📈CPI INFLATION REPORT COULD SHOCK

In 2022 nothing as been surprising. We have watched companies lose a trillion dollars in market cap such as AMZN. We have seen Bitcoin drop close to 80% from the peak. The one constant all year has been inflation. Inflation is driving the market. The simple equation I use in our trading community is: Strong Dollar= Higher Treasury yields = Lower prices of risk assets (equities ,crypto, collectibles). That equation has been around for a very long time and will continue to be the standard. It is the entire basis of the popular quote “Don’t Fight the Fed”. Tomorrow we have the release of CPI. This release has the impact to be pivotal. If we see any signs that inflation has outpaced the estimates the market will sell off. Should it be favorable the markets will rally. Simple enough. The issue is how to get ahead of it and be prepared. The estimates are simple enough to understand. We can look at the SPY in past examples to estimate the range. The Cleveland Fed does a full report on the CPI before it is been released. Oil futures and gasoline futures drive our economy. Therefore any rise in those prices could affect the outcome. Tonight’s video below goes into greater detail the graphs below. CPI is due out at 8:30 am tomorrow. We will have a live premarket stream at 8:15 am. into the CPI release. Subscribe to the Youtube channel so you do not miss it. One quick data point is rents in the U.S. are down -.75% month over month. This was the driver last CPI as crude and oil were down. For more on energy see the graphs below. Let’s get to it.

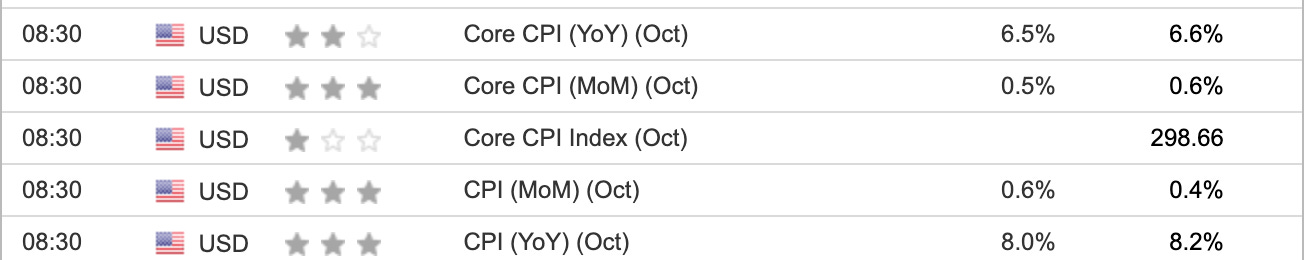

CPI estimates are listed below. Core CPI and CPI MoM will be a focal point. CPI YoY is the main focus. It is rare to see estimates of an increase in CPI MoM and a decrease in CPI YoY

SP500 averages a 2% move from the previous days close on CPI release dates. Each arrow indicates the move on the CPI release. There are outliners were it has moved substantially more. Lately the range seems to be getting wider

Cleveland Fed issues an estimate represented in gold. That estimate for the year has been consistently lower than the reported CPI in blue. The Cleveland estimate is 8% for October which is also the current full estimate 8% YoY. During the last 12 months CPI was higher by roughly 20 basis points over the Cleveland Fed.

Light Crude oil futures were down 7.5% in September. During that time CPI MoM rose at .4% . October light crude oil futures are up 8.61% and the CPI MoM estimate is .6%

Gasoline futures were down in September 1% CPI was 8.2% YoY. For the month of October gasoline futures are up 6% with a CPI estimate of 8% YoY

Today’s daily video is focused on the CPI report and what to look for. I cover the major issues we are facing. What stocks to buy based upon whether the outcome is bullish or bearish.

Preview the Trading Community CLICK HERE

📧Arete@aretetrading.net

📈Trade to Win!