📈Is Nvidia going to be bigger than Apple?

Nvidia earnings release did something unprecedented. They raised guidance from $7 billion dollars to $11 billion. No company has ever raised revenue guidance that significantly from a $7 billion base. The stock responded favorably and during the earnings call it became clear this is not going to be a one time event. Nvidia is on the forefront of the AI race with its cutting edge product line.

Nvidia data centers surpassed Intel’s data centers for the first time in history. The graph below was created by The Transcript and illustrates Nvidia’s position relative to Intel.

NVDA CEO Jenson on New chip Design

"We went from a pretty tough year last year to an overnight turnround...Packed with 80 billion transistors, H100 is the world's largest, most powerful accelerator, offering an order of magnitude leap in performance over the A100. We believe H100 is hitting the market at the perfect time. H100 is ideal for advancing large language models and deep recommender systems, the 2 largest-scale AI workloads today."

We are already seeing massive demand and a shortage of H100 chips

Full article here Click here

H100 are already selling on the open market at a premium.

Nvidia growth is far surpassing Intel. In 2000 during the dot com boom Intel was the leading company. Nvidia seems to be heading in that direction for the AI boom. Graph created by Bloomberg.

At the Sohn investors conference Stanley Druckenmiller stated that we were in the largest asset bubble in 500 years. In regard to AI he said this : "I actually think there is a very very real possibility and could be every bit as impactful as the internet literally going forward. Al could be there...My firm has only been able to participate in Al by owning Nvidia and Microsoft" 20% of his net worth are currently in MSFT and NVDA. Always watch what they do not what they say.

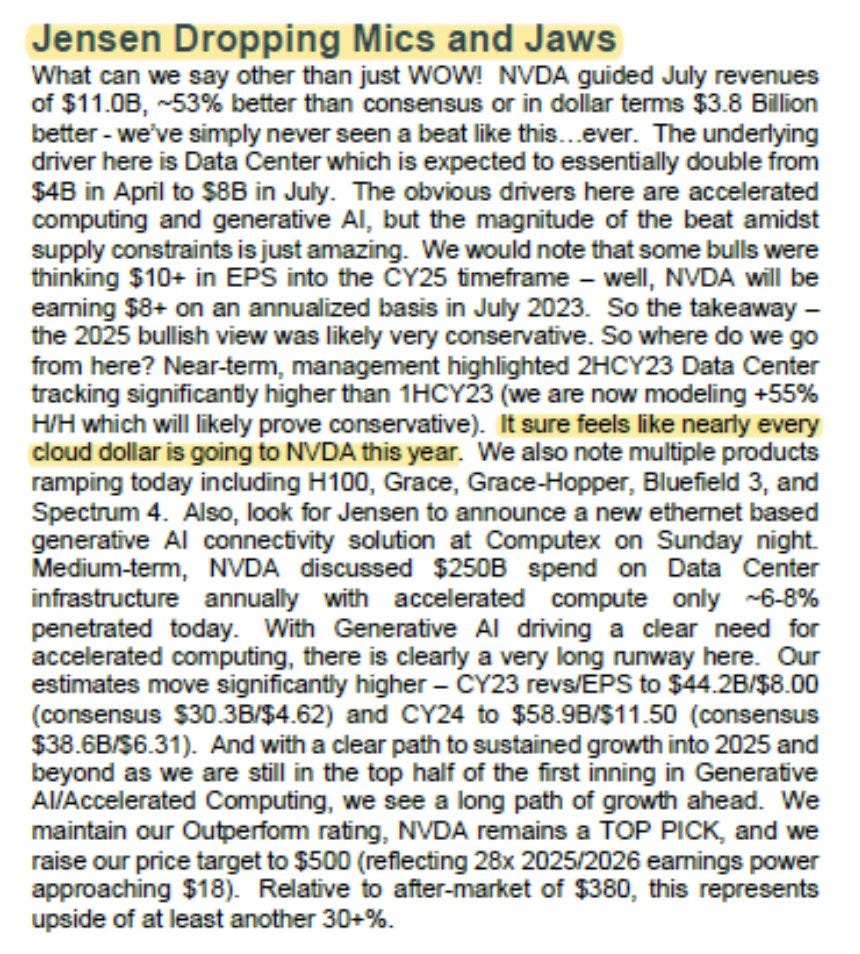

Analysts are clamoring for the stock and have been completely caught off guard. Here is Evercore comments after the call.

The one take away I see as most significant in Evercore’s notes is ramping up of the earnings guidance. Note above that 2025FY was estimate to be $11 now 2025/2026 had been raised to $18.

JPM TMT trader “NVDA defies gravity. This guide is insane. No one I spoke to has this kind of magnitude of an Q2 guide. Incredible driving that much in one quarter”

Bank of America technical team has NVDA at first position technically in the SP500.

Every analyst on the street has raised their target price. Here is Goldman sacs lifting it from $275 to $440. The stock was trading higher than the current target price at the time of the release. The fact they did not raise beforehand shows how off guard everyone was.

Bottom line the stock lifted significantly after earnings and these kind of moves take time to digest usually but we saw no sign of that the next day. We actually closed higher.

Watch the video below for a look of what stocks can benefit this week from the AI craze. Pay close attention to AVGO and CRM levels

Wishing Everyone Massive Success!