Buying Volume

On Friday we saw a day of significant buying volume - one of the most one-sided days we’ve seen in a long time.

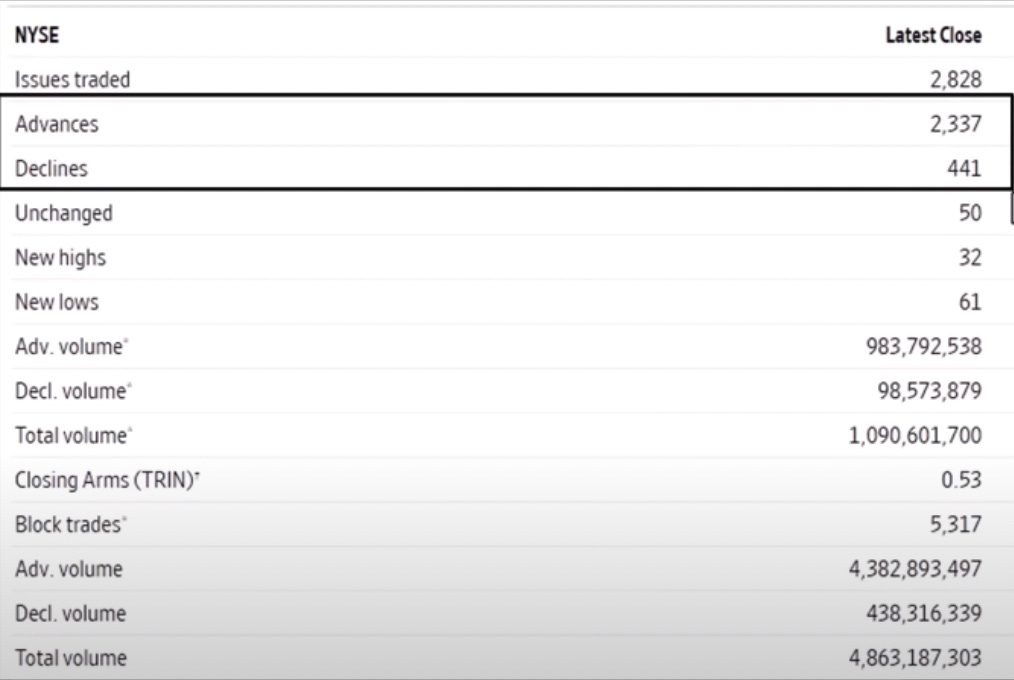

Above you can see that in the NYSE, we were roughly 5:1 in stocks advancing vs. declining.

You can also see that advance volume made up about 90% of total trading volume.

These are staggering numbers and not something to discount. However you must put this in the context of past times we have seen similar advance/decline numbers to understand its true impact.

What Does it Mean?

One helpful tool to determine what this means is by comparing UVOL (up volume) and DVOL (down volume) and then taking similar circumstances and looking at how the S&P 500 reacted afterwards.

Here it is below:

You can see that we do have a pretty significant spike in up volume relative to down volume.

However when you look at the other spikes that we have seen, they don’t necessarily correlate with bottoms in the market or rips right after.

Key Takeaway

The important thing to understand is that yes, we had significant buying volume on Friday and many people are talking about it.

At the same time, that doesn’t mean that the bottom is in or that we’re going straight up from here.

When we put the data in context of past occurrences, it clearly shows that.

For more on this and what I’m seeing in the market, watch this video: