How to Take Advantage of Year-End in the Stock Market

Tax loss selling and capital gains provide a unique opportunity.

End of Year Strategy

At the end of the year, investors begin to think about their tax strategy for the calendar year.

This provides us an opportunity to benefit by predicting how traders will behave.

Tax Loss Selling

One common strategy that we see at the end of the year is investors taking losses on positions they are down in.

This is because for tax purposes, losses offset payable taxes on capital gains.

Therefore, often traders will liquidate positions that they are down on for the year.

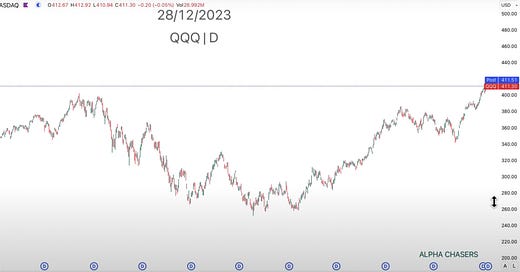

An example of this is shown below in 2022. Investors were down on their tech positions, so we saw a lot of selling in December, and then a bounce to start 2023 as they re-entered positions.

It would be wise to look for names that had poor years to potentially bottom out as we come to a close on the year, and then look for bounces in 2024.

Some names to watch include: IEP, TAN, FNGD, VIX, UVXY.

Locking in Capital Gains

Conversely, we often see traders lock in capital gains on winning stocks to end the year.

This means that stocks that performed strongly in 2023 may abruptly sell off to end the year as traders offload their positions to lock in their gains.

To identify stocks that fit this category, sort by the top performing sectors of the year.

Some names to watch include: SOXX, NVDA, SMCI, META.

For more information, watch this three minute clip