📈FED SELLS BONDS*MARKET SHRUGS

The Fed began selling bonds on it $9 Trillion dollar balance sheet. While this has been telegraphed for months, the bond market still sold off. The 10 year treasury rose to 2.93% which did caused selling in the indexes. This was short lived and was acerbated by the CEO of JPM comments that we are heading into a “hurricane and we need to batten down the hatches”. The last time we has such a brash off handed statement is was the 3rd week in March 2020 by Bill Ackman. (see below)

While above is no reason to call a bottom there are some glaring similarities. I would focus more on how the dip was bought today as a sign. We usually have been selling down and staying down. Now we are selling down and traders putting on short positions are being stopped out. This is a very different than last week. The majority of bad news has been released but we do not know the harm it can do on the economy or market long term. The Fed bought everything from treasuries to high yield funds to mortgage backed securities. This heated up the economy perhaps too much. As Janet Yellen admitted today “ Treasury secretary concedes she was wrong on 'path that inflation would take” For further in depth click the link to read the CNN piece on the topic. What is more important then her stating the obvious is how does this affect us. The fed can slow or speed up the economy two ways. The first way is through interest rates. The second way is too buy or sell bonds. Below is a graph explaining how.

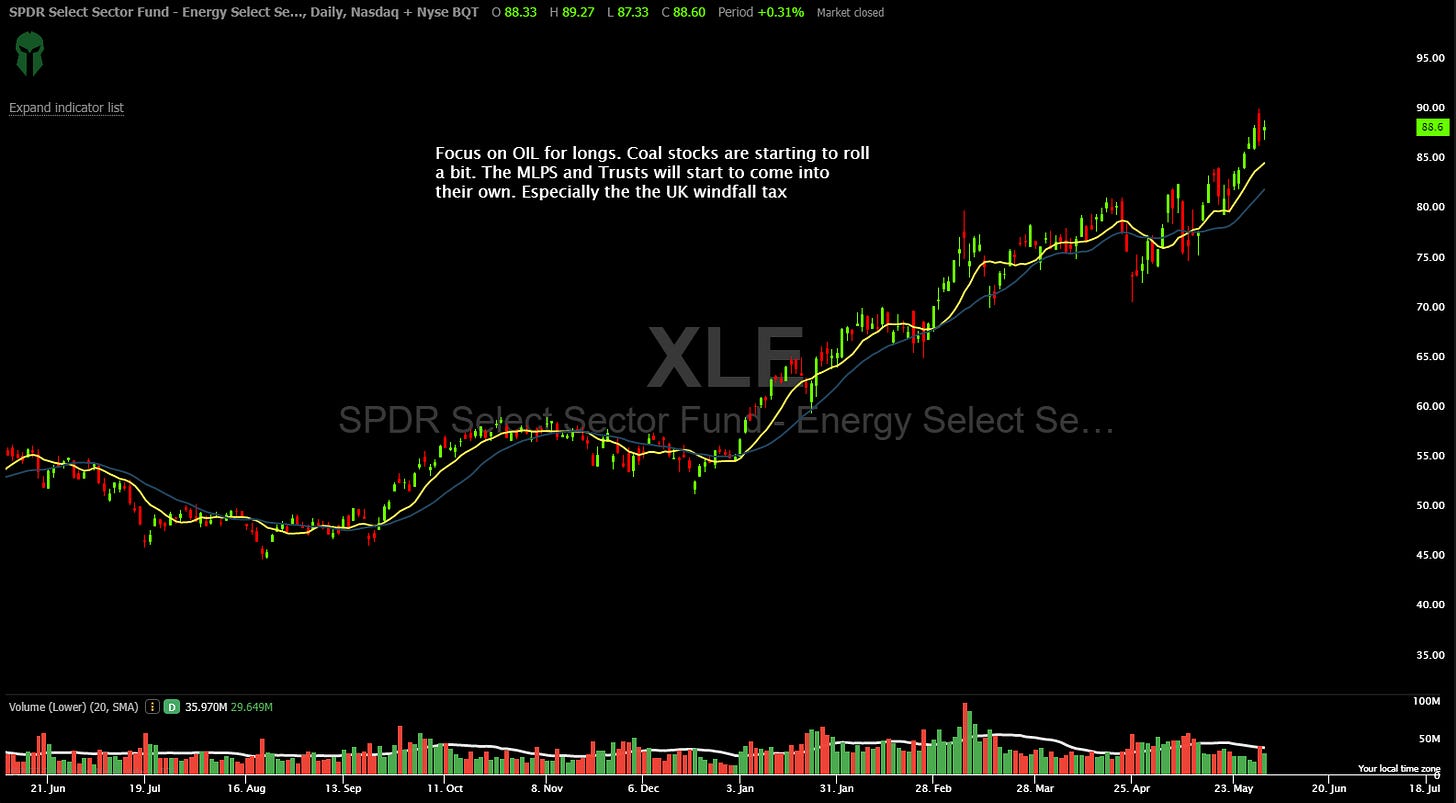

The Fed can literally step on or off the gas of the economy by how much of a specific bond sector it sells. While they have given the number of $95 billion a month, they can increase or decrease at any time. They can also pick if they are going to sell treasuries, high yield or another sector of the bond market. All of this gives them great control over the economy and by default the stock market. Next for us is too watch how this affects the indexes act this week. This is the first week in over two years the fed is not providing a backstop to the markets. 10 year rates over 3% will cause concern. For now let’s focus on the stocks that our driving the indexes. Energy. With shanghai opening up and its 26 million people getting back to work in the largest city and port in the world. Demand will only increase to a limited supply brought on by policy and sanctions. Also focus on what is not working as short ideas. In the video below I walk through in detail why COIN and MSTR can go much lower as well as three stocks to watch tomorrow. I also explain why the SPY looks closer to march 2020 then March 2022.Let’s Get to it!

Let’s Look at our Indexes

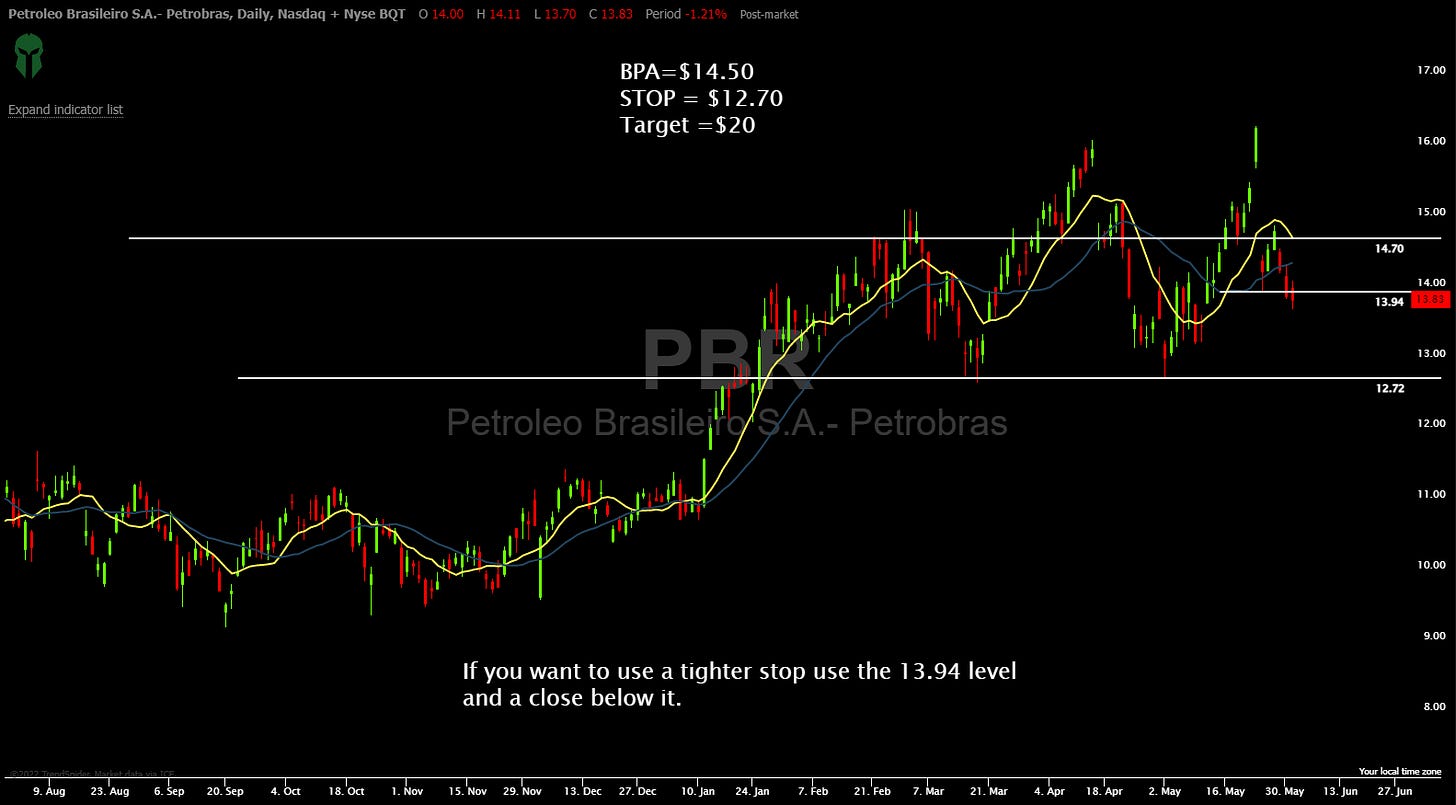

Let’s Look at our Stocks

Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes Longs and Shorts. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube. The video below is the Top 5 from tonight and focused on TSLA FB COIN and more based upon the technical moves today. Pay close attention to what is said about the SPY and how this situation is closer to 2020 than 2022

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Preview the AT Trading Community

👇👇👇

✓Trade To Win! 🔥