The Fed Minutes Today Were Important

Today the FOMC minutes provided us with important information about the future of the stock market.

The Fed announced that they would be slowing the rate of reducing their balance sheet - which effectively means that they are going to stop putting pressure on the markets.

Based on this, we should expect the dollar to drop, bonds to be bought (bringing down yields), and small cap stocks to rise.

However, this is not what happened.

We did see the dollar drop and bond yields drop as expected. We did not see small cap stocks rally - in fact we saw the opposite.

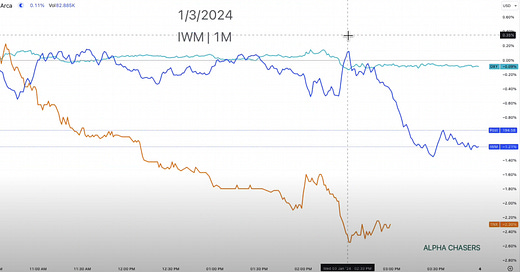

Here you can see the divergence of the IWM dropping after the Fed minutes, when it should have risen.

Then Why Are Small Caps Dropping?

It’s hard to say for sure.

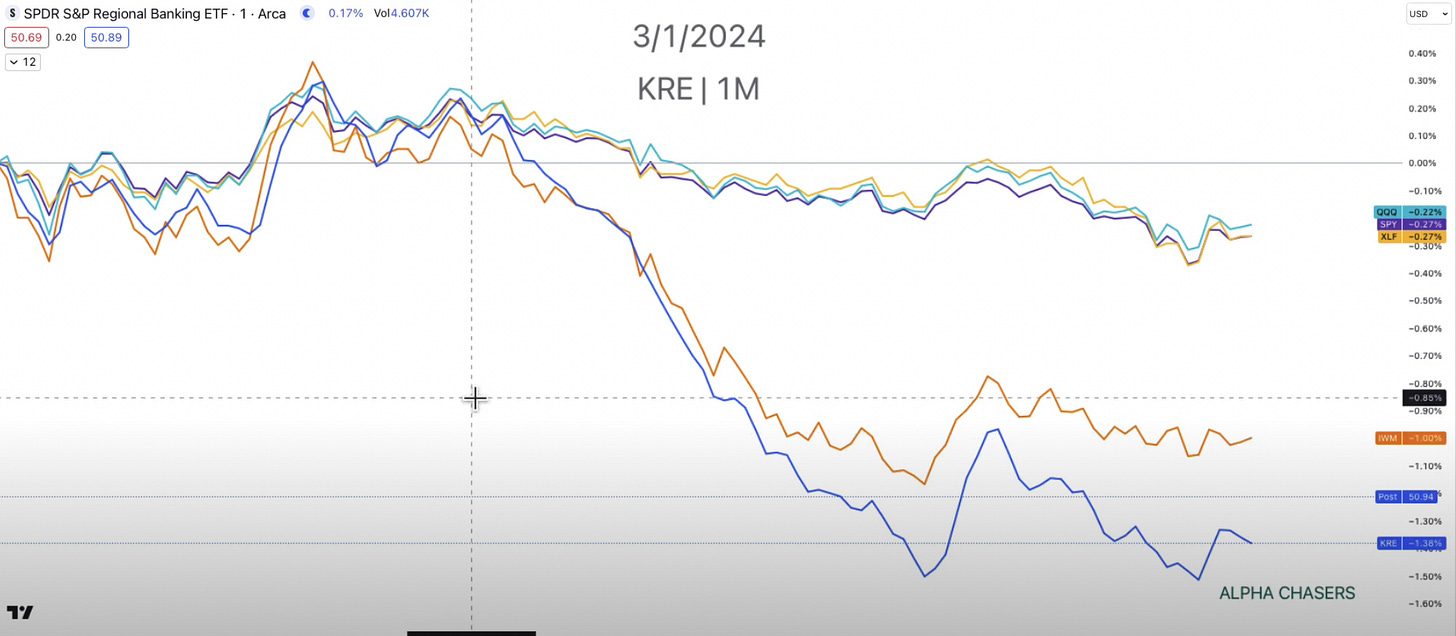

It is clear that regional banks sold off significantly, which impacted the IWM (see below).

But where actually is the selling pressure within regional banks? It isn’t very pronounced in key names like NYCB, FCNCA, or KEY.

However, we are seeing DPST (the regional banks 3X ETF) drop significantly.

Why is this important? Because institutions do not purchase 3X ETFs - retail does. So this signals that the sell off could actually be due to retail panic and not institutional selling.

For more details on this, watch the five minute clip below:

I almost didn’t dare to mention that I expect institutions to be manipulating retail. But $AAPL double downgrade after a good sell off, $AMZN dropping on something as silly as Tictoc announcing they’ll compete. There’s more, but it looks to me like institutions are trying to scare retail into selling, right before markets push higher.

Thanks for the article. I was in doubt. Some people insist that retail doesn’t have any power, but you’ve highlighted a few good cases of why retail matters, with previous notes.

All the best,