Institutions Buying at End of Day

You often hear that the majority of retail buying comes on market open, while the majority of institutional buying comes just prior to market close.

While it’s impossible to track volume by investor type, looking at total volumes throughout the day can give you a clear picture of who is buying when.

It also helps you understand what’s going on while you’re trading through various periods in the day, including when you may be more likely to be shaken out of a position on low volume.

See below as an example:

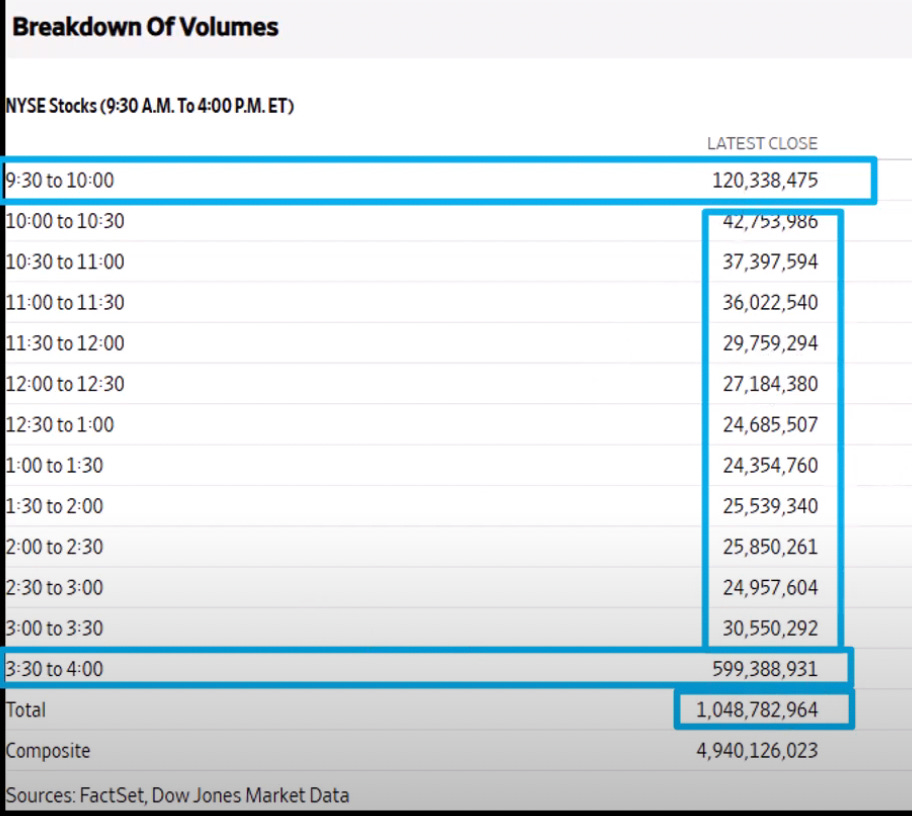

This gives you a look at trading volume by time of day from Friday’s trading session.

You can see that the first half hour of trading is relatively active - over 2x as active as the next 30 minutes of trading. This is primarily retail volume.

You also see that over half of the total trading volume on Friday came in the final half hour of trading. It is very clear that this is institutional volume.

Therefore, it is absolutely pivotal that you pay close attention to what transpires in the last half hour of trading, because this is where you will find how institutions are positioning themselves.

Institutional Buying Increases

We can also understand how institutional and retail volumes are shifting by comparing volumes to more recent trading sessions.

This is yesterday’s trading session. We have greater volume in the first half hour of trading, the last half hour of trading, and total volume for the day yesterday vs. Friday.

This tells us that we are seeing more exposure to the markets on both the retail and institutional side. Both the first 30 minutes and last 30 minutes of the day saw strong buying, evidencing that investors are putting risk on.

To take advantage of this, there are a number of stocks and sectors that I am putting daytrades and swing trades on.

For a look at what I am trading, watch this video: