Markets say they want clarity, yet it can feel like they just chase noise. Which sounds nice and pithy, but thinking like this is a trap.

As traders our job isn’t to tell the market what it should care about. It’s to read the room, spot what trends are sustaining beyond a reactionary shock, and let the market tell us where we can position profitably.

This is a busy week, with lots of potential oxygen-grabbing headlines. Here’s what to watch:

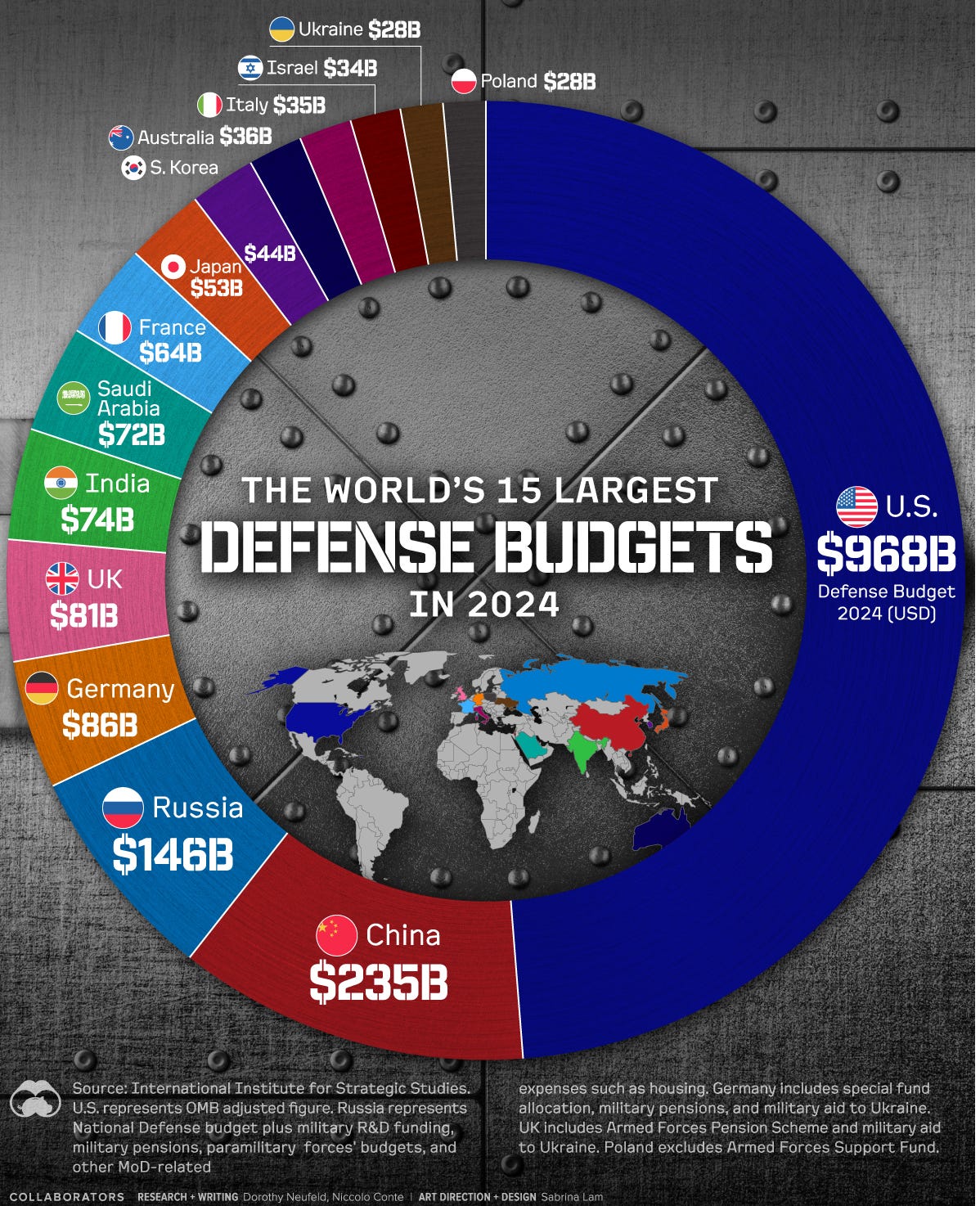

1. Germany's $536B defense revolution

Germany's proposed $536 billion defense and infrastructure package marks what Deutsche Bank calls "one of the most historic paradigm shifts in German postwar history." German political groups are rushing their proposals to parliament next week, signaling urgency despite a political process that tends to favor deliberation.

