📈Leaders Stalled Today📉

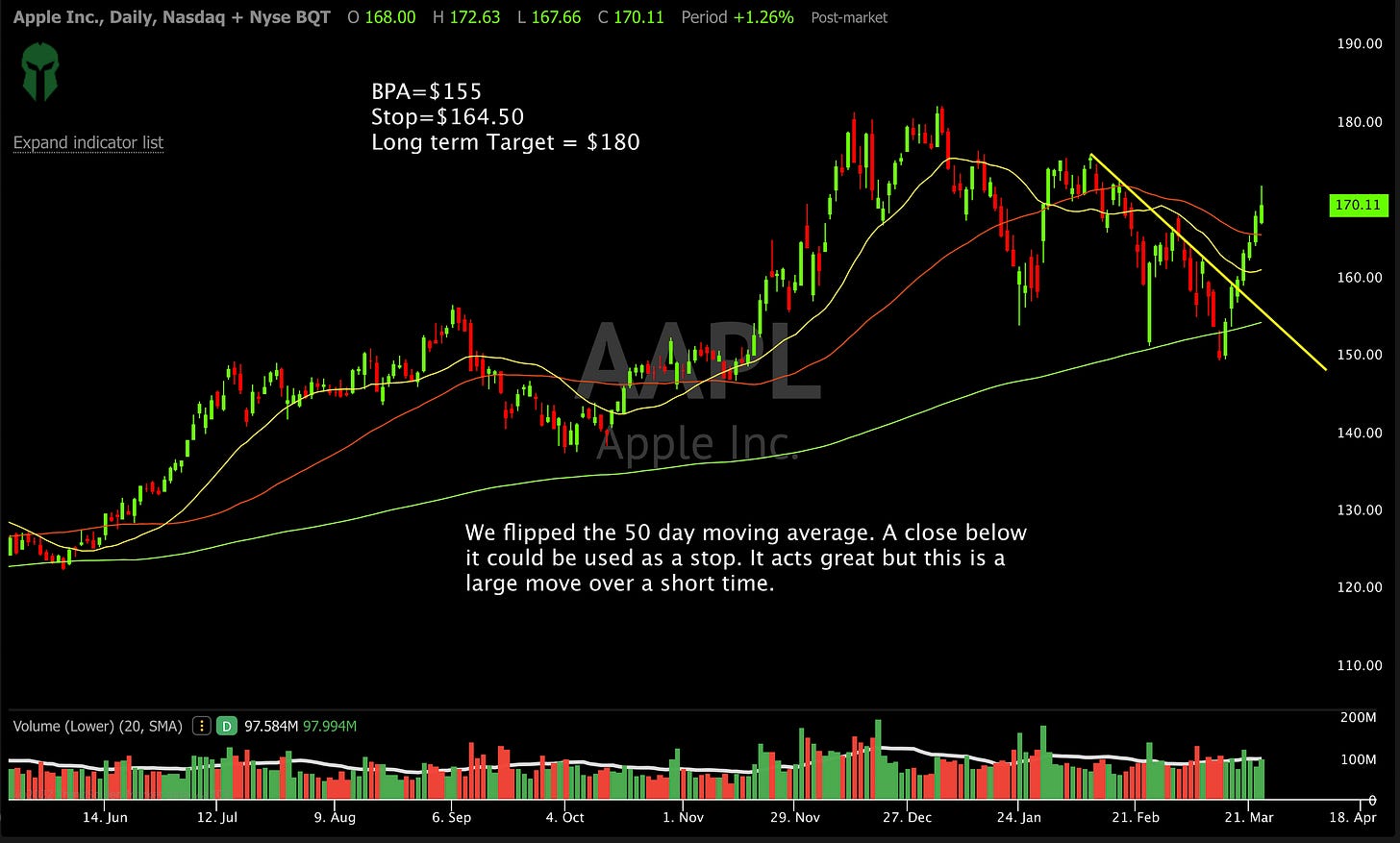

The Indexes have been on a run since last weeks Quadruple Witching. Now we are beginning to see signs of it tiring. As we talked about in previous weeks, once the large option expiration was complete we could see a bottom and that is exactly what has happened. Now we have cleared several major hurdles and it looks like a rest may be in order. Today we saw even the leaders TSLA and AAPL unable to close on the high end of their daily ranges. This shows us that buying is getting tired. We saw the 10 year bond yield rally for the first time in two weeks. Usually this suggests inflows into bonds and out of equities. This coupled with the leading sector, semiconductors, breaking three key support levels in one day. Technically this points to sideways action. There were some bright spots. Energy, metals, and commodities continue to outperform and held the SPY up modestly over the other indexes. Right now its best to wait and see how this unwinds. We had a nice run over the past week and now need the market to confirm that we are going to continue before committing more capital to ideas. The video attached below walks through what happened with GME and AMC today. It points to why this is important for overall health of the market. Key levels and support are on the charts! I have several ideas I want to add but for now I need to see support levels hold on the Indexes. Let’s get to it!

Let’s Look at our Index’s

Let’s Look at Our Stocks

Subscribe to You Tube! 👈Subscribe and turn on notifications. There is a new daily video after the market Monday through Thursday! It’s called the Top 5 in 5. It consists of the best five ideas for the next day and I condense it into 5 minutes. It’s loaded with actionable ideas. It’s worth your time. It is hyper specific and actionable. Tonight’s includes Longs and Shorts with entries and stops marked. When you subscribe turn on ALL notifications so you are notified of the daily Premarket live shows ,Top 10 Weekly Buy List and educational videos. Also, Once subscribed you will receive private content on YouTube make sure all notifications are turned on so you receive it. The video below is the Top 5 from tonight and focused on actionable ideas based upon the indexes and earnings tonight. Pay close attention to what is said about GME and AMC. It has worked twice in the past 6 months.

As always all investment decisions need to be made by the individual. We all have different risk profiles. No two people trade the same. Understand the buy points, stop losses, trims are suggestions. You need to develop your own process. I am willing to help. If you have questions email me Arete@Aretetrading.net. For example, to stop losses, I like to see them close. That does not mean that fits everyone’s risk profile.

Please make sure you Subscribe to Twitter! 👈and turn on notifications. There are times my updates are timely.

If you do not see a position and have questions please message me.

Thank you again for all the messages telling me how this Newsletter improved your performance and made you a better trader!

Now you can share the Newsletter!

👇👇👇

Subscribe below!

👇👇👇

Trade to Win!