CPI/Jobless Claims

Yesterday we had a lot of important data release that moved the market. We had CPI come in hotter than expected as well as jobless claims come in above expectations.

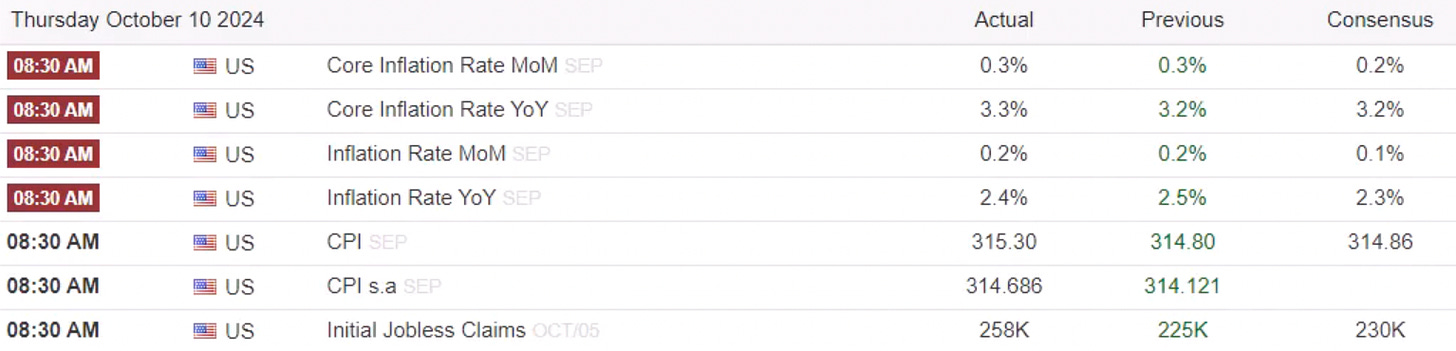

Here is the full breakdown of results. Be sure to compare Actual to Consensus.

What It Means

Despite both pieces of data coming in hotter than expected, the market stood its ground. The S&P finished with a doji on the day and the Nasdaq briefly made a higher high but also finished with a doji.

I’m not particularly worried about this data and it’s clear that the market isn’t either.

CPI came in hot across the board - it wasn’t any one specific outlier that was causing inflation. This signals that the hot CPI is likely just a byproduct of a 50 basis point rate cut into 3% GDP. It’s not a huge cause for concern at this point.

In terms of the jobless claims, this is causing some people a little bit more heartburn, but it’s not particularly worrisome to me. We came in at 258K vs. 230K expectation.

With the hurricane going on, this causes jobless claims to rise, which I think is how the market is interpreting the number. Seeing how the number comes in next month will be important to see if this is the start of a significant trend change or if it was an anomaly.

For more of my thoughts on the market and what stocks I am focused on, watch this: