Bank of Japan Raises Rates

Last night, the Bank of Japan raised rates to 0.50% from 0.25%. This is the second time that they’ve raised rates in the past 17 years.

It comes on the heels of their inflation rate coming in at 3.6%, above expectations of 3.4%.

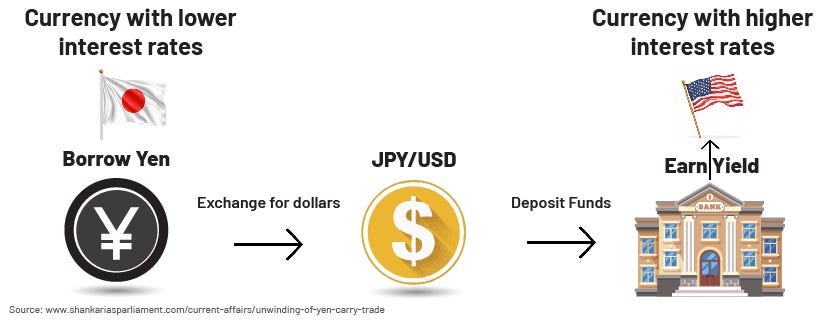

This matters to US investors because of the carry trade. Without going into a ton of detail, this essentially refers to investors borrowing money at very low rates in Japan and investing them in US equities and bonds where they can make a greater rate of return.

The carry trade represents a significant amount of investment in the US stock market, so any unwinding of it can have a massive impact to the stock market.

Institutions Unbothered

Even with uncertainty regarding the Bank of Japan’s interest rate decision, institutions were full steam ahead buying into market close yesterday.

We know that institutions are the primary source of volume into market close, so it is clear that they are willing to be risk-on even in the face of rate hikes in Japan.

On top of that, Financials are currently leading the way as the best performing sector in the entire market right now.

If we truly had concerns over what the Bank of Japan is doing, this wouldn’t be the case.

Specifically look at names like GS, JPM, C, HOOD, SOFI.

All of these names are breaking out and every dip is being bought. This is where you should be focusing right now.

I run through Financials and other names that are outperforming in this video: