FOMC Headlines

There was no change to interest rates in yesterday’s meeting. That was expected.

What was unexpected was that Jerome Powell signaled that it is unlikely that there would be an interest rate cut in the March meeting, which previously was expected.

FedWatch’s updated probability of a rate cut in March is 53%, down from 73% a month ago.

Stock Market Reaction

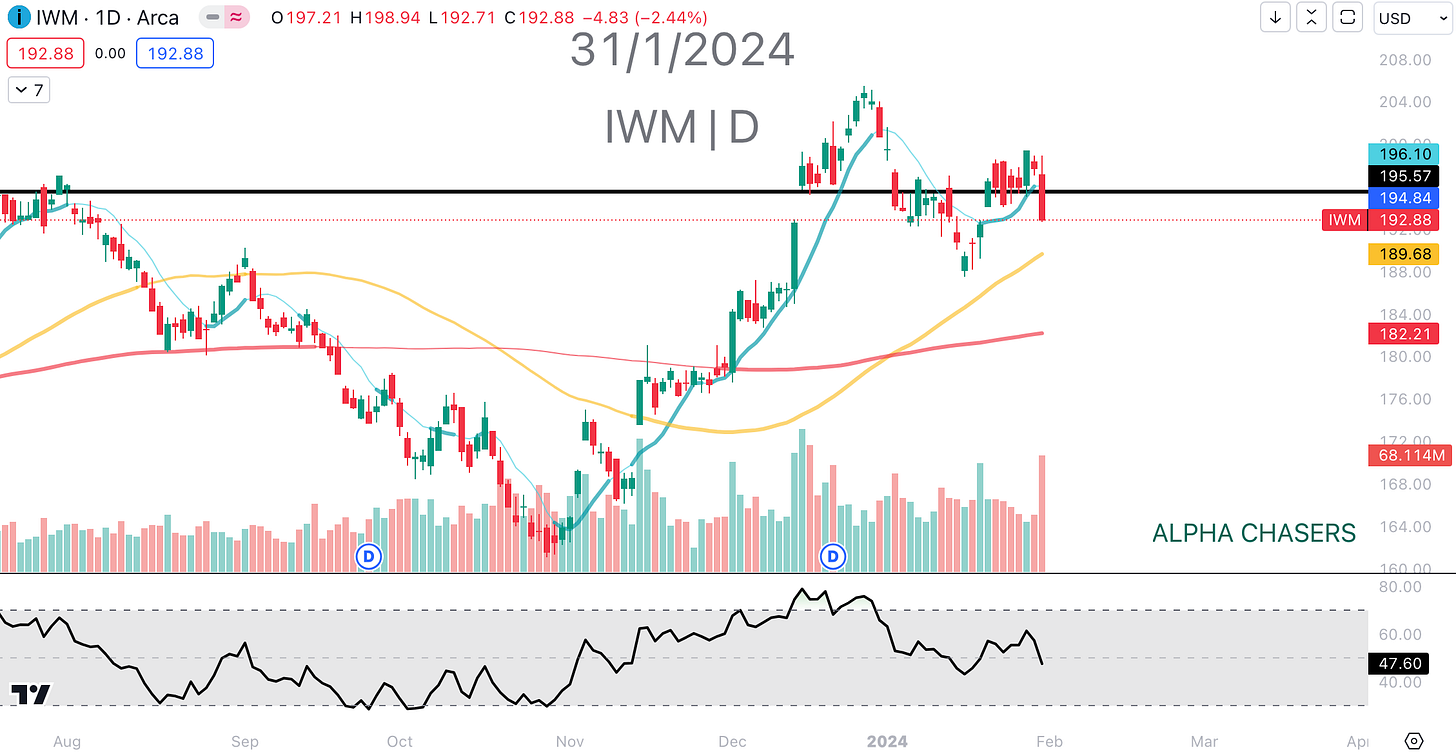

This news and growing uncertainty around timing of rate cuts is bad for the markets and we saw the indexes sell down.

The Nasdaq held up the best of the three and the Russell was the weakest. This makes sense because many interest rate-sensitive stocks are in the Russell (ex. regional banks, UPST, AFRM, etc.).

It is important to note that we closed at the low of the day on the indexes which typically signals that a further move down is coming.

Be very cautious with the market and make sure you honor stop losses as it is possible that this gets ugly.

What’s Next

We still have a lot of data and earnings ahead of us this week.

AAPL META and AMZN all report earnings after market close today.

We also have jobless claims at 8:30 and Manufacturing PMI at 10:00.

For more in-depth analysis of the FOMC meeting and what transpired, watch the YouTube video below: