📈Is this Lehman or LTCM ?

The questions about the the recent banking crisis span from how deep does it go to who is to blame. Silicon Valley Bank (SIVB) collapsed as depositors fled due to uncovered losses on their balance sheet. The question for investors is how widespread is the issue. Right after SIVB a global major bank Credit Suisse collapsed. It was bailed out by UBS. This led investors to panic and make assumptions that we are facing a Lehman moment which led to the great financial crisis. But what if the issue is contained to only a couple regional banks. We know there is commercial real estate on the balance sheet and other issues that can hamper regional banks. This is a far cry from assuming a systemic banking crisis. As time progresses its becoming clear that dear is abating. This week the chief investment strategist at Bank of America had this to say.

"Panic, flush, unwind, then Fed blinked and off we rally into April which always up in 3rd year of Prez cycle; and then we’ll see if recession or new CRE or US Treasury panics await in H2 ;if SVB was Bear Stearns we going to new lows, if LTCM then we going to new highs.”

LTCM was a hedge fund that was so large its leverage and failure was though to possibly crash the financial system. Instead is ushered in one of the largest rallies in stock market history. Based upon the recent price action it is looking at a minimum as a reprieve.

SP500 - The McClellan summation oscillator cross this week for the first time since the market top. Crosses can be used to determine possible tops and bottoms in the index.

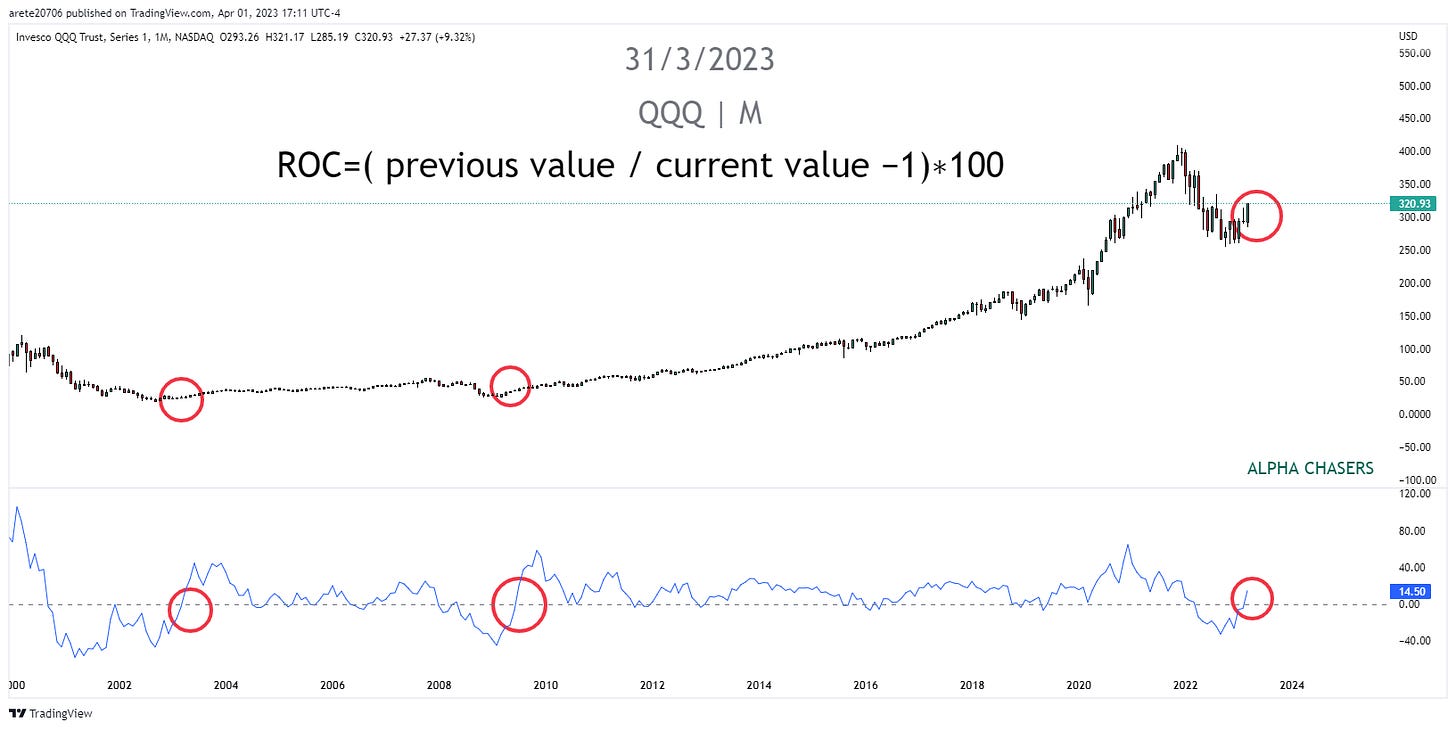

Nasdaq (QQQ) confirmed closing over the rate of change zero line for the first time in over a year. The same movement confirmed bottoms during the dotcom bottom and the great financial crisis

