📈FED MOVE SPEEDS UP RATE HIKES 🏎️

The Fed raised rates 75 basis points today in the largest hike since 1994. After the hike Jerome Powell fed Chairman answered questions for about 30 minutes. The conversation went well and he did something we have not seen him ever do. He acknowledged the gravity of the current inflation situation. He made it very clear getting inflation under control is the number one priority. The fed hike will increase the Fed’s benchmark federal-funds rate to a range between 1.5% and 1.75%. The vote after the two day meeting showed all 18 officials who participated in the meeting expect the Fed to raise rates to at least 3% this year, with at least half of all officials indicating the fed-funds rate might need to rise to around 3.375% this year. For those that are not aware the fed funds rate is the rate at which the fed suggests commercial banks borrow and lend their excess reserves to each other overnight. It is the basis for how certain bonds , loans and mortgages are priced. For example, Mortgages started the year around 3% for a 30 year mortgage and now are in the 6% range. Its important to note why we are watching their moves. Higher rates means the ability to finance less. You can only buy a car or home for what you are approved for. To put it in perspective, the typical mortgage payment in the U.S. is $664 more expensive compared to a year ago — an increase of nearly 40%. according to Redfin $RDFN. This means the housing and car market as well as retail will continue to falter for some time. Now it is best to focus on sectors where inflation does not have as great an impact such as Biotech, healthcare, consumer staples and Energy. These are all items that are needed so they will be more resilient going forward. I am happy with today’s response of the equity market to J Poww.. We need to string a couple more days together. Reminder use the 5 day moving average as your guide on the indexes. In tonight’s video below I go into detail about the Fed , what it means for stocks and which ETFs or stocks to trade tomorrow on the news. Pay close attention to $JNK. Let’s get to it!

Let’s look at our Indexes !

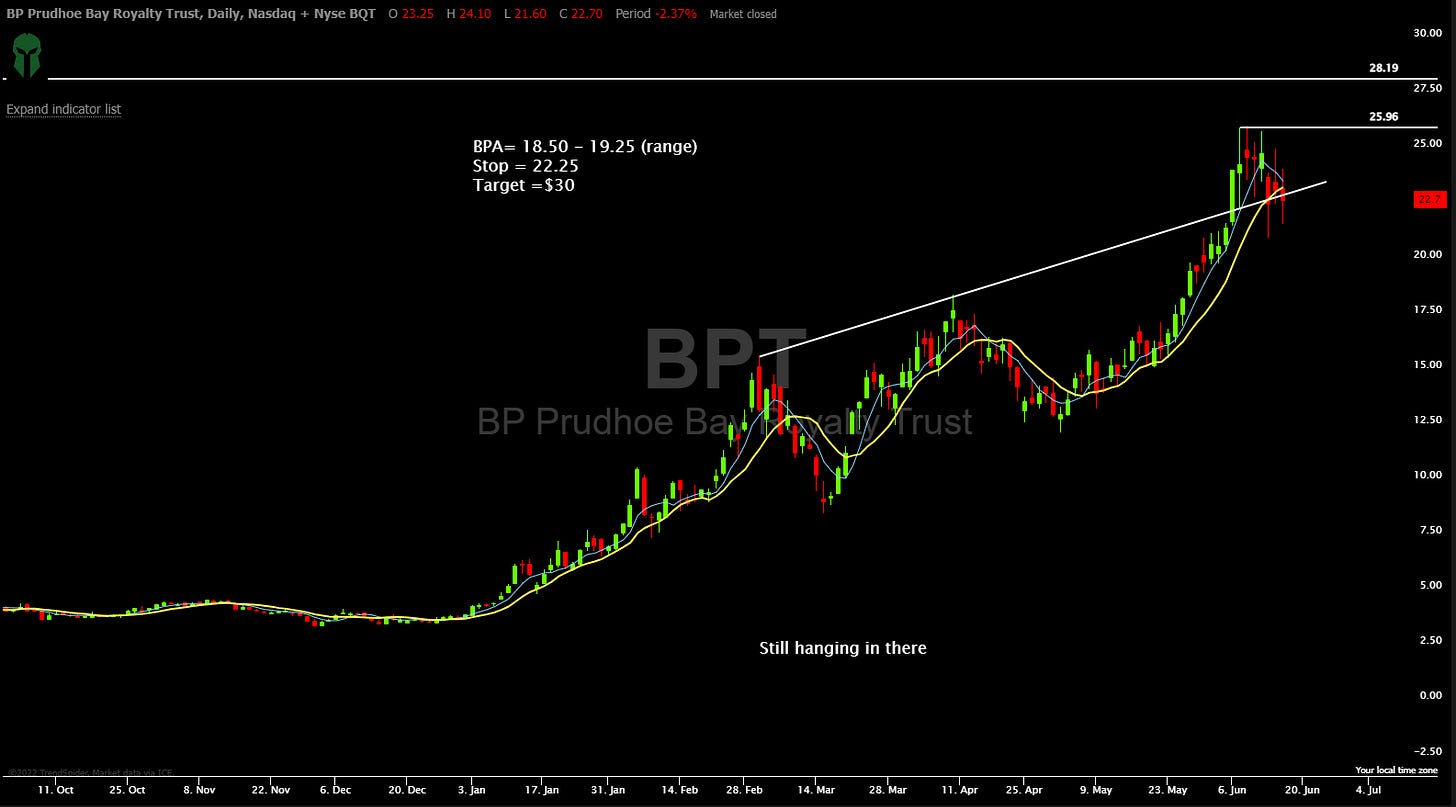

Let’s look at our Stocks!

Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes Longs and Shorts. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube. The video below is the Top 5 from tonight and focused on the Fed rate hike, what it means and what stocks to look at tomorrow. Pay close attention to what is said about $JNK.

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Preview the AT Trading Community

👇👇👇

✓Trade To Win! 🔥