CPI Wednesday

CPI comes out on Wednesday and it is the final piece of economic data that we will receive before the next FOMC meeting on December 18 (next Wednesday).

This data will be crucial in determining whether we see a rate cut again or whether rates will remain unchanged.

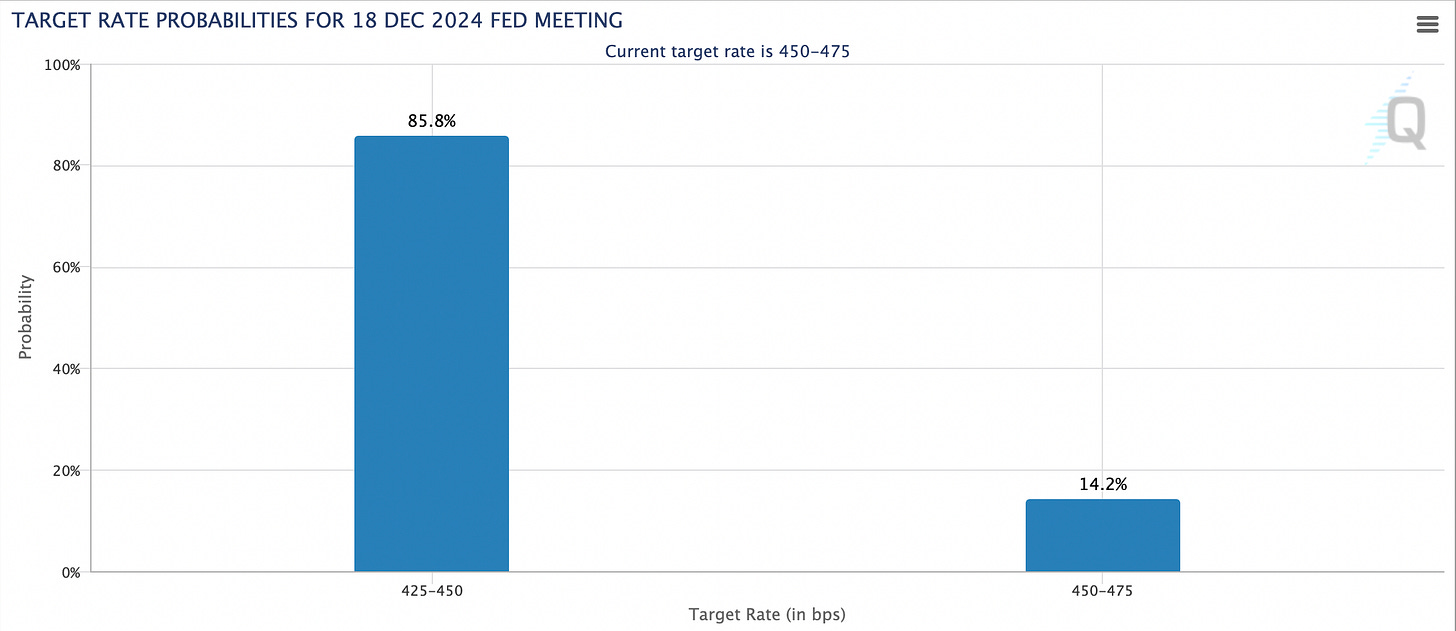

Right now, investors are expecting a rate cut, with FedWatch giving us an 86% chance of a 25bp cut. However a shocking CPI number could call that into question.

Economic Inconsistencies

One piece of data that has confused investors is the discrepancy between inflation expectations and wage growth.

You can see that the YoY expectation for inflation is 2.6%.

However, you see that Average Hourly Earnings YoY (AKA wage growth) has come in at 4%.

This is a significant anomaly, as it would be very rare to see wage growth at 4% while inflation was in the 2% range.

This is causing concern that perhaps something is being missed and inflation is actually going to come in higher than previously anticipated.

This is what is causing uncertainty in the markets right now, and I expect the volatility to continue (and volume to decrease) until we are past CPI.

I walk through this in more detail and how I am trading Bitcoin names in the video below:

Here are my Nov CPI estimate, which have consistently been closer to the actual CPI than the Wall Street firms:

https://arkominaresearch.substack.com/p/nov-2024-cpi-estimate?r=1r1n6n