CPI & Unit Labor Costs

When we think about the data that dictates whether or not we will see rate cuts, typically we think about CPI and PMI.

What we are looking for with rate cuts is actually negative news about the economy - we want the economy to be cooling off to curb inflation and put is in a position where we can cut rates without seeing rampant inflation shortly after.

This chart by Yardeni Research shows the relationship between CPI and Unit Labor Costs:

You can see there is a high correlation between the two.

What they are trying to show with this chart is that the two typically converge, so when one makes a strong move in either direction, you can expect to see the other catch up.

What we are seeing right now is that unit labor costs are plummeting, but CPI hasn’t quite caught up with it yet. They are suggesting that CPI has room to come down to meet the drop that we have seen in unit labor costs.

This would enable rate cuts - and maybe more rate cuts this year than investors are currently expecting.

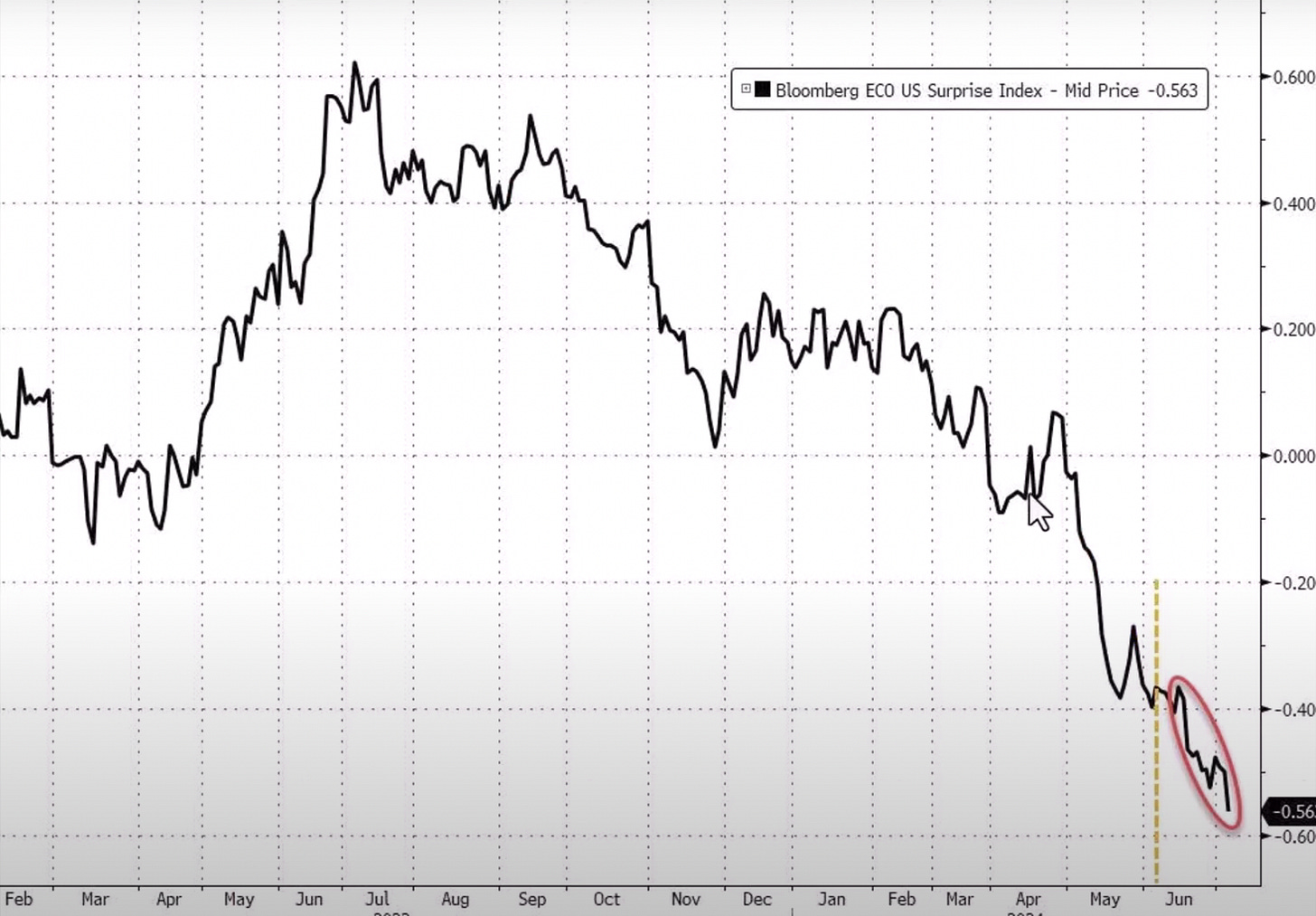

We can couple this knowledge with the chart above that shows that the momentum of surprises that we have seen in economic data has been decidedly to the downside.

So if that were to continue, then we would see CPI surprise to the downside.

Putting these two pieces of data together makes me think that CPI may come down faster than expected, enabling rate cuts.

I walk through my thesis in more detail here: