Smart Money vs. Dumb Money

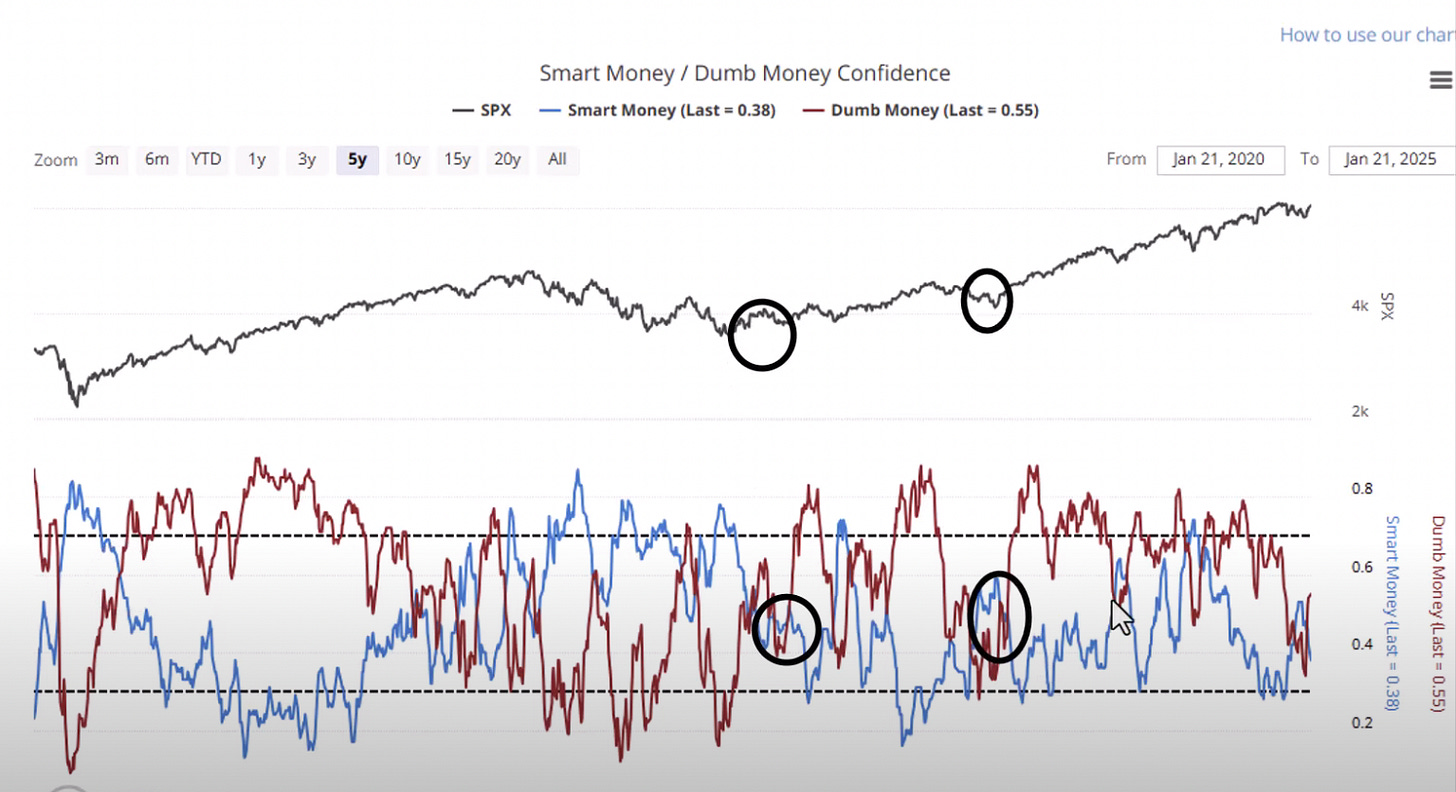

Anybody who has watched my YouTube channel for some time knows that I often look at Smart Money vs. Dumb Money Confidence to understand how institutions and retail are positioning themselves and what may be on the horizon for the market.

Right now I’m seeing a signal that has only happened a few times in the past three years, and when it happens, it’s bullish.

Specifically what I look for is when retail (dumb money) crosses institutions (smart money), as this can predict longer-term outsized moves to come in the S&P 500.

You can see a few examples of this above which worked perfectly as triggers for the market.

When you look at every time this has happened since May 2022, you can see that the sustained moves upward happen when retail crosses institutions below the 0.5 line.

Above shows each cross and it is clear that the resulting move was greatest when the cross happened below the line drawn.

We are just now starting to see that cross and it is occurring below the 0.5 line, which is a great sign for the market.

One other data point that has caught my attention is an indicator called the Zweig Breadth Thrust, which is a measure of market breadth via advance/decline. What you’re looking for here is large week-over-week surges, which mark bottoms in the market.

You can see above that the last time we had a week-over-week above 38% surge was in November 2023, which perfectly marked the start of a bull run in the market.

We just registered our first surge over 38% since that moment, which may be telling us that we are ready for the start of a new bull cycle.

These two signals have me bullish on the market right now. I dive into these signals in much greater detail here: