📈FED DECISION| ONE BIG TRADE

The federal reserve raised rates 50 basis points today. This was widely anticipated and a decrease from the previous unprecedented 75 basis point consecutive hikes. The Fed is slowing down. While this is not a full pivot it is important to note. Jerome did leave the door open for a possible 50 basis point hike in February. J Poww. suggested that he did not know if they would be raising 50 or 25 basis points. He stated he is not aware of the full effects of the several rate increases will have on the economy. This led him to answer questions about the recession. as “we simply don’t know and don’t know how anybody could possibly know”. The important takeaway is this is a major shift in Fed Policy. The market has gone through CPI numbers, a Fed hike and the Fed speech and its in the same exact spot it was Monday. We have been in one big trade being led by the Fed and we are seeing a change in their policy once again. I’ve seen this play out a couple times in the past couple decades. In tonight’s video I walk through one example.

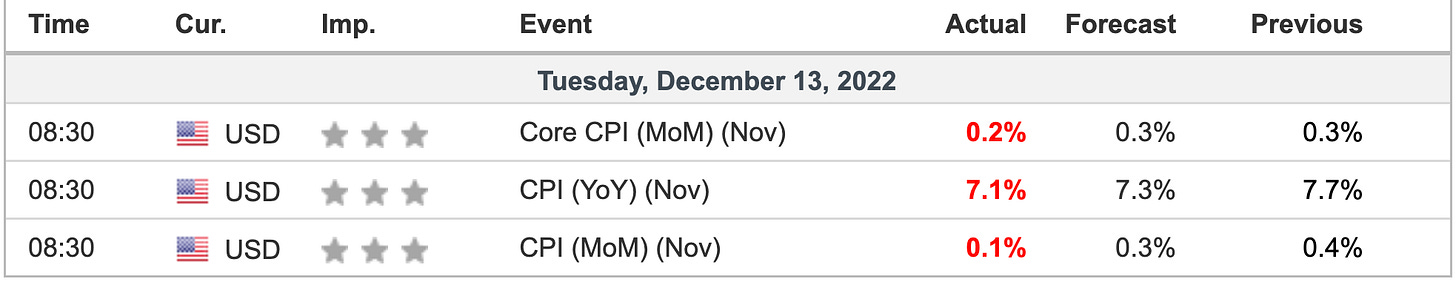

CPI data came in considerably lower than expected on all forecasts and previous readings.

SP500 has been one big trade since 2020. It was fueled by massive amounts of capital injected into the monetary system by the federal reserve. In Nov-Dec 2021 the Fed made three statements(marked by arrows). These stated that the Fed may have to raise interest rates, stop buying bonds and reduce its balance sheet. The new three arrows show the last three CPI readings. Note how equities are bought every time the CPI is released.

SP500(green) rallying as the dollar(orange) drops and the 10 year treasury(blue) is bought. This has been one big trade and continues to be only now we are seeing a major shift in policy.

SPY trading at the 200 SMA with the same range for the past month.

SP500 closed right at the level of Monday after the CPI and Fed Rate Hike and Jerome Powell Speech.

Percentage of stocks above the 200 day moving average made a higher high while the index did not. (Bullish Divergence)

SP500(green) did not make highs today even though the VIX(orange) end of day.

It is extremely rare for the index to stay flat as the Volatility index implodes

Tonight’s Video covers the SP. Pay close attention to the SP500 NVDA and TSLA levels. I explain a time period very similar to now and how this may play out.

📈 JOIN THE AT COMMUNITY WAITLIST CLICK HERE

📈Trade to Win!