Why Look at Sectors?

One of the most important things that a trader can do is follow the money.

Understanding where institutions are committing capital is critical to being successful in the long run as a trader. You want institutions to be behind the stocks that you’re in.

How to Find Target Sectors

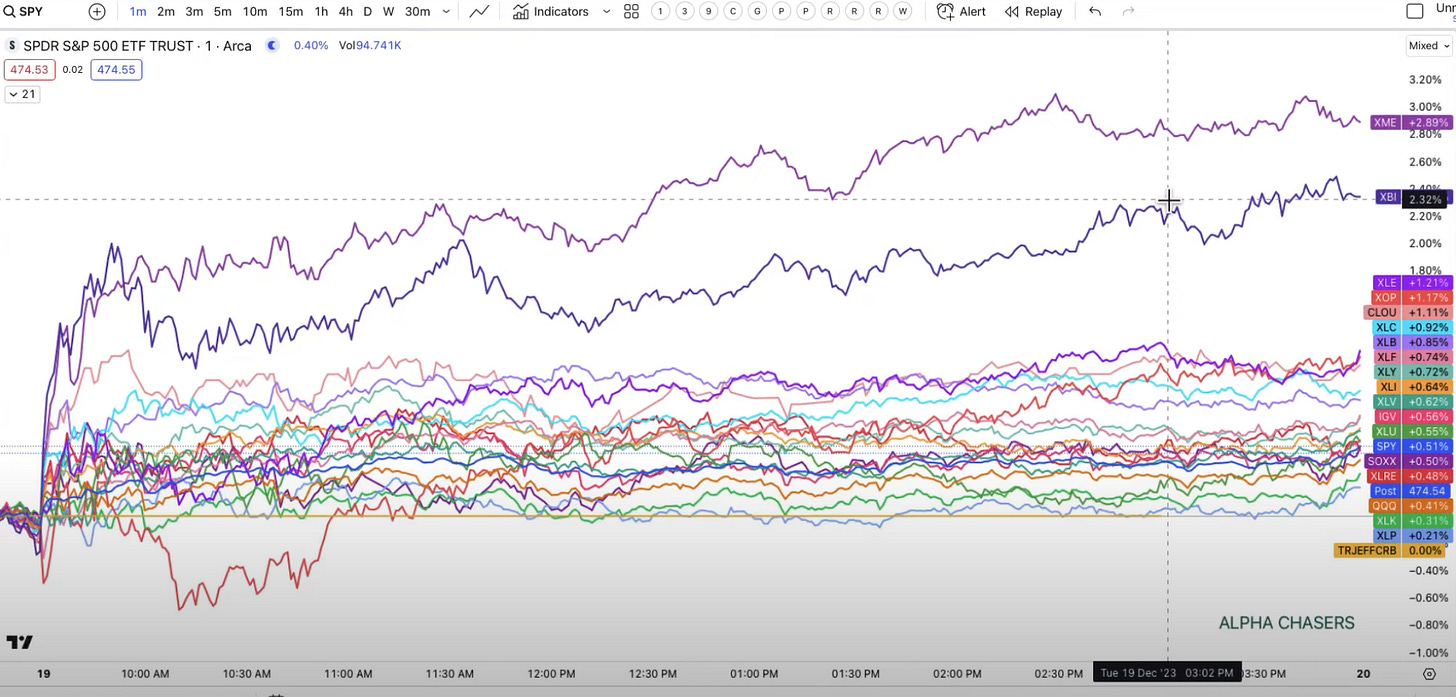

The easiest trick to identifying strong sectors is to compare them to each other over a particular period of time.

Each day you can compare sector performance for the day to see where money was flowing. You should be doing this daily and intraday to identify where you should consider committing capital.

The next most important thing for you to do is to take a look at sector performance in two different time frames: from 2:30 PM to the end of the day and from 3:50 PM to the end of the day.

First, you should look at performance from 2:30 going forward because that is when institutions begin placing bets and making trades.

Therefore by looking at performance from 2:30 forward, you have a clearer picture of what institutions are doing (as opposed to retail which typically makes up most of the trading in the morning).

Finally, you should look at sector performance for the last 10 minutes of the trading day. That is because 3:50 is Market on Close (MOC), which is the last opportunity that institutions get to make trades for the day, guaranteeing that their orders will be filled.

Therefore, a significant amount of the trading volume in the last 10 minutes is occupied by institutions. This provides a great opportunity to understand where money may flow in the next trading day.

Notice how if you compare the previous two images, XLK rises from sixth strongest sector to the third strongest sector. That is an indicator that institutions rotated into tech at the end of the day, a signal that we may see strength in tech tomorrow.

This is a very simple technique you can use that can help your trading massively. For a more in-depth look at this technique, watch the three minute clip below: