📈Is The Rally Real? Five signs...

Since the beginning of the year we have been told by “experts” that the bear market will persist. Economists keep talking about inflation. Russia/Ukraine war continues to escalate. Market analysts continually talking about SP500 earnings estimates being too high. In the face of everything the market is off to one of its best starts in several years. There are five signs that the rally can be sustainable.

#1 Inflation has peaked. Inflation has been defined by the rise in costs that causes the decline in purchasing power over time. Below is a graph of the consumer price index year over year comparison. CPI is the cost of services and goods over a period of time. It measures the change. Since the peak in July it has dropped precipitously

To put this in perspective. Here is the CPI Month over Month. We can see that monthly the rate is dropping so fast that we went negative. This is rare and something seen in an event driven situation such as the pandemic.

Inflation has peaked. This is a quantitive objective fact. We can of course see intermittent spikes but the trend is down. Why is this good for the stock market?

When inflation rises the dollar gets stronger. We can see that by the sheer strength in 2022. Since Jan 2022 to the peak in September 2022 the dollar rallied over 20%. In the last quarter alone the dollar dropped 11%.

We can see the correlation between inflation and the dollar but how does the dollar effect the stock market? Here is one simple equation to remember:

Weak Dollar + Bond Buying = Rising Equity Prices.

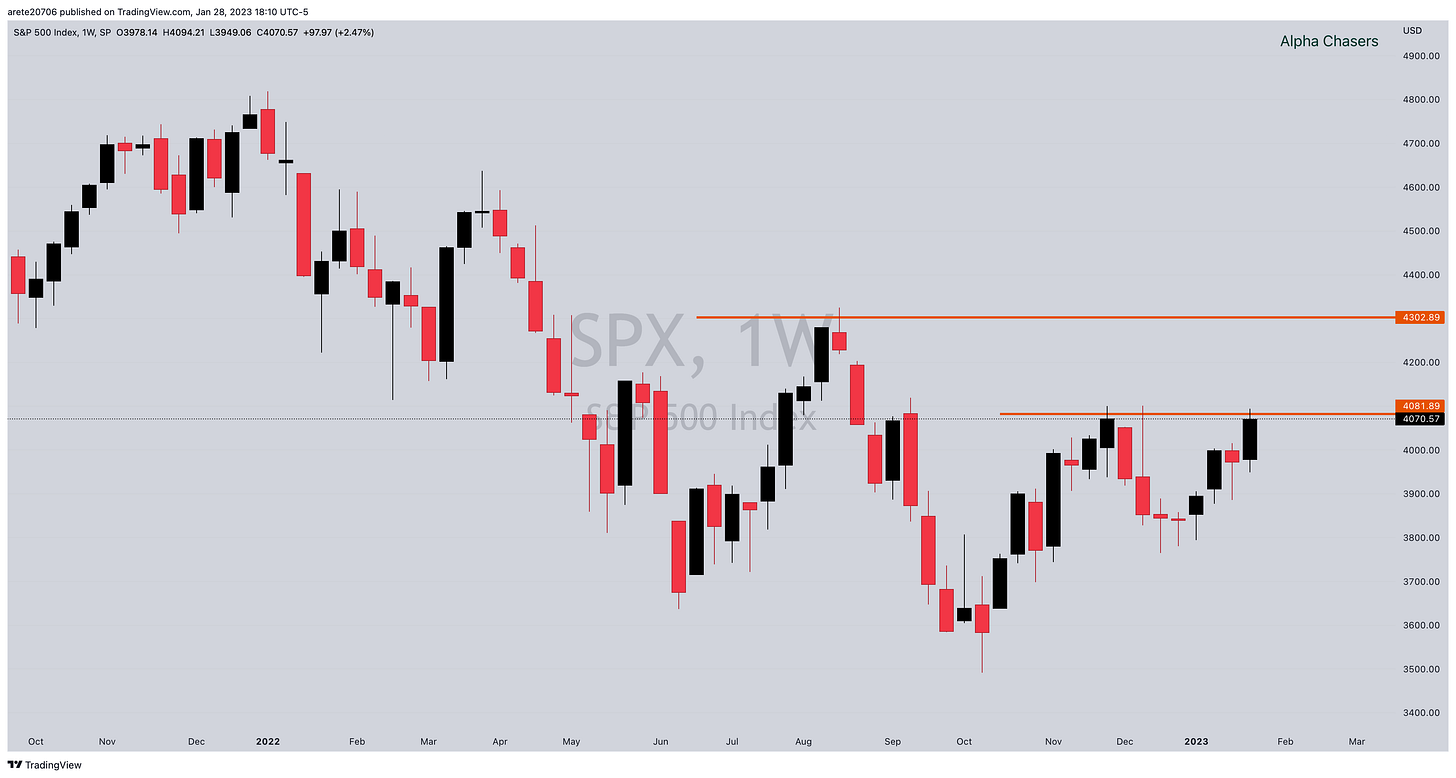

If we look at the SP500 during the same time period we can see that the the bottom was put in right when the dollar started selling off.