The German economist Holger Schmieding agrees:

These proposals for an immediate loosening of Germany’s fiscal rules will likely be enacted. They are a fiscal sea change for Germany.

Takeaway: As the chart shows, getting to the levels discussed is a massive shift that will move markets. Already the DAX hit record highs and European defense stocks are ripping.

2. China’s 40% outperformance in internet stocks

For the first time since October 2022, KWEB (Chinese internet stocks) has outpaced the Nasdaq QQQ by over 40%. Despite this surge, Chinese tech names still trade at a steep discount to U.S. peers. With the dollar (DXY) weakening, the setup here has tailwinds.

The question is whether this shift is a reversion to the mean, a larger change in trend, or a short-term hedge against US equity exposure. The market hasn’t answered yet, which means before getting involved, you need to know which playbook you’re trading from.

Takeaway: Positioning in Chinese tech is well underway while headlines are distracted elsewhere. By the time consensus catches up, the easy part of the move may be gone.

3. FOMC holds a 2% chance of rate cuts, but…

The Fed meets Wednesday with markets pricing just a 2% probability of a rate cut. These meetings have often become binary catalysts for market direction regardless of the actual decision. Even minimal shifts in forward guidance could trigger outsized market reactions.

While the probability suggests a non-event, the real action will be in the dot plot and Powell's language around disinflation progress. The Fed offering clarity on its next move reduces uncertainty (which, without overstating the obvious, has been the market's albatross for weeks now). That clarity alone could provide immediate lift before the substance gets digested.

Takeaway: Position for volatility, not direction. Initial moves may not reflect sustained sentiment. The asymmetric risk lies in any hint of acceleration in the cutting cycle, not the March decision itself.

What I'm listening to

🎧 The Founders podcast really delivers if you’re interested in history and business and how they intersect. I particularly like the perspective in this episode discussing qualities of leadership and how we define leaders as heroes, using a range of historical figures as case studies.

Listen here: Founders: Heroes from Alexander the Great and Julius Caesar to Churchill and de Gaulle

From the episode, on the four traits of heroes:

Absolute independence of mind. Think everything through yourself.

Act resolutely and consistently.

Ignore the media.

Act with personal courage at all times regardless of the consequences to yourself.

More noteworthy signals & developments

💴 The Bank of Japan meets March 18th to 19th, with recent signals they're likely to hold rates steady. Unlike the Fed's deliberate ambiguity, Japanese policymakers typically telegraph moves to their citizens well in advance. Yen pairs hold billions of dollars of weight across worldwide financial markets, so the BOJ’s moves directly affect US markets.

⚛️ NVIDIA is hosting its first-ever Quantum Day on March 20th, featuring presentations from leading quantum computing companies. It’s a big pivot from Jensen's January comment that quantum computing wouldn't be "very useful" for 15-30 years (popular quantum stocks did not enjoy the aftermath).

⚔️ U.S. military strikes in Yemen have significantly elevated tensions with Iran. The expanding scope of conflict increases the tail risk of supply chain disruptions - the Strait of Hormuz remains a critical chokepoint that could send energy markets into chaos if directly impacted.

The bottom line

This week is stacked with potential inflection points. Be prepared, but don’t get caught chasing every dollar. The best trades don’t require you to be first, and the market will happily take back your money if you try to force a view that isn’t working.

There’s no need to be a hero. Know your edge, trade within your risk tolerance, and let the market figure itself out - especially when it looks like it’s chasing its own tail.

👉 What do you think is going to be the big market mover? Are you finding these longer-form weekly digests useful?

Definitely like the broad, longer term perspective. In terms of macro factors, do you believe that if President Trump refuses to comply with a Court decision, which could trigger a Constitutional crisis, that would trigger a significant market correction?