📈INDEXES STALL.....BUT GET READY

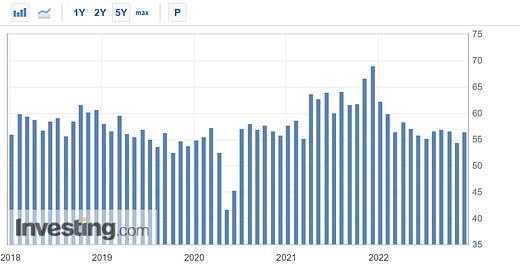

Indexes stalled and traded sideways after two days of selling. After Monday’s release of the Purchasing Managers Index (PMI) the indexes began selling down. A high PMI means the economy is running at a rate higher than expected. The reading of 56.5 was higher than the 53.3 estimate. This led investors to become concerned about the chances of a 75 basis point hike next week. Below you can see the uptick in PMI Month over month. This was significantly out of the expected range.

The hot PMI had an immediate and swift reaction. THE SP500 sold down 1.58% in 10 minutes.

Now we have a clear rejection on the SP500 of the 200 Simple moving average (SMA) and the trendline. Watch the Doji bar tomorrow morning. Doji bars are signs of uncertainty.

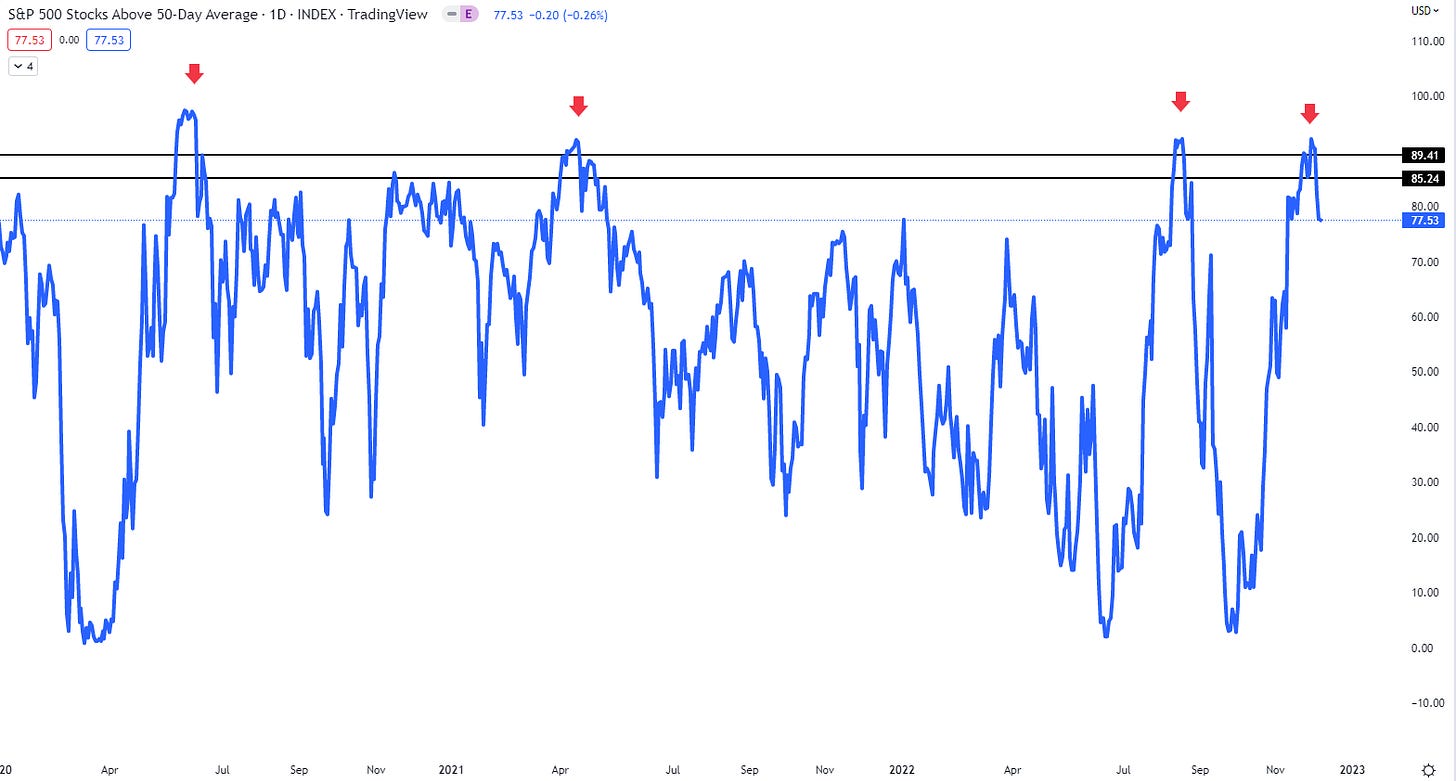

SP500 stocks above the 50 SMA have been at an extremely high reading. We started the week with 92% of stocks over the 50 SMA. We have only been here 4 times in two years. Now we are at 77%. Pullbacks usually slow down around 50-55%

The longer term prospects are much better. Below is the percentage of SP500 stocks above the 200 SMA. Note the higher high(blue) while the SP500(Orange) did not make a higher higher. This lets us to ascertain that the market internals are stronger previously than in August.

STOCK HIGHLIGHT

On Wednesday’s I will share one idea from the trading community. Tonight’s is TOL breaking above the 200 SMA.

Price to Tangible Book Value is at 1.

Toll Brothers Inc. (TOL) on Tuesday reported fiscal fourth-quarter earnings of $640.5 million. The Fort Washington, Pennsylvania-based company said it had profit of $5.63 per share. Earnings, adjusted for non-recurring gains, were $4.67 per share.

Weekly Chart. MACD Buy Signal

Tonight’s Video covers the Indexes AAPL MDB TOL and several others in detail. Pay close attention to the SP500 levels.

📈 JOIN THE AT COMMUNITY WAITLIST CLICK HERE

📈Trade to Win!