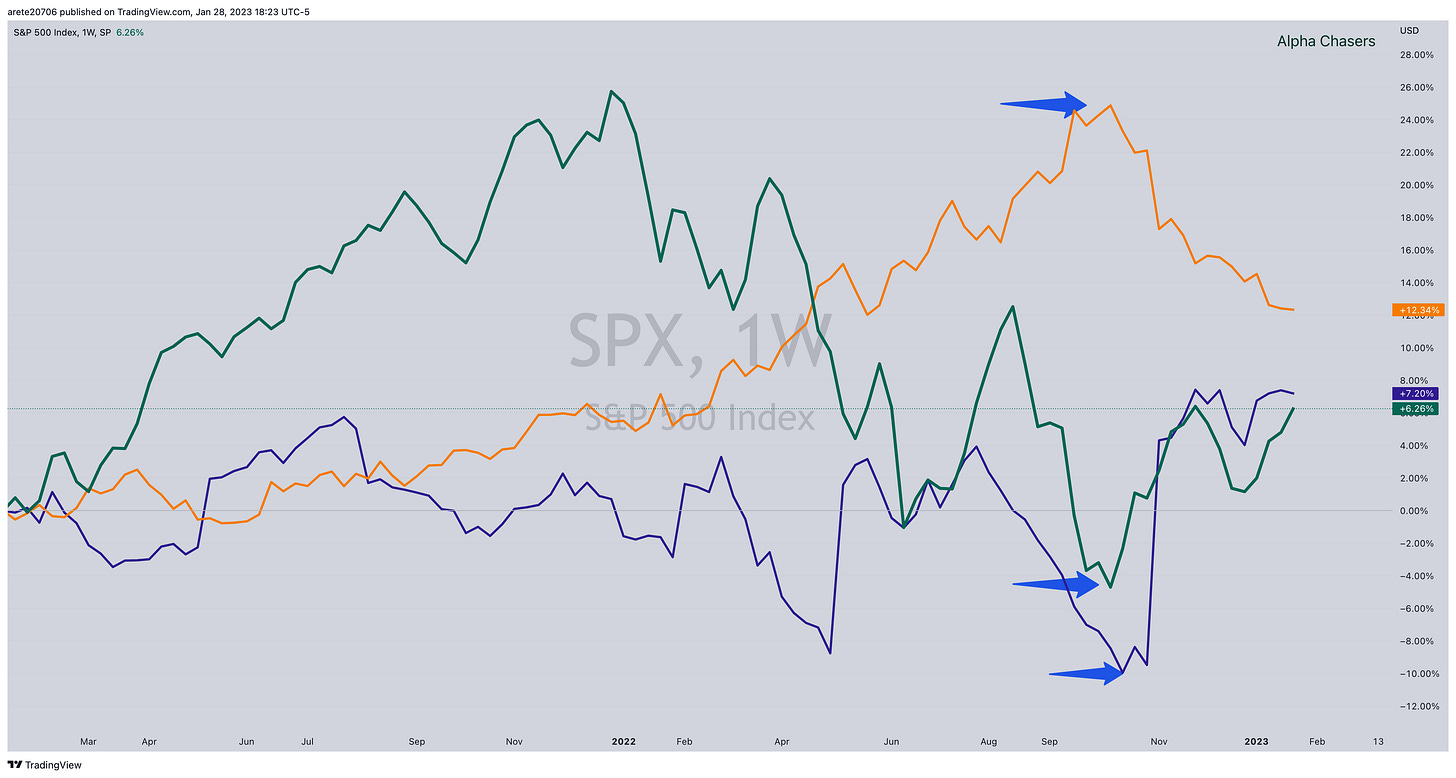

To further illustrate the correlation. Below is the SPX(green) , 10 year bond price(purple) and U.S. dollar(orange)

Over the course of the week I will be be reviewing 4 others signs that the rally has the ability to sustain the rally. Please share this newsletter. It’s important to me that investors understand what is happening at this turning point.

Watch the Video below for a more in depth look at what stocks I am watching next week as well as what to expect from the fed. Pay attention to the comments on RIVN LCID and TSLA

Alpha Chasers Community Waitlist Click Here

1 on 1 Coaching Program Click Here

Wishing Everyone Massive Success in 2023 🍾