Did The Stock Market Bottom?

📈The most elusive question everyone asks “Did the stock market bottom?”. There is no bell that is rung or alarm that goes off when a bottom is formed. We can however look at what caused the sell off in the equity markets and see if it is changing. Like all major corrections or bear markets there was a set of circumstances that led to the decline of the stock market. In 2000 it was the dot com bust , 2008 financial crisis , 2020 Pandemic. All of those ended the same way. We formed a bottom when the circumstances that caused the sell off cease to exist. Usually that bottom starts to form 6-12 months out before the actual change in circumstances. Our current set of circumstances that is causing us to sell off is mainly inflation.

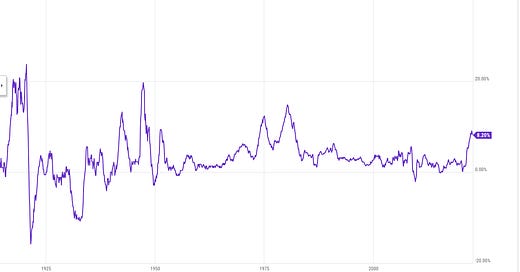

CPI which is a measure of inflation is at the 7th highest level in 100 years.

Inflation is wrecking havoc and causing imbalances across the global markets. The questions is how. The answer is two fold. First the USD is extremely strong and is causing a massive sell off in other global currencies. That sell off is affecting their bond market and their ability to purchase goods and services from other countries.

A strong dollar(green) is causing the U.K. ,EU and Japan currencies to sell off drastically through out 2022.

Major currency fluctuations can affect the bond market. Essentially why own a long term bond if the underlying currency is eroding. This causes bond yields to rise. A fast move in bond yields can lead to large investors such as pension funds in the U.K. being out of position. The GILT ( UK 10 yr treasury bond) was dumped to 20 year lows within in months causing a panic. That panic cause yields to rise through out the world including the U.S.

Now that we have an understanding of the issue and we know how the issue needs to be remedy itself we can look for signs. We can see the correlation between the bond market $TNX (10 year treasury and the stock market). Yields rise equities sell down.

We know the rise in yields is primarily driven by inflation and the Fed raising rates which in turn is leading to a multi decade high on the U.S. Dollar. The highest the dollar(green) the higher the yield.

We must see the U.S. dollar drop and yields stabilize. We can use this information to look for signs of a possible bottom. The video below talks about what index levels to look for and what stocks to buy at next week. Pay close attention to what is said about NFLX and TSLA.

Preview the Trading Community CLICK HERE

EMAIL: Arete@aretetrading.net

Trade to Win!