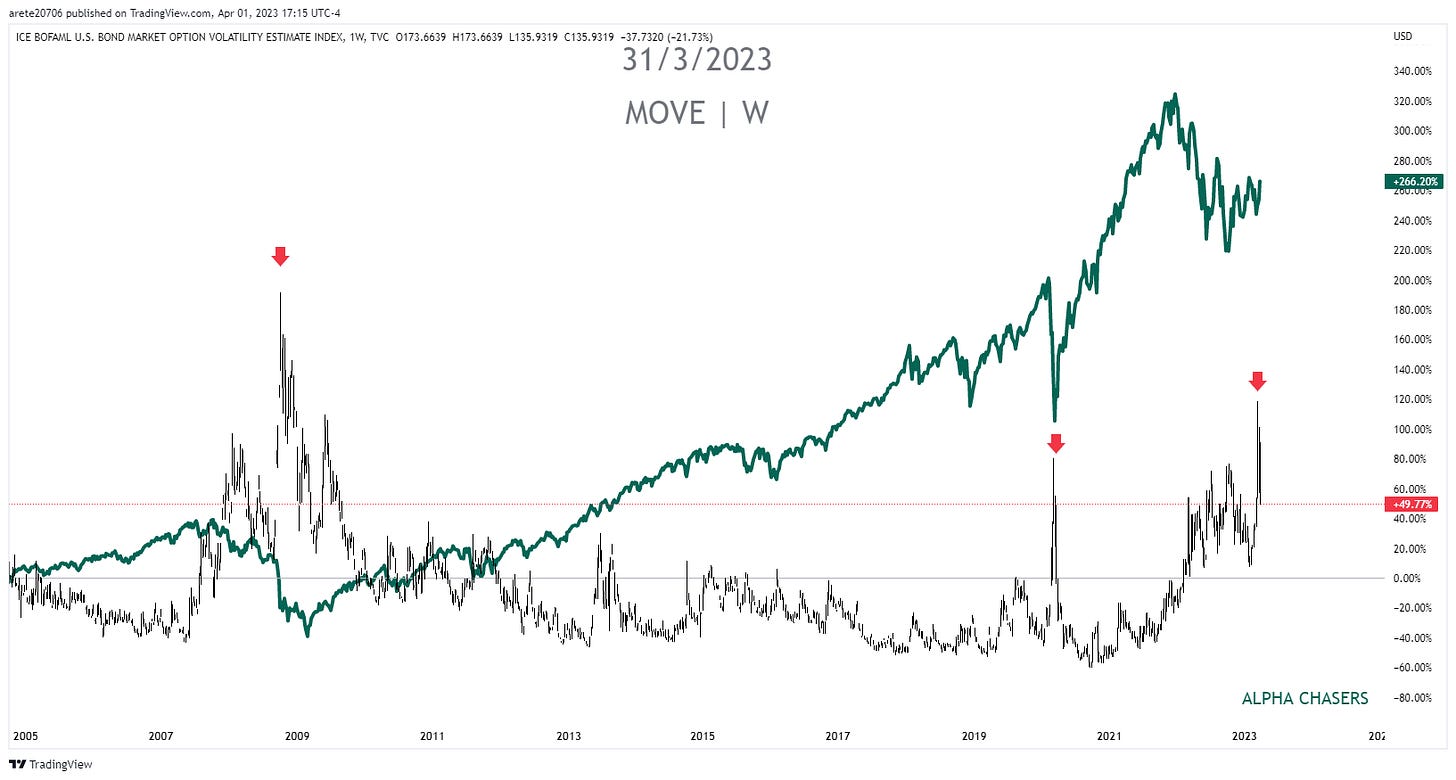

Fear is needed to create bottoms. Usually we look for that spike in fear in the stock market through the VIX. It’s possible the spike of panic was in the bond market. MOVE is the bond market volatility index. It spiked to levels only seen once in 20 years. The last two highest spikes in MOVE were a precursor to a market bottom.

For a more in-depth look into the indexes , sectors , indicators and stocks that are giving flashing signals watch the video below.

Wishing Everyone Massive Success in 2023 🍾