Fast Market

Yesterday was a rollercoaster to say the least. We gapped down on the market with the onset of tariffs for Mexico and Canada, which triggered retaliatory tariffs.

After selling down in the morning, the market made a massive comeback, only to sell off in the last hour of trading.

This was again due to uncertainty in the market, especially with President Trump making his State of the Union speech last night. Traders had no idea what to expect from him, so they simply got out of the way and will come back to the market today.

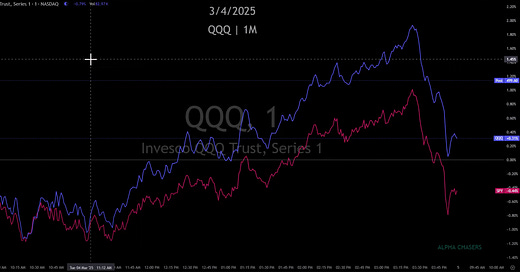

One bright spot is the image above, showing that the NASDAQ led the S&P 500 yesterday for the first time in a long time.

When the market moves higher, it is led by the NASDAQ so this is one bottoming sign that I am seeing.

Economic Uncertainty

Nobody - not even Commerce Secretary Lutnick - knows what is going on from a foreign policy perspective right now.

Yesterday we operated under the assumption that tariffs on Mexico and Canada were on for the foreseeable future.

However just after the market closed, we got a wave of news contradicting this.

Lutnick came out and said that tariffs could potentially be lifted as soon as today.

News also came out that no agreement was signed between the US and Ukraine on a minerals deal, despite news leaking earlier in the morning that President Trump was going to announce the deal in his State of the Union address.

Again, this is all confirmation that economic policy uncertainty is at an all-time high, and overnight positions hold significant risk.

I will continue to remind everyone that we are at all-time highs on this index until the headline risk subsides.

Yesterday provided incredible day trading opportunities. I walk through how I identified the bottom in the market and used it for intraday trading in this video: